&me Investing App Review – Pros and Cons

LINKS MARKED * ARE AFFILIATE LINKS.

A new player has entered the robo advisor app market in the form of the &me investing app. With so many robo advisors to choose from, though, is &me the right choice for you? We’re sure this &me investing review will help you to decide!

While this &me review goes into great detail, here’s a quick summary for those looking for a short &me review…

- Invest from £500

- Invest via a General Investement Account, Stocks and Shares ISA, Pension or Junior ISA

- &me are FCA Regulated and Funds Protected

- Dedicated Human Consultants available via the app at no extra cost

- Pay less in fees the more you invest… 0.35% – 0.75%

If that’s enough information for you then you can get started via this link* (or any link in this post) and get 3 months free management fees!

Who are &me

&me is the coming together of two big players in the financial sector, these being MFM investments – who some of you might know better as Moneyfarm – and M&G wealth.

For more information on who Moneyfarm are then check out our full Moneyfarm review.

M&G are a leading savings and investments company who wanted a route into the robo advisor market. This was enabled by a deal with Moneyfarm to use their platform technology.

How &me Works

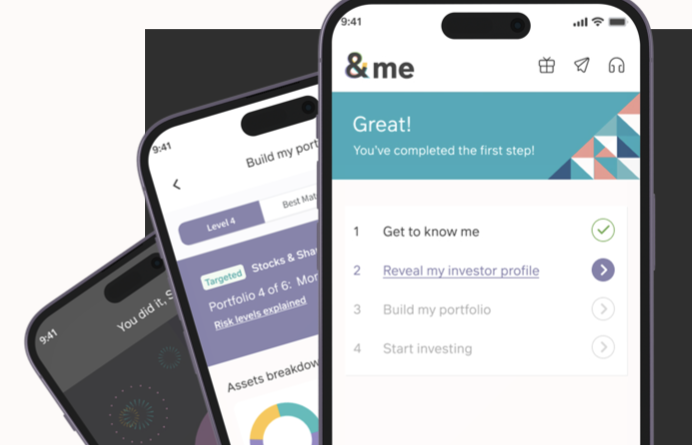

&me has been designed to simplify the investing process and remove much of the financial jargon.

Before you start investing with &me you will be asked some simple questions which will help &me to decide how best to invest your money. These will be questions like…

- How much do you want to invest?

- How long do you want to invest for?

- Why do you want to invest?

&me will also try and determine what kind of investor you are and how much risk you would be willing to take.

Once you’ve answered these questions &me will match you with one of their 6 investment portfolios. These portfolios are pre-made and will consist of a variety of ETF funds to keep any investment fees low and also to streamline the investment process.

On top of this a decision will also need to be made about which type of &me investment account will best suit your needs. Would you be best off with a General Investment Account, for example? Or would a Stocks and Shares ISA or Personal Pension account better suit your current needs and long term goals?

You would be forgiven for starting to scratch your head a little at this point. ‘I thought this process was supposed to be simple?’ you might say. Well, while much of the financial jargon has been stripped away by &me it’s clear you may still have some questions.

This is where &me market themselves as being different to other investing apps in the that they provide a greater level of human support.

Dedicated &me Consultants

&me provide accesss to a dedicated team of human consultants via the &me app. These consultants are easily accessible and are there to answer any investment questions you might have. All of this is included in your &me overall fee and does not cost any extra.

Which &me Account to Choose

Let’s now quickly now consider the various types of &me account you might want to open.

&me Stocks and Shares ISA

If you are looking to invest no more than £20,000 a year into your &me account then an &me Stocks and Shares ISA might work well for you.

Investing via a Stocks and Shares ISA will allow you to enjoy the benefits of tax-free growth on your investment. This is true for both capital gains and tax on earnings. Your investment can still be accessed quickly and withdrawn from an &me Stocks and Shares ISA, with no penalties for doing so. If you already have a Stocks and Shares ISA elsewhere and would like to transfer this to &me, then this can easily be done.

&me Junior ISA

If you are investing for your child’s future then a Junior ISA could be a good choice.

With a Junior ISA you can enjoy tax-free investments on up to £9k each tax year. You can transfer an existing Junior ISA or Child Trust Fund to &me and the company will take care of this process for you.

One big thing to remember with a Junior ISA is that your child won’t be able to access the money until they turn 18.

Another nice perk of Junior ISAs is that friends and family are able to contribute to it. All you’d need to do is share the Junior ISA details with them.

