What Is a Cash Advance and How Does It Work?

A cash advance is an unsecured loan that lets you borrow money against your credit limit. Merchant cash advances and payday loans work similarly.

The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

Cash advances are unsecured loans that let you borrow money against your credit limit. If you’re in a situation where you need cash fast but don’t have enough funds in your checking account, a cash advance can be helpful. However, cash advances often come with fees and specific restrictions.

If you’re wondering “what is a cash advance,” we’ll explain how this loan works and break down the pros, cons and fees that come with it. We’ll also cover how Lexington Law Firm could help you improve your credit after taking out a loan.

Table of contents:

What is a cash advance?

A cash advance is an unsecured short-term loan from a lender, such as a bank or financial institution. With unsecured debt, you don’t have to offer collateral to access funds. However, unsecured loans typically have higher interest rates, repayment terms and transaction fees—all of which apply to cash advances.

Depending on your credit, your history with a bank and the amount you borrow, your fees and interest rates for cash advances can vary.

How does a cash advance work?

Banks, credit unions and payday loan companies all offer cash advances. These companies make money by providing you with a loan and then charging fees and interest for the service. When you receive the loan, you’ll also receive terms that outline items such as fees, interest and the repayment period for your loan.

The money you can borrow with a cash advance is based on a percentage—typically 20 – 30 percent of your credit limit. For instance, if you have a $1,000 credit limit, you’ll likely be able to borrow up to $200 or $300.

How to get a cash advance

Essentially, a cash advance allows a credit card to be used as a debit card. But unlike a debit card, which gives you access to money that is already yours, you have to pay back the money from a cash advance.

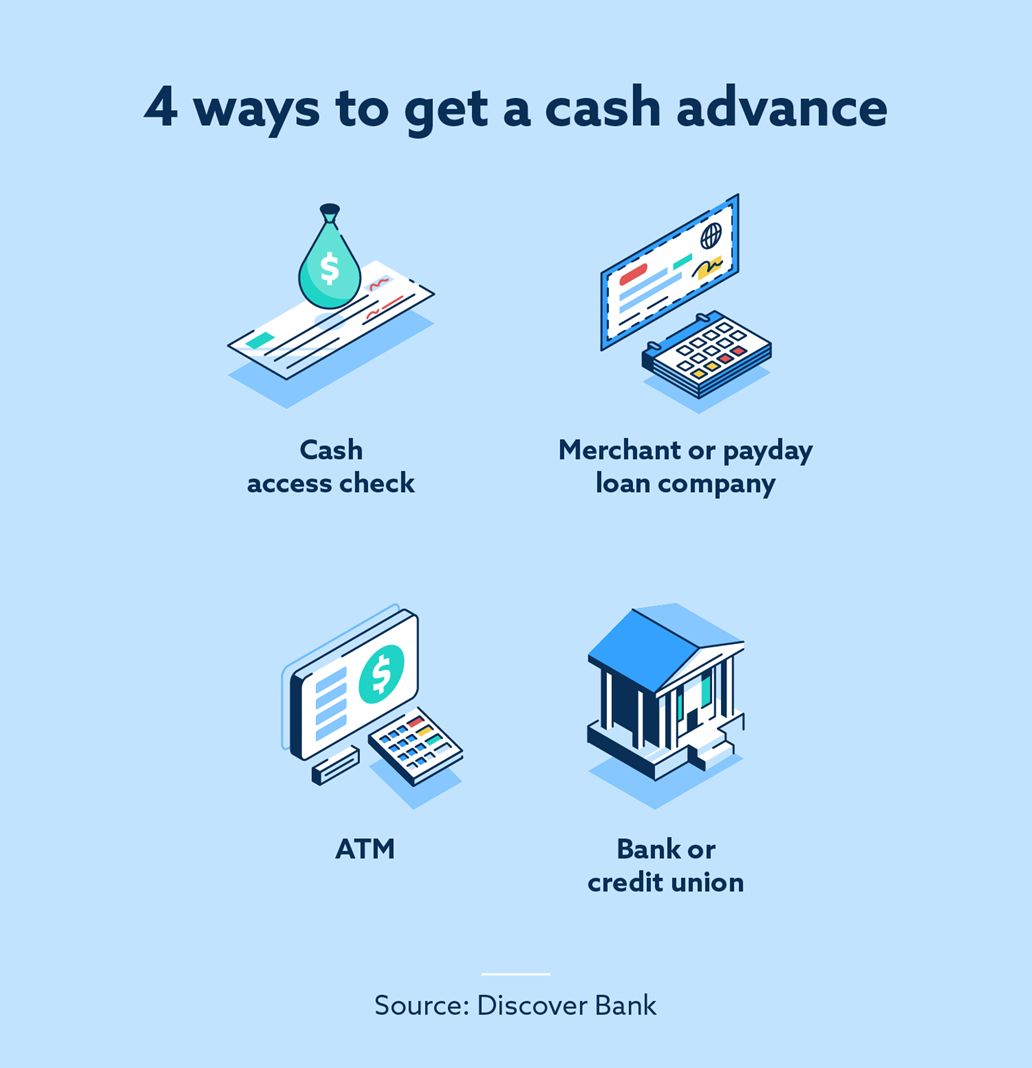

Here are four ways you can get a cash advance:

- Request a cash access check delivered via mail

- Go to a merchant or payday loan company

- Use your PIN at an ATM

- Visit a bank or credit union

Are cash advances expensive?

