What Is VantageScore 3.0 and How Does It Work?

The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

VantageScore® 3.0 is a credit scoring model that each of the three major credit bureaus uses to determine your creditworthiness.

VantageScore 3.0 is a popular credit scoring model that helps to reflect a person’s creditworthiness. VantageScore® and the FICO® score model help banks and lenders determine if they’ll offer credit cards and loans to applicants.

Understanding the factors that lower and raise your VantageScore can qualify you for better opportunities in the future. We’ll explain what VantageScore 3.0 is and how it works so you can work to improve your credit.

Table of contents:

How does VantageScore 3.0 compare to other scoring models?

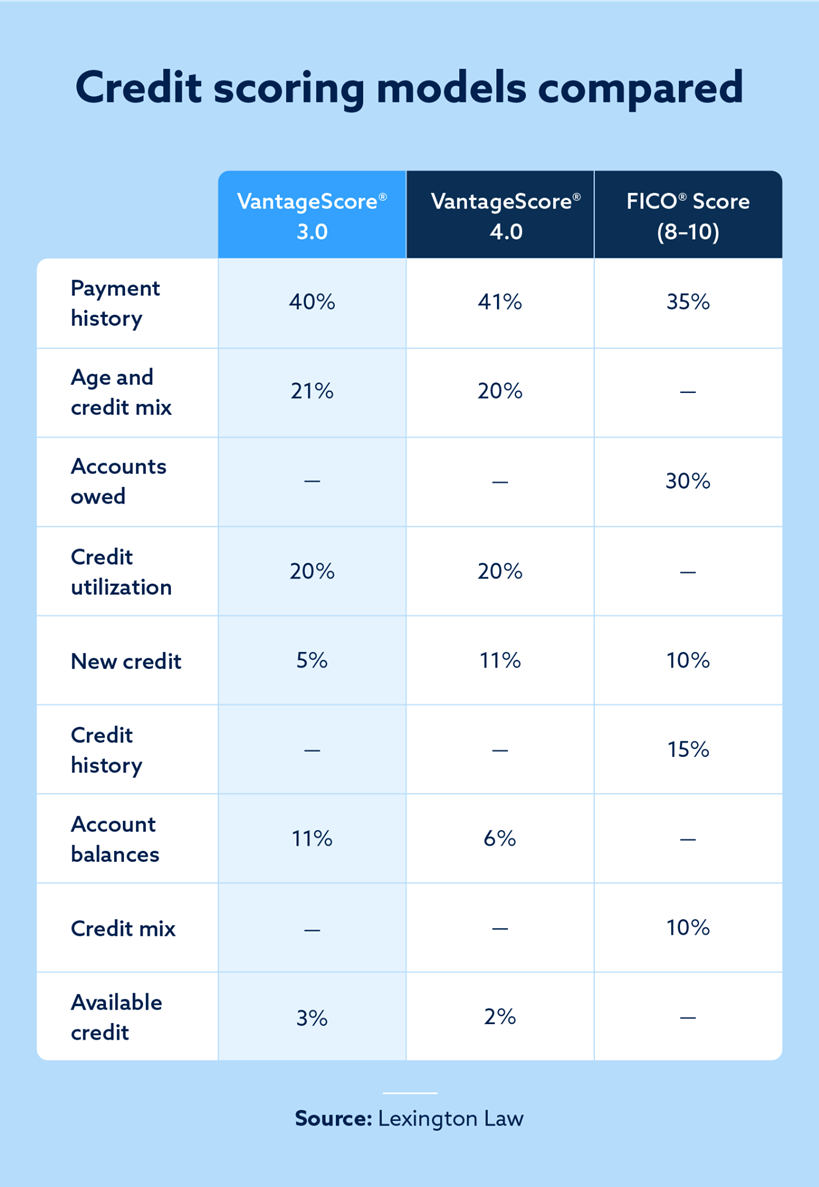

VantageScore 3.0 shares multiple similarities with other popular scoring models, including VantageScore 4.0 and several iterations of the FICO scoring model. There are also certain nuances that set each model apart when comparing VantageScore vs. FICO scoring models.

- VantageScore 3.0 and VantageScore 4.0 place a heavy emphasis on a person’s payment history, and they place moderate emphasis on age and mix of credit and credit utilization rates. VantageScore 3.0 does focus more on a person’s total account balances, while VantageScore 4.0 is more concerned with new credit.

- FICO scores differ from VantageScore in several ways. FICO scores need six months of account activity to generate credit scores, while VantageScores just need one. Vantage Scores generally take six categories into account, while FICO scores focus on 5. Otherwise, VantageScores and FICO scores both use 300 to 850 credit ranges—and the factors they use to calculate credit scores are generally similar.

How are Vantage credit scores calculated?

If you’ve ever asked yourself, “why are my credit scores different?” learning how a VantageScore is calculated may provide clarity.

- Payment history makes up roughly 40 percent of your VantageScore and can significantly increase or decrease your score based on how timely you are with your payments.

- The age of your credit and how diverse your credit profile is make up about 21 percent of your VantageScore. If you have a wide range of account types and consistently make positive actions with your oldest accounts, your VantageScore will likely steadily improve.

