What Is It and How to Find It

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations.

An expense ratio is how much it costs to operate a fund compared to the total value of its assets. The lower expense ratios between 0.5% and 0.75% are ideal.

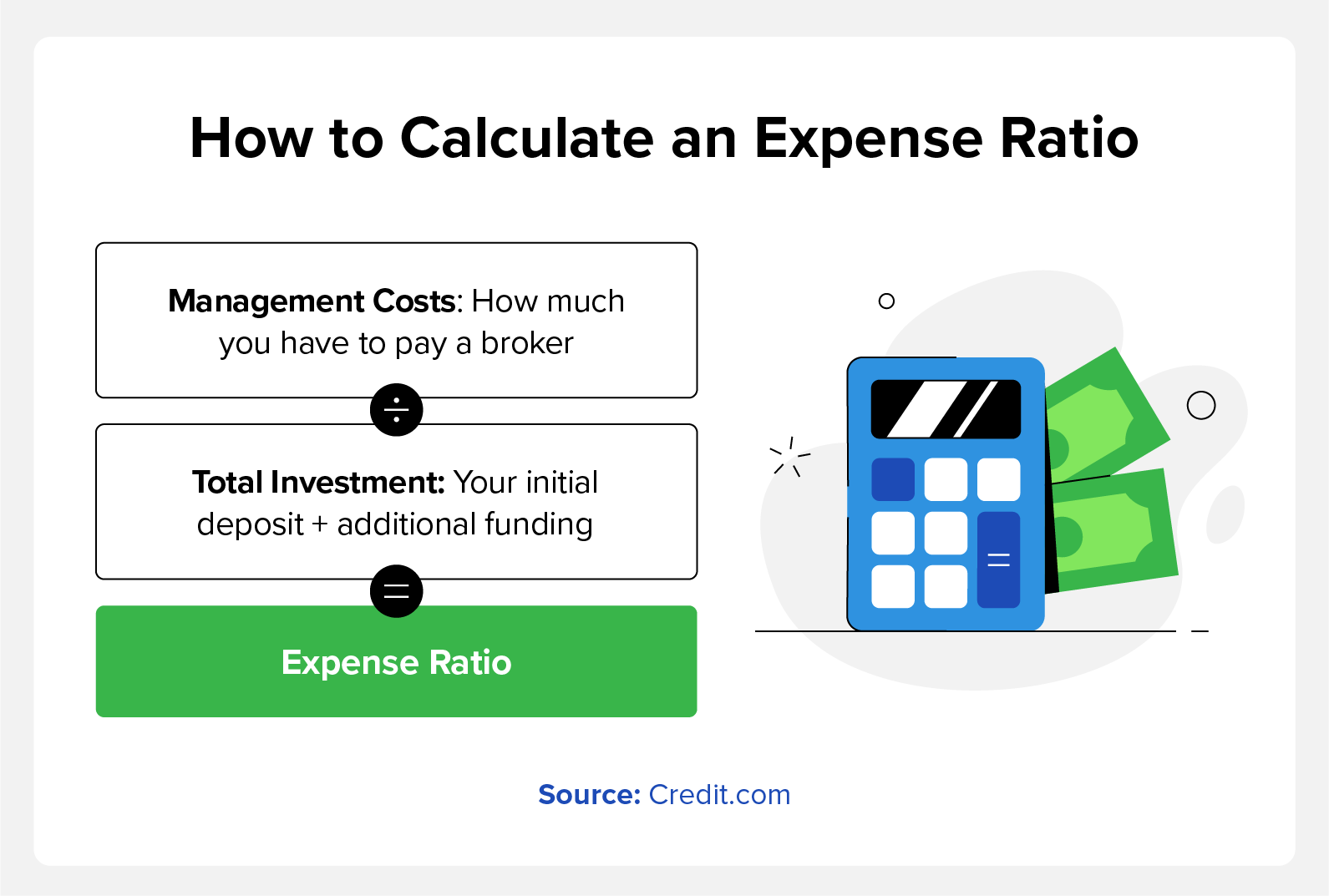

An expense ratio compares the cost of managing a fund to the total value of a fund’s assets. Mutual funds are like businesses—people actively manage your investment to maximize gains and minimize losses. These management fees and operation costs get passed on to you, the shareholder.

Understanding expense ratios and how they work is vital for anyone looking to add mutual funds to their investment portfolio. We’ll explore how expense ratios can affect your investment returns and share several helpful resources, like our investing guide.

Key Takeaways:

- Expense ratios exist because of a fund’s management costs.

- The closer an expense ratio is to 0, the more money you’ll save.

- A high expense ratio can dramatically reduce your return on investment.