Cash advances can be more expensive than other types of loans, like personal loans. The trade-off is that cash advances are often quicker to acquire than if you go through another loan application process. The following are some terms and fees to keep in mind:

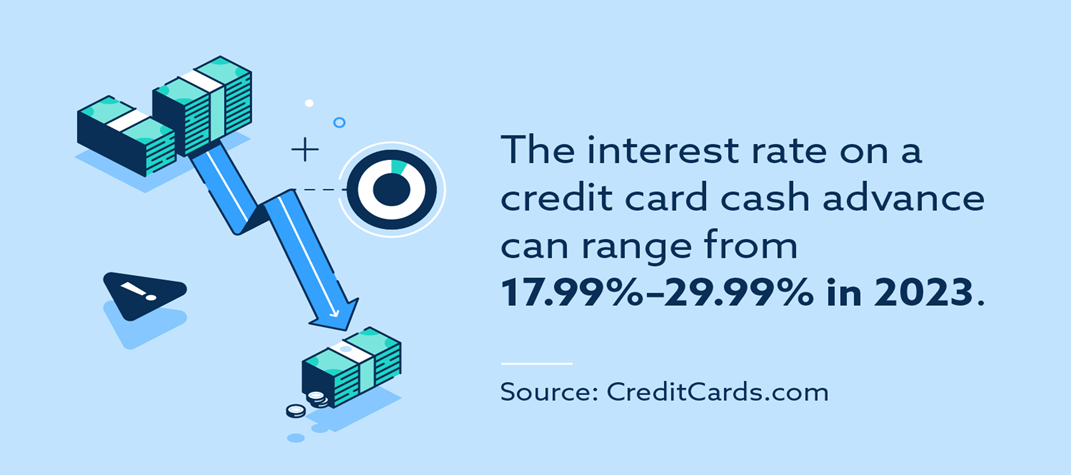

- Cash advance APR: The interest rate on a credit card cash advance in 2024 can range from 17.99 to 29.99 percent, according to Forbes.

- Cash advance fees: Fees will range from 3 to 5 percent of the total amount withdrawn or $5 to $10, whichever is greater. To learn more about your credit card issuer’s fees, check your online credit card account or your cardholder agreement terms.

- ATM or bank fee: Most ATMs or banks will charge a fee for their services.

- No grace period: Unlike other loans, there’s no grace period for cash advances. This means you’ll start accruing interest as soon as you take the loan.

- Separate credit limit: Your cash advance limit will differ from your credit limit.

Types of cash advances

There are a few different types of cash advances that each function differently and have unique fees.

