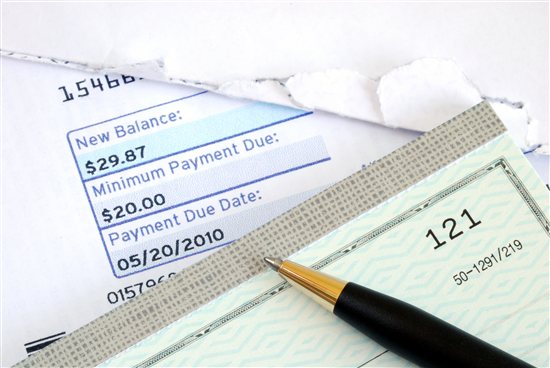

Save Money News – Millennials Learn How to Save up Money, Even When Their Funds are Limited

In recent save money news stories, information has been released on how Millennials are learning how to save up money, even though they do not have a lot of money at their disposal. According to studies, the Millennials throughout the nation have the lowest net worth of any other generation that is of working-age. Based on statistics, half of all of the adults between the ages of 18 and 34 have a net worth of less than $11,000.00. Additionally, the average income of the Millennials is also considered to be the lowest in the nation, at approximately $35,000 or less, annually. Given the fact that this age group faces the largest amount of complications with the job market, has a surprisingly large amount of student debt, and are

Read More