When Should I Pay My Credit Card Bill?

The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

Try to pay your credit card bill on or before the due date as often as possible. The due date is usually 20 to 25 days after your billing cycle ends.

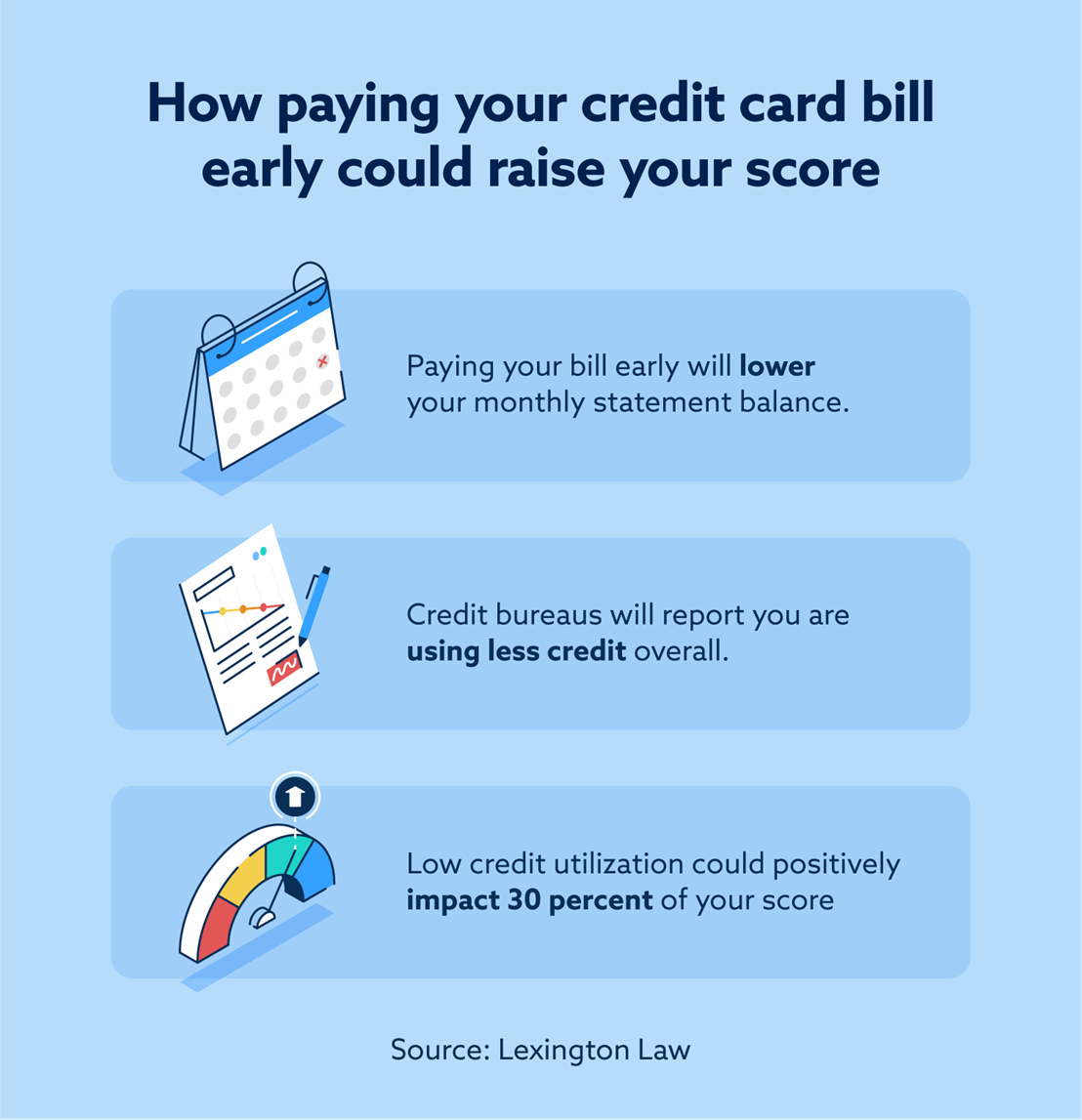

Paying your credit card early can improve your credit. After your statement closes, your credit card issuer reports your balance to the main three credit bureaus (Equifax®, Experian® and TransUnion®). Paying your bill early lowers your overall balance, so the bureaus will see you using less credit in total.

