Quicken Alternatives: Other Options To Manage Your Money

You can still use some of the older versions of Quicken on your computer today. You just can’t automatically download transactions without an annual subscription. Instead, you have to manually input transactions.

This can be a painstaking process. Since you have to pay an annual subscription to continue using all of Quicken’s features, you may want to consider your other options.

Here are the pros and cons of several other of my favorite money management alternatives.

Empower

Empower is a company that makes money by managing people’s investments. That said, Empower also offers money management software as a way to expose people to their brand and acquire new customers over the longer term. They offer a web-based solution, an iOS app, and an Android app.

Empower allows you to link your financial accounts to their software. Once linked, transactions imported automatically. Then, Empower provides plenty of detailed reports to help you manage your finances based on that information.

I use Empower to track my net worth because it consolidates all of my accounts in one place. I occasionally use some of their other features, but I don’t use it to track my income or expenses.

Features

Current personal finance tools Empower offers for free include:

- Net worth tracking.

- Budgeting.

- Bill-tracking.

- Cash flow.

- Investment analysis.

- Retirement planner.

- Savings planner.

- Fee analyzer.

Once your net worth reaches a certain level, Empower financial advisors will reach out to you to offer their fee-based services.

I personally don’t use their fee-based investment management, but you will have to decide if it is worth it for yourself. You can still use the free software regardless of whether you use their fee-based investment management services.

Empower pros

- Free to use.

- Tracks more than only net worth.

- Automatic syncs with many accounts.

Empower cons

- After you reach a certain amount of assets, expect calls trying to sell their investment services.

- Accounts can have trouble syncing.

- Free tools are an addition to the main Empower offering so may not be as in-depth as budgeting focused alternatives.

(Personal Capital is now Empower)

Learn more about Empower or read MU30’s full review.

You Need a Budget (YNAB)

You Need a Budget, commonly called YNAB for short, is a budgeting tool built from an individual’s homemade budgeting tools. The software has grown by leaps and bounds since then and now focuses on giving budgeters the tools they need to budget and succeed.

The software is based around a four rule budgeting system. Once you understand the rules, the software helps you follow them to budget while trying to avoid common failures. The rules are:

- Give every dollar a job.

- Embrace your true expenses.

- Roll with the punches.

- Age your money.

Features

The software comes with plenty of features, too. They include:

- Access to your info from any device.

- Budgeting tools.

- Goal tracking.

- Spending, net worth as well as income and expense reports.

You can subscribe to YNAB for $11.99 per month or save money by paying $84 annually. You can use YNAB almost anywhere you are. They have a web-based option, iOS app, Android app and even apps for iPad, Apple Watch and Alexa.

I like the concept of YNAB and believe this software would be super useful in helping someone budget successfully if they were just getting started budgeting. However, I’m at a different stage in my financial life and prefer to stick with what I’ve used up until this point.

YNAB pros

- 34-day free trial.

- Budgeting based on a philosophy to help you be successful.

- Free courses and video workshops.

- Link accounts to the YNAB app.

- Many apps to track your money anywhere, including Alexa.

YNAB cons

- Monthly or annual subscription payment required after free trial.

- Budgeting focused on YNAB’s methodology which may not work for everyone.

Unifimoney

*Editorial Note: This offer is no longer available. Please visit the Unifimoney website for current terms.

Based in San Francisco, Unifimoney specializes in automating the many time-consuming tasks associated with money management.

Unifimoney is perfect for those who want to get started with investing but don’t really have the extra bandwidth to learn a new platform. With Unifimoney, you get a high-yield checking account, as well as a savings account and a credit card that become your all-in-one digital money management app. The app is currently only available to iOS users, but Unifimoney hopes to add Android and Desktop access in the future.

Features

Once you’ve made your $100 minimum deposit and set up your account, you’ll get access to the following features:

- Checking balance earns 0.20% APY.

- Bill pay, direct deposit, remote check deposit, and a debit card.

- Fee-free ATM access.

- Interest can be directed to your portfolio.

- Commission-free investing.

- Cryptocurrency and precious metal investing.

If, like me, you’ve been thinking about investing in cryptocurrencies, Unifimoney can really come in handy. With more than 30 different cryptocurrencies supported, you can build a portfolio that includes cryptocurrencies and precious metals alongside stocks and ETFs. You can have your interest automatically moved to your portfolio, as well as a minimum monthly amount starting at $25.

The Unifimoney checking account packs plenty of features, including bill pay, remote check deposit, and even a checkbook in case you ever need it. You can also sign up for a credit card (Unifi Premier) that will roll out in Q3 earning 2% cash back, with the option of putting that cash into your investments.

Unifimoney pros

- High-yield checking with 0.2% APY.

- Full-featured checking, including bill pay and direct deposit.

