What Is a FICO Credit Score + How Is It Calculated?

The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

A FICO® credit score consists of a three-digit number ranging from 300 to 850, with a higher score indicating better credit.

A FICO® credit score is a type of credit score that consists of a three-digit number ranging from 300 to 850 (and up to 900 for certain industry-specific scores), with a higher score indicating better credit. Credit scores inform lenders about your creditworthiness based on credit history and your current credit situation.

We talk through what makes a FICO score different from other credit scores, how your score is calculated and how to check your score below.

Table of contents:

What is a FICO score?

The Fair Isaac Corporation (FICO) introduced the first FICO credit bureau risk score in 1981. Since then, the FICO score is now recognized as a highly reliable source of credit information.

Before the FICO score, nearly every lending institution had its own criteria, which meant you could be approved by one lender but not another. Some criteria were also discriminatory, factoring in a person’s race, gender or political affiliation. The FICO score makes the entire process more transparent and controllable for people seeking credit.

FICO scores are used by many types of creditors, such as insurance providers and lenders, to gauge whether you will be able to pay back the money loaned to you. It’s also the most common credit score used in credit decisions, with 90 percent of the nation’s top lenders claiming to use it.

The FICO scoring algorithm is intended to predict how likely you are to default on a loan within two years. A higher FICO score represents a higher statistical likelihood that payments will be made on time.

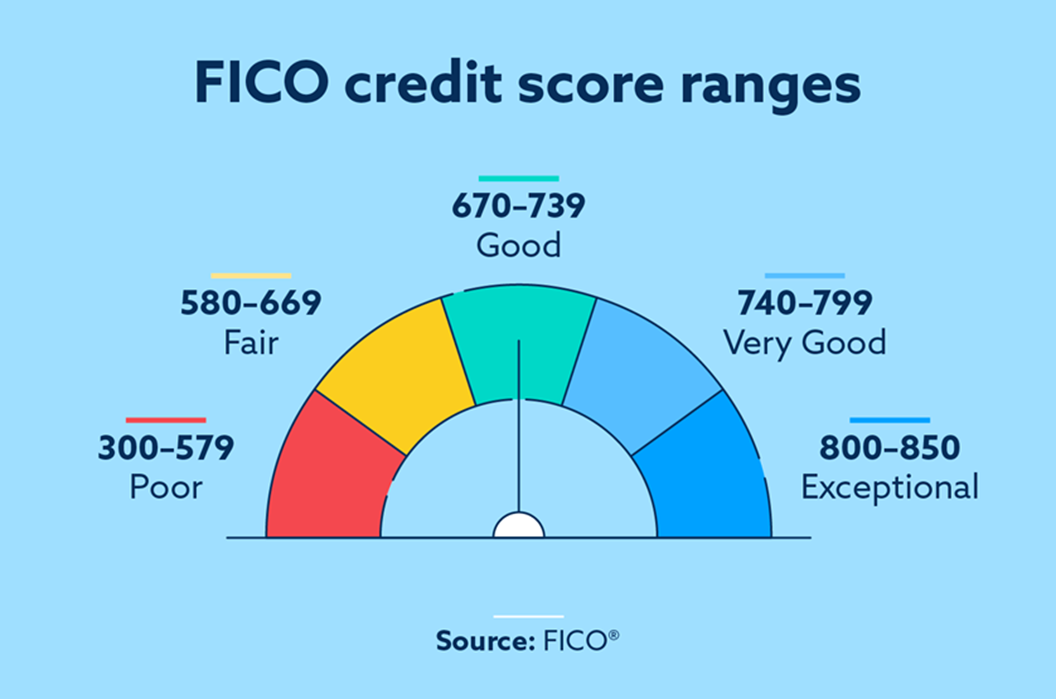

What is a good FICO score?

FICO defines a good credit score as one that falls between 670 and 739, with scores above this considered even better. Higher scores are better than lower ones and often lead to higher approval odds and access to more competitive rates.

