Money Orders vs. Cashier’s Checks

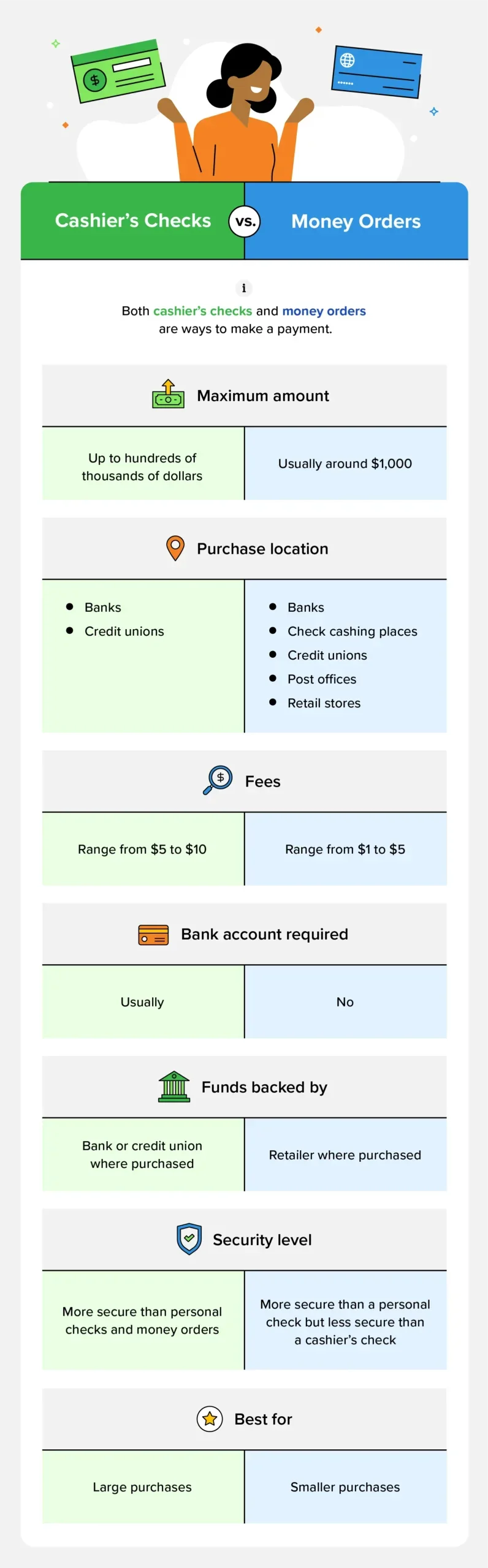

Money orders and cashier’s checks are both payment methods similar to personal checks. However, a money order is issued and guaranteed by the retailer where it was purchased, while a cashier’s check is issued and guaranteed by a bank.

Money orders and cashier’s checks are payment methods that look much like personal checks. Their similarities may make it difficult to choose between a money order versus a cashier’s check.

Money orders and cashier’s checks are similar to paying by check—you write them out to the recipient for the amount due. The difference is in who guarantees the money. In a money order, the amount is guaranteed by the retailer that sold it, while the funds of a cashier’s check are guaranteed by the bank’s checking account.

We break down the similarities and differences between money orders and cashier’s checks so you can use the right payment method for your situation.

Table of Contents:

- What Is a Cashier’s Check?

- What Is a Money Order?

- Similarities between Cashier’s Checks and Money Orders

- Differences between Cashier’s Checks and Money Orders

What Is a Cashier’s Check?

A cashier’s check is a check issued and guaranteed by a financial institution such as a bank or credit union. The funds for a cashier’s check are withdrawn from the bank’s checking account rather than your personal account. A person typically uses them for large purchases.

To get a cashier’s check, you’ll go to a bank or credit union, preferably one where you have an account. Some banks and credit unions may issue a cashier’s check without an account, so call ahead and ask. Tell the teller the amount and recipient of the check, and they will print it out for you after taking the money out of your account, plus a fee for issuing the cashier’s check. The recipient then cashes the check to get the money, just like a personal check.

The benefits of a cashier’s check compared to a personal check include:

- A cashier’s check has no risk of bouncing.

- A cashier’s check includes guaranteed funds.

- Funds are immediately available to the recipient when the check is cashed, while large withdrawals from a personal account may take up to five days to be available.