What Is a Good Expense Ratio?

Determining a fund’s expense ratio is relatively simple. Take a fund’s total operating expenses and divide that by the fund’s net asset value (NAV). For example, if a fund has $500,000 in expenses and $50 million in assets, it would have a 1% expense ratio.

Because expense ratios are percentages, even seemingly small numbers can have big impacts. Going back to the previous example, a $50 million fund with a 2% expense ratio would have a total of $1,000,000 in expenses.

Ideally, a good expense ratio would be as close to 0% as possible. We recommend looking for funds that have expense ratios between 0.5% and 0.75%, which would be beneficial to investing beginners and experts alike.

What Is a Bad Expense Ratio?

A bad expense ratio could be any percentage over 1%, according to conventional wisdom. Percentages affect larger numbers at an increasingly noticeable rate. For example, 1% of 100 is 1, but 1% of 10,000 is 100. This effect becomes more drastic as the percentage increases; e.g., 2.5% of 10,000 is 250.

As previously mentioned, we recommend looking for funds with expense ratios between 0.5 to 0.75% at most. Should you commit to an investment with a higher ratio, expect your total gross to be lower.

Why Are Expense Ratios Important?

Knowing the fees associated with anything you’re paying for is essential when investing. A higher expense ratio will reduce your returns, while lower ratios can help you invest in multiple funds easily. Even if you aren’t investing millions of dollars, expense ratios will add up for any investor over the long term.

Below are two examples of investments with different ratios:

- $10,000 goes to a fund with a 1% expense ratio.

- $10,000 goes to a fund with a 1.25% expense ratio.

If you initially invest $10,000 into a mutual fund and contribute $0 annually over a period of 10 years, your gross ending value would be $19,671.51 with $1,763.03 in fees if you have a 1% expense ratio. With a 1.25% expense ratio, a similar investment would result in a gross ending value of $19,671.51 with a total cost of $2,180.95 in fees.

Although the fees may seem small in the short term, there are always long-term effects to consider. Now, imagine the difference in your investments when you keep contributing! Personal finance courses can also help you understand these seemingly small factors much better.

How Does Expense Ratio Affect My Investment?

A high expense ratio can significantly impact your return on investment (ROI) and potentially offset any gains you might’ve experienced. In the examples above, we explored two investments that didn’t consider future contributions.

This normally isn’t the case—investors are encouraged to invest more money in a fund over time. While these added investments will increase your gross return, they’ll also increase the management costs of your investment.

How Do I Know a Fund’s Expense Ratio?

When looking up any fund, you’ll typically find details about its attributes. It’s easy to overlook a fund’s expense ratio if money-making aspects are top of mind. In these instances, managing expectations is key. Using a brokerage account is an easy way to gain realistic insight into a fund’s expense ratio.

Another way to find the expense ratio is to find the fund’s prospectus. A prospectus is an overview of a fund’s investments. It needs to be filed with the Securities and Exchange Commission (SEC) and sent to investors each year. Here, you’ll find a section detailing any fees associated with a fund—including its expense ratio.

Investors receive a fund’s prospectus annually, so carefully search through your email if you believe it’s missing. Brokerage firms normally provide the prospectus when you research their website as well. Finally, you can go directly to a funds website, if available, and you’ll also be able to find the prospectus there.

If all else fails, harness the internet. A quick and simple search for a stock ticker plus the words “expense ratio” will quickly uncover the information you need.

Can You Avoid Expense Ratios?

Any fund you invest in will have operating expenses, so expense ratios are part and parcel with mutual funds. However, you can find funds with relatively low fees. It’s also important to consider the type of fund and strategy you want.

Mutual funds, exchange-traded funds (ETFs), and index funds are three of the best investments at your disposal.