FICO score range:

- Less than 580: Poor

- 580 to 669: Fair

- 670 to 739: Good

- 740 to 799: Very good

- 800+: Exceptional

However, what exactly is considered a “good” score will depend on the criteria of the lender reviewing your credit profile.

Keep in mind that lenders have their own criteria and guidelines they use to make lending decisions. Many use other factors, like monthly income, in addition to your credit score to decide if you meet their requirements.

Benefits of an excellent FICO credit score

An excellent FICO score does more than just get you better terms on a loan. You’ll also gain a few unexpected benefits.

Your credit impacts your insurance rates.

Many auto insurance companies run a credit check before offering you your rates. Having great credit suggests you are more responsible and may file fewer claims, so they’ll charge you a lower rate.

You’ll also have negotiating power with financial institutions.

With great credit, you’ll likely get multiple offers for credit. Since banks want to lend money to the people with the lowest risk, you can negotiate to get the best offer possible. People without great credit, on the other hand, are at the mercy of whatever offers they receive.

Utility and cell phone companies may not require a security deposit.

These companies often look at credit scores before initiating a contract. If your credit is low, they may require you to put down a security deposit to protect them if you don’t pay your bills.

You’ll have better housing opportunities.

Even if you have the necessary income to afford rent, a landlord may decide not to rent to you if you have bad credit. A strong credit score shows potential landlords that you’ll pay your rent on time every time, making them more likely to rent to you.

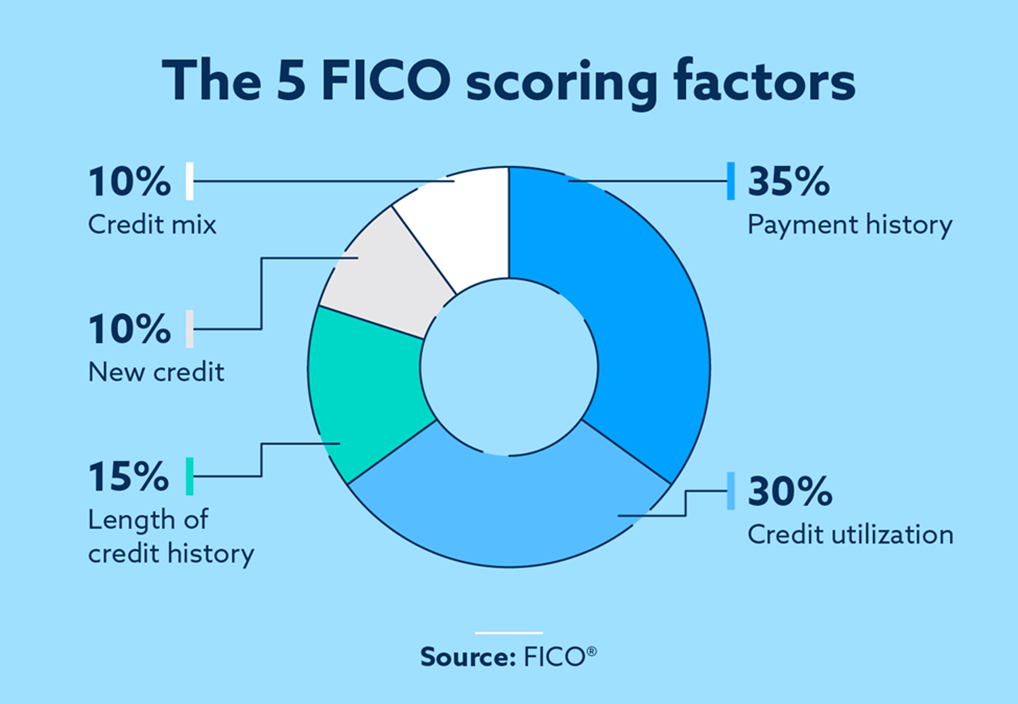

How is a FICO score calculated?

FICO credit scores are determined by five factors:

- Payment history

- Amounts owed

- Credit history

- Mix of credit

- New credit

Actions that fall under these categories can raise or lower your score.

You can learn more about the five FICO score factors and their impact below.