- Automatic investing in cryptocurrencies and other assets.

- Self-guided, commission-free investing.

- Unifi Premier credit card earns you cash back of 2%.

Unifimoney cons

- Minimum balance or monthly deposits required for fee-free checking.

- No cash advance feature.

- $100 minimum opening balance.

Learn more about Unifimoney.

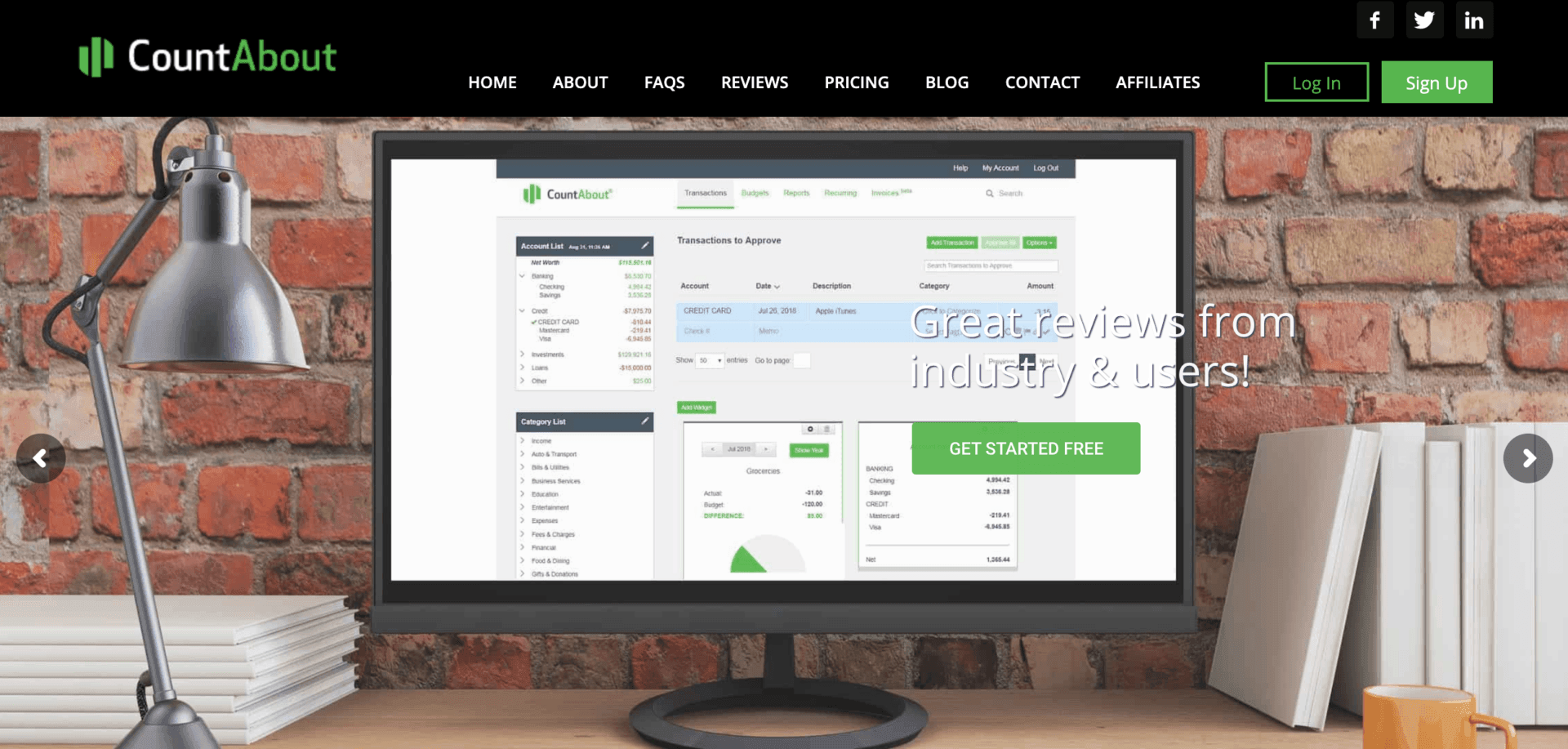

CountAbout

CountAbout is an online personal finance app that allows you to import your historical data from Quicken or Mint. If you’re switching software, it’s always nice to bring your history with you. You can either use their web-based app, iOS, or Android apps. It also offers a free 15-day trial.

Features

CountAbout offers many features that can help you manage your finances. In particular, they offer the following features:

- Budgeting.

- Customizable categories and tags.

- Recurring transactions.

- Automatic transaction downloads (with a Premium subscription).

- Attaching receipts to transactions ($10/year additional fee).

- Financial reports.

- Invoicing capabilities ($60/year additional fee).

- FIRE widget.

- No advertisements.