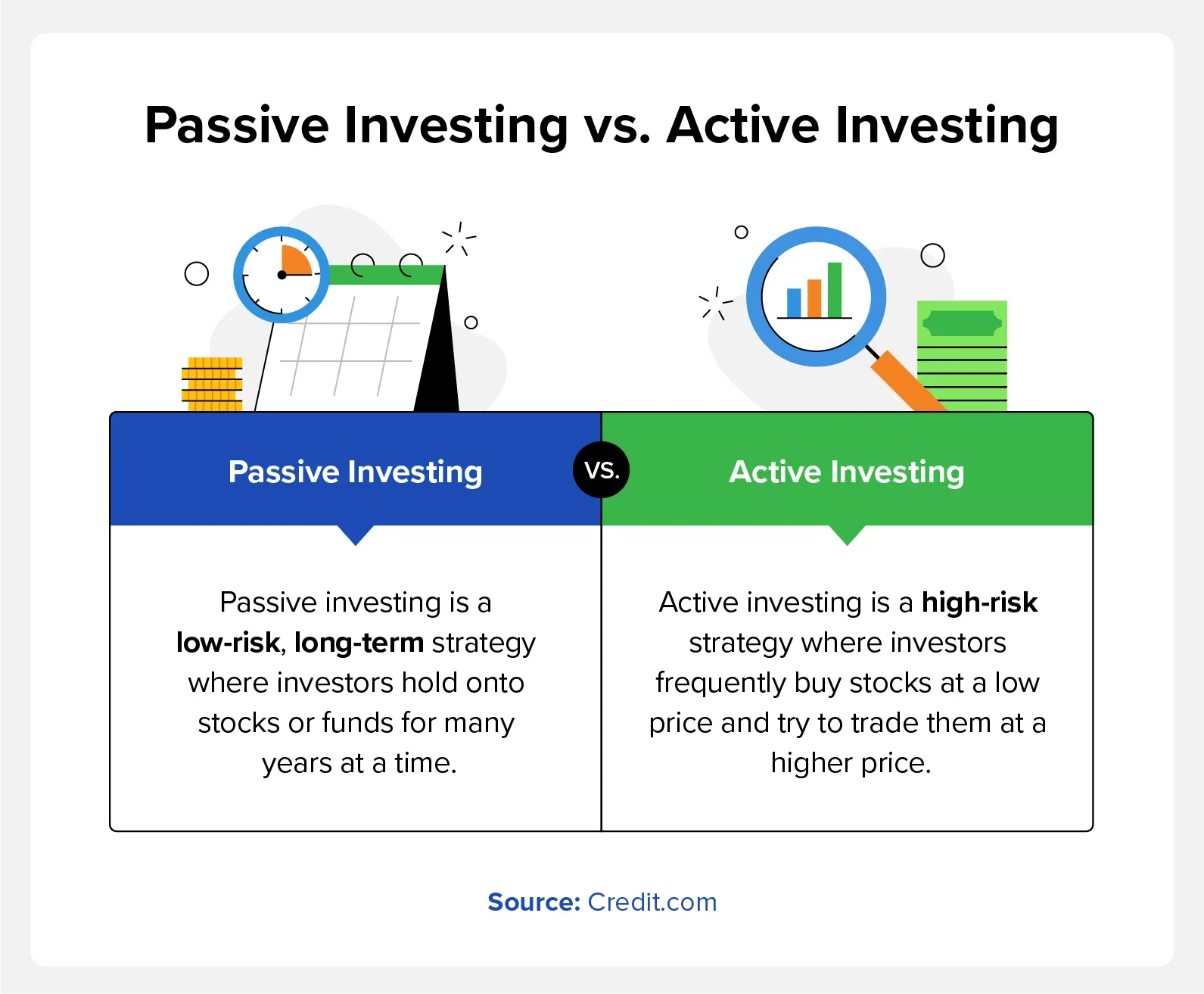

- Mutual funds and ETFs are actively managed funds, meaning that brokers actively make trades on your behalf. An active fund typically comes with higher expense ratios as it’s more expensive to research and make trades constantly.

- Index fund investing is more of a passive investment. Indexes are diversified and aim to track a particular section of the stock market or the whole thing, like the Dow Jones Industrial Average or S&P 500 index. These funds typically have a low portfolio turnover and are rebalanced far less than their actively managed counterparts.

Many firms such as Vanguard Group, Fidelity Investments, or T. Rowe Price will have index funds specific to their brokerage accounts with even lower rates as well.

Which Investment Strategy Should I Use?

A major part of your investment strategy is choosing how active or passive you want to be. According to a financial study from 2022, actively managed funds don’t typically outperform index funds over time (Sommer). With the higher fees and similar returns, passive investing makes sense for most of us. Index investing allows us to put our money in an index fund and forget about it.

However, actively managed mutual funds can outperform index funds in the short term. If you want to take on a more active investing role overall, you can manually review and rebalance your portfolio. But, keep in mind that short-term investing can be risky and result in a large loss of funds. Make sure you are ready to put in effort consistently and be aware of your total expenses.

You can always take on a hybrid investment portfolio. You can invest most of your money with index funds while investing in a few mutual funds for higher gains. Diversification is always an effective way to generate income from a portfolio.

Up Your Personal Finance Knowledge With Credit.com

Expense ratios help us understand the costs of investing in a fund. Before you buy shares, increase your understanding of the fees associated with a fund and general personal finance concepts.

Credit.com offers a wealth of personal finance resources to help you better understand investment concepts and strategies. When deciding which type of investment you want to make, it helps to know all you can about the types of funds within your reach and their true expenses.