- Increased security features make counterfeiting less likely.

- No personal data connects you or your account to the funds.

- Faster processing than personal checks gets money to the recipient quicker.

What’s a Money Order?

A money order is a paper document used to make payments. You pay the sum of the money order to the bank or retailer and specify the recipient. The bank then issues the money order, which looks like a check. Because you’ve prepaid for the money order total, the funds are guaranteed. There is no risk that it will bounce like a personal check.

To get a money order, head to any retailer that sells them, such as a bank, credit union, post office, or the customer service desk of a supermarket or convenience store. You’ll fill out the money order, including:

- The recipient’s name and address

- Your name and address

- Memo field (a description of the purpose of the money order)

Then, you’ll sign the front of the money order before paying for the money order, which will include the amount the money order is made out for, plus additional fees. The retailer will issue a receipt, which you’ll want to keep for your records.

Similarities Between Money Orders and Cashier’s Checks

Money orders and cashier’s checks share some traits. These traits make them more appealing than paying by cash, check, or credit card.

Both Are Similar to Checks

Recipients deposit both money orders and cashier’s checks into their accounts as they would a personal or business check. Alternatively, a recipient can cash a cashier’s check or money order at a bank or credit union that allows cashing these payment options.

Both Benefit Recipients

Both cashier’s checks and money orders guarantee that the funds exist, unlike a personal or business check. Unless counterfeit, there’s no risk that either will bounce. This can assure the recipient that your money is guaranteed, which makes it an appealing option in certain situations, such as paying rent.

Both Offer Privacy

Neither money orders nor cashier’s checks require personal information from the payer or payee. Unlike a personal check, they do not include your address or phone number.

Both Are Hard to Stop Payment On

Stopping payment on a cashier’s check or money order is difficult, and it’s all but impossible once the recipient cashes the check or money order.

Differences Between Money Orders and Cashier’s Checks

Even though they look like checks, there are differences between money orders and cashier’s checks.

Different Maximums

The maximum amount for money orders is roughly $700 to $1,000. Actual amounts depend on the issuing bank or credit union. Cashier’s checks have higher limits, even up to hundreds of thousands of dollars.

Different Issuers

You can purchase a money order by walking into any store that sells them. These stores include convenience stores, pharmacies, post offices, grocery stores, banks, and credit unions. You cannot purchase money orders online.

You can only purchase cashier’s checks from banks and credit unions. It’s best to go to your own bank or credit union for a cashier’s check, but if you don’t have an account at a local branch, you can also get a cashier’s check:

- Online, by mail, or by fax from a bank or credit union where you have an account

- From an online bank where you have an account

- From a bank where you do not have an account—if you have cash for the amount and the bank is willing

Some banks restrict who can order cashier’s checks online and where you can send them.

Different Trust Levels

Cashier’s checks are more trusted than money orders because banks issue and guarantee cashier’s checks. Money orders are seen as less trustworthy (although more trustworthy than a personal check).

Different Costs

Both cashier’s checks and money orders include a cost. You can purchase money orders for 70 cents to $5 above the value of the order, depending on the issuer. Cashier’s checks can cost $10 on top of the check’s value. Some banks and credit unions may waive the fee for select customers.

They are also issued by the banks, which have a higher reputation compared to the low reputation of the mass sellers who often sell money orders for a dollar.

Availability of Funds

The first $5,000 of a cashier’s check is typically available within one business day. The remaining funds will take longer to become available. Money order funds also take longer. Only the first $200 is available within a business day.

Money orders purchased from the United States Postal Service typically ensure funds are available within a business day.

When to Use a Money Order vs. a Cashier’s Check

There is a time and a place for money orders and cashier’s checks.

Use a money order when:

- You don’t want to share personal information on a check.

- You are paying a smaller amount (less than $1,000).

- You are sending money overseas. First confirm that your issuer’s money orders can be cashed overseas.

Use a cashier’s check when:

- You want to protect your personal information.

- You are making a large payment (for example, buying a home or a car).

- The merchant you are working with requires it for security purposes.

Keep Your Credit Secure with ExtraCredit from Credit.com

People often use money orders or cashier’s checks for large payments when they want an extra layer of security. If you’re looking to protect your credit, sign up for Guard It from ExtraCredit®, our credit identity protection service. Guard It monitors your credit and sends proactive alerts when it notices something suspicious.