Pricing starts at $9.99 per year for a Basic subscription. This allows manual input of transactions or file imports from QIF files. If you’d rather have your transactions automatically downloaded, it is included in the Premium subscription which costs $39.99 per year.

CountAbout also offers add-ons. If you need to attach images, that increases the price by $10 per year. Adding invoicing capabilities increases the price by $60 per year. I like the fact that I could import my Quicken data if I decided to switch, but the annual fee and the barrier of learning new software have kept me from switching to CountAbout.

CountAbout pros

- Free 15-day trial.

- Can import history from Quicken.

- Can automatically download transactions with a Premium subscription.

- Invoicing capabilities for small businesses with a fee.

- Ability to track your FIRE timeline.

- Web-based or phone apps available.

CountAbout cons

- Requires an annual subscription for even the most basic option.

- Add-on fees can add up if you need invoicing or image attachment options.

Learn more about CountAbout or read MU30’s full review.

Pocketsmith

Pocketsmith is a robust financial management tool you can use to get an overview of your finances. It has a web-based solution as well as an iOS and Android app you can use.

Features

PocketSmith offers several features including:

- Dashboard overview.

- Net worth statements.

- Income and expense reports.

- Cash flow reports.

- Automatic bank feed importing.

- Categorization and labeling based on your own categories.

- Budgeting with the flexibility to meet your needs including daily, weekly, monthly and more options.

- Supports multiple currencies in spending accounts, assets and liabilities.

- Forecasting tools.

- A budget calendar to help you visualize your bills and their due dates.

- What-if scenarios to test your forecasting against several options.

While most apps focus on U.S.-based consumers, this app allows you to combine accounts across many countries and currencies. This can help global citizens get a single view of their global finances.

This isn’t a big deal for me as all of my finances are based in U.S. Dollars, but I could see it helping others with more complicated finances manage their money easier.

Pocketsmith pros

- Automatic bank feeds from over 12,000 institutions.

- Many reports and forecasting tools.

- Manage currencies, assets, and liabilities from several countries in one place.

- Offers a discount for an annual subscription.

- Secure two-factor authentication.

Pocketsmith cons

- Monthly subscription fee or annual fee with a discount.

- Premium and Super subscriptions are relatively expensive compared to other options.

Learn more about Pocketsmith or read MU30’s Pocketsmith review.

Comparing all the alternatives

| Empower | CountAbout | Pocketsmith | YNAB | Unifimoney | |

|---|---|---|---|---|---|

| Cost | Free basic service, with an extra cost for financial management | Starts at $9.99/year | Free-$19.95/month | $11.99/month or $84/year | Free as long as you meet minimum balance requirements, which are $20,000 in your account or $2,000 in direct deposits each month |

| Basic features | • Net worth tracking • Budgeting • Bill-tracking • Investment analysis • Fee analyzer |

• Budgeting • Automatic transaction downloads • Financial reports • Attaching receipts to transactions • FIRE widget |

• Net worth overview • Income and expense reports • Budgeting • Forecasting tools |

• Budgeting • Goal tracking • Net worth, spending, income reports |

• High-yield checking • Automatic investing • Cryptocurrency investing • Free ATM withdrawals |

What is Quicken?

Quicken is a money management software that can help you manage your personal finances, investments, rental properties, and business.

You can complete the following tasks with Quicken depending on the level of software you purchase:

- Manage spending.

- Budgeting.

- View and pay bills.

- Track investments.

- Plan for your retirement.

- Manage a business.

- Manage rental properties.

The software is available for Windows or Mac computers but the home and business version isn’t available on Macs. Quicken also has a mobile companion app that is available for iOS and Android devices.

You can purchase a subscription based on your needs starting at $34.99 and going up to $89.99 for one year. A two-year subscription option runs from $69.98 to $159.98 depending on the software you need.

Tracking your finances is better than avoiding a decision

It’s more important to track your finances than picking the perfect software to do so. Tracking your finances gives you a clear picture of where your money is going. It also gives you opportunities to find areas where you can improve.

I know when I started tracking my finances, I became much more conscious of every expenditure I made. Did I really need it? Or was there a better use for the money?

Pick a tracking software from the above list and start tracking your finances today. If you find out it doesn’t work, you can always switch later once you get an idea of the features you like or want.

Summary

Picking an alternative to Quicken will depend on your specific finances and your needs. While all of the above software solutions can track your finances, you’ll need to figure out which one works best for you.

It may take some trial and error, but finding the perfect software solution to track your finances can make the task much easier and allow you to start improving your finances quickly.

Read more:

Empower Personal Wealth, LLC (“EPW”) compensates Webpals Systems S. C LTD for new leads. Webpals Systems S. C LTD is not an investment client of Personal Capital Advisors Corporation or Empower Advisory Group, LLC.