&me Pension or SIPP

If your reason for investing is more long-term with retirement in mind, then an &me pension might prove to be the right account choice for you.

There are various tax advantages to investing via a Personal Pension or Sipp. The first is a 25% boost or top up from the government on every £100 you invest. (This might vary depending on your tax status) You can also withdraw up to 25% of your pension tax-free when you hit age 55 as a tax-free lump sum.

If you want to transfer a pension to &me or even combine a few pensions you hold under the umbrella of &me, then the company will help you to do this. Don’t forget that &me have dedicated consultants on hand to answer any questions you might have regarding this.

&me General Investment Account

If for any reason the above account options with their various tax benefits don’t work for you then a General Investment Account is still available.

With an &me General Investment Account there is no limit on the amount you can invest. This makes it a good option for people who have used up their ISA allowance already.

&me fees

At this point in our &me review it would be good to discuss the fees involved with using the &me investment app.

The first thing of note here is that there are two types of fee you will pay when investing with &me. These are the annual fees charged by the company for using their platform. The second are the fees charged by the funds in which they invest your money.

Firstly, let’s take a look at the annual fees you will pay if you invest with &me through one of their accounts mentioned above. You will notice the percentage amount you pay to use the platform and app decreases as you invest more money.

Then there are the fees charged by the underlying funds in which your money has been invested into by &me. To be clear, this money does NOT go to &me themselves and will change depending on whether you opt for a classic portfolio (one of their 6 pre-made portfolios) or whether you opt for a targeted portfolio, which includes more investment options and therefore requires more active portfolio management.

A typical example of the overall fees paid on a classic portfolio can be seen below…

If you have been researching different UK robo advisors then you may have noticed that the fees charged by &me are very similar if not exactly the same as those charged by Moneyfarm. While this is not surprising – as Moneyfarm power the &me app – it might make you wonder which company is right for you? On this point I would suggest you check the past performance of both companies (when available) and their various funds. I’d also encourage you to consider which company you feel might offer the best human advice element to their service.

&me Minimum Investment Amount

The minimum investment amount to open an &me account* is £500.

For those who want to make regular deposits to their &me account this option is available but you will need to deposit at least £200 per month. This is reduced to £100 per month for a Junior ISA (JISA).

I’ve observed many different robo-advisors over my 10 years running this blog. While some have experimented with different minimum investment amounts – some starting as low as £1 like InvestEngine (InvestEngine have now increased their minimum investment amount to £100) – they often end up reverting to an amount around the £500 mark. Don’t forget you can still withdraw your money at any time with many of &me’s account options.

Socially Responsible Investing

Another aspect of their service &me are keen to promote is their approach to Socially Responsible Investing.

When investing with &me you have the option to choose one of their targeted funds. These funds will give you the chance to invest in portfolios where the companies selected are known for meeting strict environmental and social standards.

Is &me Safe?

&me is authorised and regulated by the Financial Conduct Authority. This means your money and investments will be held in a separate account and never mixed with &me’s own money.

Your funds are held with MFM Investment limited who are covered by the Financial Services Compensation Scheme up to the £85,000 limit. Do be aware that this limit applies to the whole of MFM’s operations. So if you hold a Moneyfarm account already, for example, then your funds held in that account will also be counted in this £85,000 limit.

To be very clear here, we are talking about what would happen to your money if &me were to collapse. This scheme does not cover any losses made if the value of your investments were to fall.

&me Pro and Cons

The main pros of &me are ease of investment, the option for socially responsible investing and the fact that human advice is available when required.

The cons of &me are the fact that you need £500 as a minimum investment to get started and then a further £200 a month available if you want to invest regularly. (£100 for JISA)

Conclusion

If you are looking for an easy route into investing then &me could be a good option for you. The app is simple to use and with Moneyfarm’s technology powering it, there are years of experience under the hood. &me offer pretty much all of the investment accounts you might want in a Stocks and Shares ISA, Junior ISA and Pension as well as their General Investment Account. With a minimum investment amount of £500 the platform will be accessible to most semi-serious investors but not everyone. Your money is ring fenced to keep it safe.

If this &me investment review has helped you to decide that they are the right choice for you then do consider signing up via this link*. If you do then we will receive a small commission which helps us keep this site free to use. You will also receive 3 months free management fees when using our link!

With investment, your capital is at risk and you may get less than what you invested.