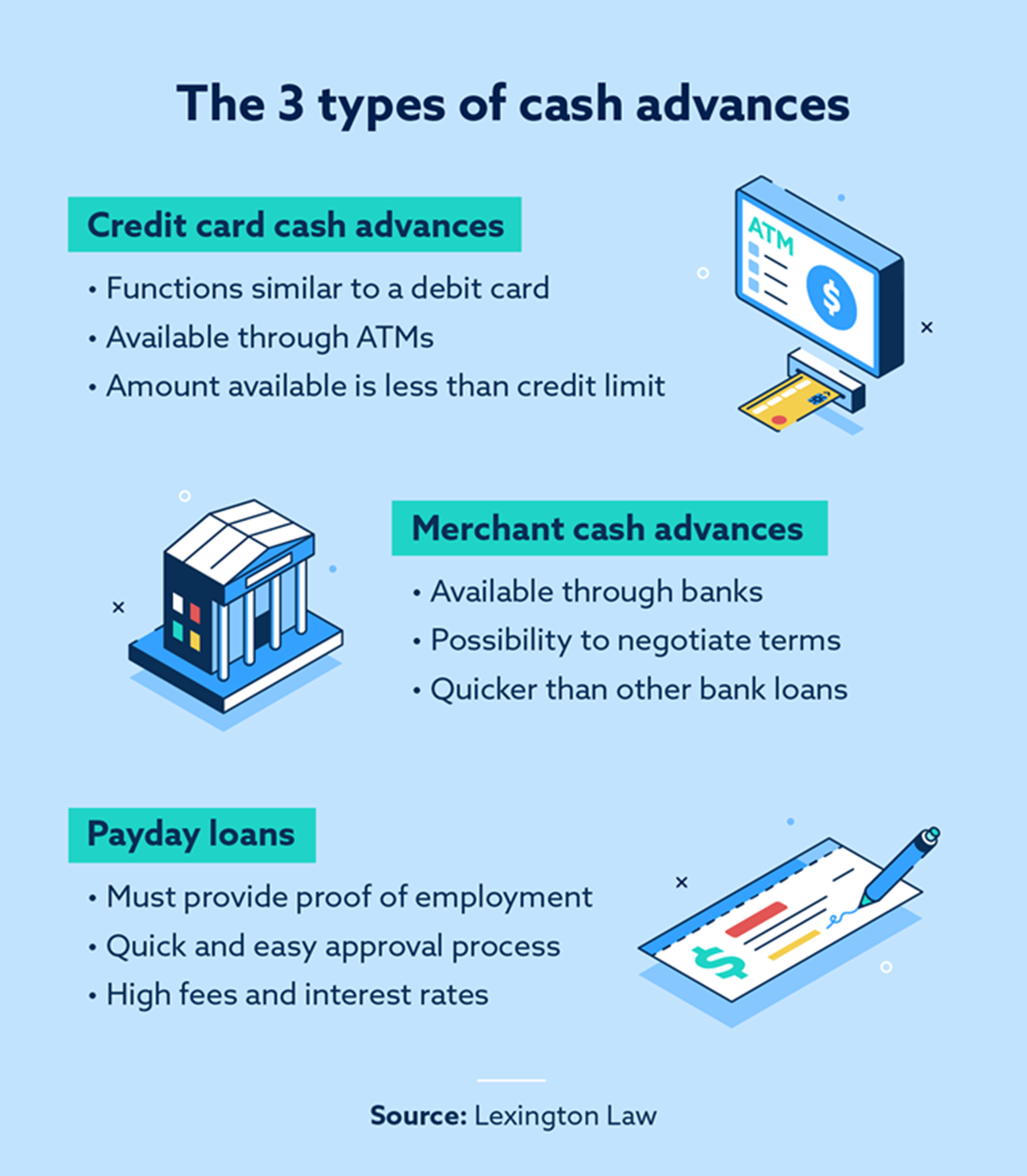

Credit card cash advances

This type of cash advance uses your line of credit to provide you with money you’ll pay back through regular payments.

Merchant cash advances

Merchant cash advances provide a lump sum of money in exchange for a percentage of a borrower’s future sales. This type of cash normally becomes available after a company has established a strong rapport with a financial institution.

Payday loans

Certain companies offer payday loans that give borrowers fast access to cash. Payday loans often have very brief repayment periods, and their payout amounts depend on your state’s laws. In California, for example, payday loans cap out at $300, and lenders are only allowed to charge 15 percent of the amount (about $45) as a fee.

Are payday loans bad? Not necessarily, though payday loan companies often charge the highest fees and interest rates. It might be wise to use this option as a last resort.

Can cash advances hurt your credit?

The act of taking out a cash advance doesn’t directly impact your credit. However, it may indirectly affect your credit in two different ways.

First, it can raise your credit utilization rate—which is best kept at or below 30 percent credit utilization. If your cash advance causes your utilization rate to rise above that threshold, you may see a negative change in your credit profile.

Second, the high fees and interest rates may affect your ability to make on-time payments. A missed or late payment will negatively affect your credit, so always make sure you have a repayment plan whenever you take out an advance. These loans are also sent to collections if they aren’t paid, which can negatively impact your credit as well.

Pros and cons of cash advances

As with all types of loans, there are pros and cons to cash advances. Some of the most common advantages and disadvantages include the following points.

Pros:

- Streamlined application process

- Fast approval time

- Useful in case of an emergency

Cons:

- Higher than average interest rates

- Often come with many fees for transactions

- No grace period for repayments

Less expensive cash advance alternatives

Despite their convenience, cash advances aren’t always the best way to cover a cost. The following alternatives might better suit your financial situation and ultimately cost much less in the long run.

- Consider a personal loan: If you have good credit, the interest rate on a personal loan will likely be lower than that of a cash advance. You may not gain access to the cash as quickly, but you may save more money over the life of the loan.

- Borrow from friends or family: Although it may be uncomfortable to ask, friends and family can be a great resource in an emergency. Should you consider this route, make sure to have a repayment plan in mind to ease your loved ones’ financial burden.

- Build an emergency fund: Although this is a longer-term solution, having an easily accessible emergency savings fund ensures you’ll always have cash on hand when you need it the most. This could help you avoid the need for a cash advance.

- Use home equity: If you’re a longtime homeowner, you may qualify for a home equity loan or line of credit. This strategy allows you to borrow against the value of your home and pay it back over time with a variable rate (i.e., home equity line of credit) or a fixed interest rate based on your credit score (i.e., home equity loan). Talk to a financial planner about which choice is right for your situation and credit.

- Adjust your 401(k) contribution: Saving for retirement is a wise choice, but you might consider temporarily changing your 401(k) contributions if you need liquid funds. After consulting with a financial advisor, talk to your employer’s HR department about how to make changes to your paycheck.

Address credit reporting errors with Lexington Law Firm

Cash advances can be helpful in a bind, but sometimes, late and missed payments are reported in error—and might even go to collections. These errors can have a significant impact on your credit, and that’s where Lexington Law Firm can help.

Our team of professional legal consultants are here to assist you with addressing errors on your credit report. In addition to assisting with challenging these errors, our services include credit monitoring, identity theft insurance and assistance with inquiry disputes. Get a free credit assessment with Lexington Law Firm today to learn more.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.