The Credit Restoration Institute World Famous Weblog: June Newsletter 2022

When you take out a mortgage, what does that do to your credit?

Credit reporting agencies are known to use a short-term ding on your credit score, followed by a significant boost once they see a consistent pattern of regular on-time payments. A mortgage loan can temporarily lower your credit score until you can prove you are capable of handling a large sum of debt.

On average it takes about 5 months to get your credit score back on-track. It is recommended to focus on making consistent on-time payments and keeping other debt responsibilities to a minimum. Remember, not all debt is bad debt and eventually your mortgage will manifest into good debt.

Read the full RocketHQ article here.

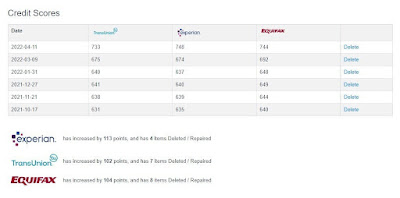

These are REAL results!

As a client, we dispute accounts with the bureaus and creditors on your behalf. Using our years of experience, we utilize the tools you need to move your case forward and the results you are looking for.

You too can improve your creditworthiness.

Read More About Credit Worthiness Here

Are you ready to make a big purchase but want to take a deeper look into your credit first? You’re not alone.

Our credit consulting services play a huge role in separating CRI from others. Our ongoing credit consultation service helps you ensure that you’re making the best choices.

We want you to know that you can count on the information we provide. Call us today for more information.

Join Our Workshop

Topic

Building Credit 101: Tips for the Small Business Owner

Description

You’ll learn credit restoration tips, credit building strategies, the importance of personal credit, and more. Whether you’re considering startup costs or new expansion strategies, establishing a strong credit profile can help ensure your immediate and future business plans are successful.

Guest Speaker: Robert Linkonis, Executive Director, Credit Restoration Institute

Continued Mortgage Trends

According to Freddie Mac, mortgage rates continue to fall but they still remain above 5% fueling an ongoing problem for buyers trying to break into the market.

In a recent article from CNN they reported on numbers from Freddie Mac showing that at the end of May 2021, a buyer who put 20% down on a $375,500 home, financed the rest with a 30-year, fixed-rate mortgage with an average interest rate of 2.95% would have a $1,258 monthly mortgage payment that included principal and interest.

Today, if a homeowner bought the house at the same price with an average rate of 5.10% they would pay $1,631 a month in principal and interest. That is $373 more each month and $134,140 more in cumulative interest payments over the life of the loan , according to numbers from Freddie Mac. According to CNN “For many people, that several hundred dollars in additional payment a month is the difference between deciding whether to buy a home or rent.”

Wishing all the awesome father’s out there a

Happy Father’s Day!

Give us a call today to start your credit repair journey!

Mon-Fri 9 a.m. – 5 p.m. (804) 823-9601 | (800) 648-5157

mail@creditrestorationinstitute.com