- Payment history (35 percent): The factor that has the biggest impact on your score is whether you consistently make on-time payments. Late and missed payments hurt your score.

- Amounts owed (30 percent): The amount of money you owe compared to the amount of credit you have available has the second largest impact on your score. This ratio is also known as your credit utilization. The lower your credit utilization, the better your score typically is.

- Length of credit history (15 percent): The next most impactful category is your credit age. Longer credit histories give credit bureaus a better understanding of your past payments and other behavior.

- Credit mix (10 percent): The types of credit you have also have an impact on your credit score. Successfully managing a mix of credit cards, mortgage loans and other things can give your score a positive bump.

- New credit (10 percent): Opening or applying for multiple credit accounts in a short period of time can have a small, negative impact on your credit. This is because many hard inquiries and new accounts in a short amount of time can appear risky to lenders, especially for people who have short credit histories.

What is a FICO score used for?

A FICO score helps people gain access to the credit they need to cover certain expenses, like buying a home or paying for medical bills. In some instances, landlords or utility companies may use your credit score to determine how much your deposit should be or whether your application will be approved.

Having a strong FICO credit score will help you access lower interest rates, which can save you thousands of dollars in interest and fees over time. It also determines the total amount of money you can borrow and the length of your repayment period.

There are numerous versions of FICO credit scores that were created to meet the needs of different lender types.

Why are there different FICO scores?

There are many types of FICO credit scores because FICO periodically releases new FICO score versions to stay current with the way people use credit.

There are two general categories that FICO scores fall under:

- Base FICO scores: This is the most commonly used type and is used to predict a person’s general risk for any given credit obligation.

- Industry-specific FICO scores: These scores are tailored to specific credit products like car loans and credit cards.

Industry-specific scores are built on top of the base FICO scoring model to create consistency across all FICO score versions. Because they are a different metric, the industry-specific scores are slightly different, ranging from 250 to 900. FICO Auto Scores and FICO Bankcard Scores are two examples of industry-specific scores.

When FICO releases new FICO scoring versions, they tend to offer better predictions and new or updated methods for gauging creditworthiness. For example, FICO Score 10T was released in 2020 and utilizes trended data to take into consideration factors that traditional credit scores do not.

FICO score vs. credit score

The difference between a FICO credit score and a non-FICO credit score comes down to how each one is calculated. FICO uses a proprietary scoring model that includes the five factors we’ve already mentioned: payment history, amounts owed, length of credit history, credit mix and new credit.

Other credit scores are determined using different methods. Your FICO score is just one type of credit score that a lender could use.

FICO vs. VantageScore

VantageScore® is a newer credit scoring model created jointly by the main credit bureaus—Experian®, TransUnion® and Equifax®—in 2006. Both VantageScore and FICO aim to help lenders make informed lending decisions regarding how likely a person is to repay a loan.

FICO and VantageScore assign different weights to certain credit factors. For example, credit history length makes up 15 percent of your FICO score, whereas VantageScore groups together age and type of credit to make up 21 percent of your VantageScore.

Another key difference between the two is how widely they’re used. FICO is the only credit risk evaluation tool used by government-sponsored organizations like Fannie Mae and Freddie Mac.

How to raise your FICO score

Since your score is based on your spending behavior, you have the power to change it for the better, but it can take some time.

To improve your FICO score, address the five scoring factors:

- Payment history: Make regular, on-time payments.

- Credit utilization: Keep your credit card balances low.

- Credit history: Keep older accounts open.

- Credit mix: Successfully manage multiple lines of credit.

- New credit: Avoid hard inquiries on your credit report.

How to check your FICO score

There are several ways you can check your credit score and credit report to see where you stand and what information each bureau has on you.

To get your FICO score, you can start by taking a look at your credit card statements and credit issuer’s website. Some credit card providers offer customers a free look at their FICO scores on a monthly basis.

You can also visit the FICO website and choose from one of three plans that provide monthly reports detailing your FICO scores and other credit information.

Lexington Law will help you review your credit reports to ensure your information is accurate and up to date. Learn more about our credit repair service to see how we can help you ensure your information is fairly reported.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.