Interview With Dorethia Conner of #MoneyChat

Interview With Dorethia Conner of #MoneyChat is a post from: Faithful With A Few. If you enjoy it, please subscribe to the Feed.

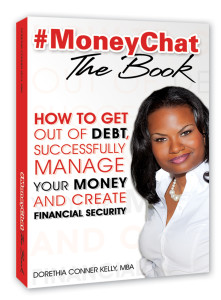

A few days ago we posted a review of #MoneyChat The Book, by Dorethia Kelly Conner. This new personal finance book was born out of the popular ‘money chats’ that Dorethia hosts each week on Twitter.

To coincide with the launch of the book, we are posting a Q&A with the author about the book and how you can take control of your finances.

Why did you write #MoneyChat: THE BOOK?

Before the book was the website and before that the online Twitter Chat – which is the catalyst for the #MoneyChat movement. It is a way to take a conversation that can often be shameful or awkward and make it less  intimidating.

intimidating.

It’s a community, I want people to know we are all in this together and there is no judgment. After doing the chat and workshops for a few years, I decided it was time to put on paper some of the key things that we had discussed , some of the reoccurring topics I heard during the chats and in my financial coaching practice, thus we have #MoneyChat THE BOOK.

How should readers apply this book to their personal finances?

I wrote #MoneyChat THE BOOK in 3 sections based on common themes I was finding in my financial coaching practice. Most people wanted to get out of the debt hole and learn successful money management so that they could save, invest, retire and create college funds for their kids. Throughout each chapter there are ‘how to’s and action plans’. Highlight, dog ear and underline the things in this book that resonate with you and follow the action plans.

What are some of the best tips you can offer people who have tried, but just aren’t good with their personal finances?

First, I’d say don’t beat yourself up, only look toward the future, but do learn from your past mistakes. You don’t want to repeat the cycle.

Second, get back to the basics, a notebook and pencil. List all your monthly income and subtract your monthly expenses. Do this at the start of each month on a new page in the notebook.

Third, there are all kind of websites and cell phone apps that are free! You may have to log your information into them once and then monitor or update. These sites/apps are perfect for people who can’t keep up with a written budget; don’t know their investment status, etc. You can print graphs, reports directly from the sites. It is also easy to update changes in your financial situation.

If none of this works, get help. There are free community programs and you can also hire a financial coach. Financial coaches help you create a financial strategy and teach you how to handle your money yourself with education and guidance.

Your book dives into the topic of Investing. Why is investing important yet intimidates so many people from doing it?

It’s all about educating yourself; people are intimidated by what they don’t understand. In the book I show people how ease into investing little by little, help them understand the basic terms and then dig deeper.

Investing is a viable way to build wealth and is an important key to lifelong financial planning.

You talk about getting out of the hole in the book, what about dating/engaged couples who are both in debt? Should they be out of debt before they get married?

Whether one or both are in debt or facing other financial challenges, I would first ask if the two are on the same page of becoming financially stable. Are they both determined to get out of debt and committed to traveling that path together?

Have they both been completely honest about the good, bad and ugly of their finances? If one is better at money than the other, is the other willing to learn? If the answer is yes, then you can work to get out of debt together after marriage. If there is a continued pattern of poor financial decision making from either or both, I would not suggest marriage until those issues are resolved.

They will only cause big arguments in the marriage.

As we know, student loan debt is crippling a lot of people financially. What can people do to lighten the load?

I believe in accountability, the fact of the matter is that we all signed on the dotted line and used the money for our tuition, books, living expenses pizza, parties, etc. Therefore we are responsible. That said, I do believe the system needs an overhaul, I too am paying back student loans, it’s one of my final debts.

There are various payment options, call your lender to inquire before you start to feel the pinch. There are also forbearance and deferment options. Just be careful, because those only prolong the debt, make sure they are absolutely necessary.

Lastly, there is a lot of legislation being proposed around student loan debt to ease the pain for borrowers. Set up Google alerts so you can receive emails whenever it is mentioned in the news. Bookmark the Federal website so that you know immediately if a new program is implemented that can help you with your student loans.

What made you write about gambling in this book?

I have personally seen how gambling has crippled households, from casinos to gambling house parties. In the book I discuss how one man lost his family over scratch-offs.

It’s a real issue that is rarely talked about in mainstream but people are losing houses, life savings, and families over it. I had to address it and offer help to those who are faced with this struggle.

I also address IRS debt, pay day and cash advance loans because they are a detriment to financial success.

If you need help in your financial journey, regardless of your income level or financial knowledge, this book is relevant and essential to help you achieve your goals. I recommend this book for someone who is ready to hit the ground running and begin doing what it takes to get their money in order.

You can purchase the book here from Amazon.

Dorethia Conner Kelly, MBA is the president of Conner Financial Coaching, LLC, providing results-oriented personal finance and business coaching services. She is also the founder of the popular #MoneyChat personal finance blog, themoneychat.com and online Twitter chat.

Dorethia Conner Kelly, MBA is the president of Conner Financial Coaching, LLC, providing results-oriented personal finance and business coaching services. She is also the founder of the popular #MoneyChat personal finance blog, themoneychat.com and online Twitter chat.

Dorethia’s financial expertise has been featured in various national media including Black Enterprise, U.S. News and Nerd Wallet. She lives in Detroit, Michigan with her family.

Connect with Dorethia at @MoneyChatLIVE & @DorethiaConner Visit www.themoneychat.com and www.connercoaching.com

© 2015, Khaleef Crumbley. All rights reserved.

The post Interview With Dorethia Conner of #MoneyChat appeared first on Faithful With A Few.

SOURCE: Faithful With A Few – Read entire story here.