- Credit utilization composes 20 percent of your VantageScore. Your credit utilization ratio is determined by weighing how much of your available credit you’re currently using.

- Your brand-new credit accounts only make up five percent of your VantageScore.

- The total amount of your account balances contributes roughly 11 percent to your VantageScore. This factor is also linked to your credit utilization ratio.

- Available credit makes up about three percent of your VantageScore and generally reflects how much credit you’ve taken out.

The answer to “When do credit scores update?” is a bit complex. Credit scores are frequently updated, but there’s no preset date for these updates. It’s best to regularly check your credit scores and dispute any errors that you notice.

Vantage 3.0 credit ranges

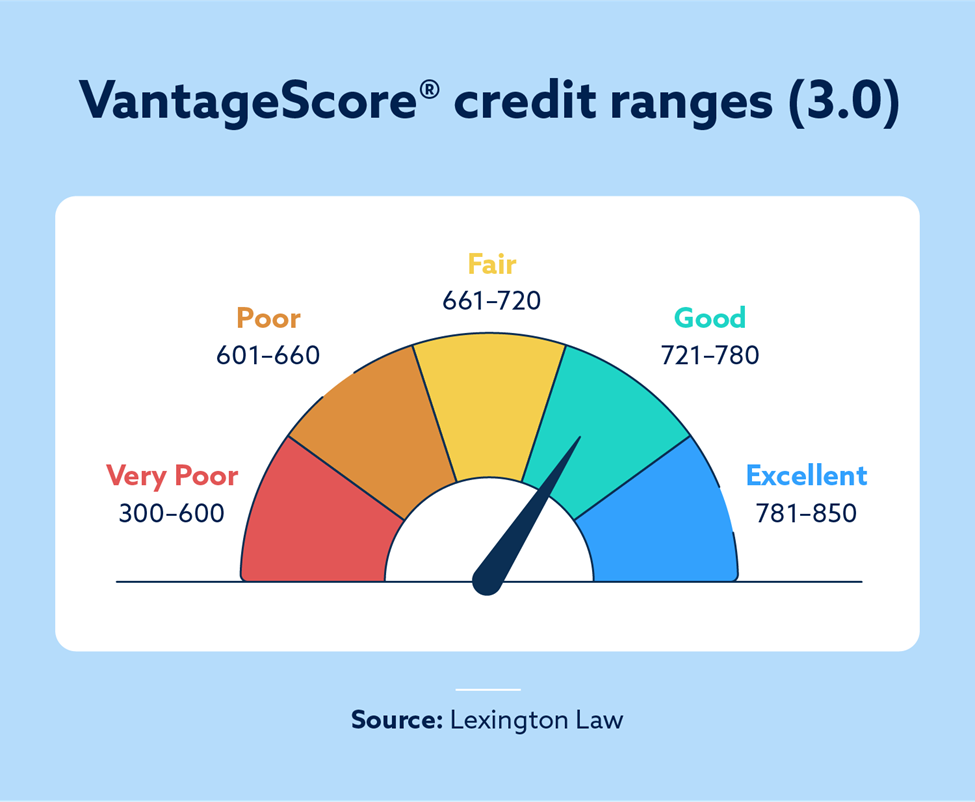

Just like a FICO credit score, VantageScores can fall between 300 and 850. However, there are subtle differences between the credit score ranges of both models. For example, a FICO credit score of 780 would be considered “very good,” while a Vantage 3.0 credit score of 780 is simply considered “good.” Here’s a full breakdown of the VantageScore 3.0 credit score ranges.

- Very poor: 300 – 600

- Poor: 601 – 660

- Fair: 661 – 720

- Good: 721 – 780

- Excellent: 781 – 850

5 ways to improve your VantageScore 3.0

Consistently practicing good financial habits can improve your VantageScore over time. The following tips can help you work on poor credit and eventually reach and maintain higher scores.

1. Don’t apply for too much new credit

Each time you apply for credit, creditors will enact a hard inquiry on your account that temporarily lowers your score. If you apply for too much new credit within a set period, your credit score may sharply decline.

2. Pay down credit card balances

Account balances compose 11 percent of your VantageScore, so paying down your debt can positively impact your credit. Lowering your account balances will also improve your credit utilization ratio, especially if you target your largest balances first.

3. Try to make your payments on time

Since payment history makes up 40 percent of your VantageScore, this step’s importance can’t be understated. Strive to make all of your payments on time. Even if you can only make the minimum payment or have to pay within the grace period, you’ll still maintain good standing with your creditors.

4. Maintain your oldest accounts

Taking positive actions on your oldest accounts will have a greater impact than activity on your newer accounts. Remember that merging your oldest accounts can drastically lower your score if you ever consider using a debt consolidation service.

5. Sign up for a credit monitoring service

A credit monitoring service can maintain watch on your credit reports and clue you into any fluctuations or inconsistencies. Lexington Law Firm offers comprehensive credit monitoring services that can help you take positive steps toward improving your credit.

How can I monitor my VantageScore?

You can monitor your VantageScore by reaching out to the three credit bureaus and requesting a free credit report. You can also capitalize on credit monitoring services like the products offered by Lexington Law Firm. Get your free credit assessment today.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.