If you’re wondering, “When should I pay my credit card bill?” know that it’s always best to pay as early as possible. According to the FICO® credit scoring model, credit utilization makes up 30 percent of your score. We’ll explain the factors that affect credit in more detail below and answer common questions about when to pay off your balances.

Key takeaways:

- Making at least the minimum payment is good for your credit health.

- Payment history and credit utilization make up 65 percent of your FICO credit score together.

- Credit card grace periods usually last up to 25 days after a billing cycle ends.

Table of contents:

Why should I pay my credit card early?

To understand how paying a bill early could raise your score, you need to understand what factors affect your score and how your credit issuer reports to the credit bureaus.

The Fair Isaac Corporation (FICO) uses a unique credit scoring system to issue a FICO credit score to every individual. FICO scores consist of the following five categories:

- Payment history makes up around 35 percent of your score. Late payments can negatively affect your score, so paying your bill on time or early can help improve it.

- Credit utilization accounts for 30 percent of your score and represents how much of your available credit you’re currently using. You should aim to use 1/3 of your credit or less (e.g., if you have a total credit limit of $9,000, try to keep your balance below $3,000.)

- Age of credit reflects your total credit history, and it makes up roughly 15 percent of your score. Your oldest accounts will influence this factor the most.

- Credit mix measures the variety of open credit accounts you have, and it makes up 10 percent of your score. Having several cards and an auto loan or mortgage can help.

- New credit makes up the last 10 percent of your score, and it considers your applications for new lines of credit.

After your monthly statement is issued with your balance, you have a grace period before the payment is due—ranging from 21 to 25 days. During that time, your credit card provider will report your balance to the credit bureaus. If you pay your balance before your statement closes, the total listed balance will be lower. Moreover, credit bureaus will see your overall utilization as lower, which could increase your score.

However, paying your credit card bill early may work differently if your card has a balance each month. Instead of paying your next statement early, you’re making an extra payment on your balance. Therefore, you’ll likely still need to pay the minimum amount on your next statement, or your payment could be considered late.

Is it bad to pay off a credit card early?

It is never bad to pay your credit card bill early, but the benefits you receive from doing so may vary depending on your circumstances. For example, if you carry a balance on your credit card every month, you may need to adjust how you handle early payments.

It’s also important to separate facts from credit myths when planning out your debt repayment strategy.

If you do carry a balance on your card each month, keep the following in mind:

- Your early payment may not count as your minimum payment. If you have a balance from a previous month, your early payment will count as an extra payment on your outstanding balance.

- You may not save money on interest and fees by making an early payment. For example, if you’re charged based on your average daily balance, simply paying at the end of the month may not help much.

All that said, it’s still usually a good idea to pay down your credit card debt if you have the funds available to do so. When considering how to build credit, remember that consistent, timely payments can help you eliminate debt and qualify you for better loans and cards.

When is the best time to pay your credit card?

The best time to pay your credit card bill is before the payment is late. While you may benefit from paying your bill early, you’ll definitely see negative effects if you pay your bill late.

Paying early keeps your payment history intact and may help lower your overall utilization, while paying your bill more than 30 days late will likely lead to a negative item on your credit report. And if you neglect to pay long enough, your account could get sent to collections.

If you do start paying your credit card bill early, begin checking your credit report regularly to see how your balance is being reported to the credit bureaus. Over time, you should see your utilization drop and your credit improve.

Understand your credit with Lexington Law Firm

While sifting through your credit report, look for inaccurate information like fraudulent accounts, incorrect negative items or factual mistakes. Any of these inaccurate items could be hurting your credit, but you can challenge them with the right credit repair services.

Lexington Law Firm helps clients repair and monitor their credit. Learn more about our services, which can help you address incorrect marks on your credit report. Start by taking our free credit assessment today.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.