How to Rollover an IRA to Betterment in 4 Simple Steps

Earlier this month I completed a Roth IRA rollover from my Edward Jones account to Betterment. Edward Jones is considered a full-service broker while Betterment is an up-and-coming robo-advisor.

Rolling over my Roth IRA is something I’ve been meaning to do for a couple of years. So why did it take me so long?

Well, I actually thought the process was going to be more involved than it was, and I didn’t think I had the time. To my surprise, rolling over an IRA to Betterment only takes a few minutes. The most time spent is mostly waiting for the whole thing to finalize and process, which takes about 2-3 weeks.

Why Rollover an IRA to Betterment?

Edward Jones is a well-known investment firm and comes with awesome customer service. They are a well-established company and have been around since 1922, while Betterment was only founded in 2008.

When I was first dabbling with investing back in 2005, my (then) boss opened and contributed $4,500 into a retirement account for each employee as a bonus. After a couple years, I rolled over this amount (and any earnings) to Edward Jones so I could have more control and learn about the investing process.

As my knowledge and boldness of investing and retirement accounts grew, I opened a new Betterment account in 2011. I was actually one of the first people to invest with Betterment after the new startup began a national campaign to increase their customer base.

I even got to meet their team at one of the annual Financial Blogger Conferences I attend every year, and was able to write for the blog for a short period of time. Since that time I’ve held multiple accounts with them, including a small individual Roth account.

Save Money on Investment Fees

My reason for sharing this info is to say that I began testing out Betterment’s service with the intent that I wanted to eventually merge all of my investing and retirement accounts with them. They offer very good customer service, quick responses, and their team is very friendly.

On top of that the fees are much lower with Betterment than Edward Jones.

- Edward Jones charges an annual fee of $40 plus a 2{6fac3e6a3582a964f494389deded51e5db8d7156c3a7415ff659d1ae7a1be33e} commission on any investments and reinvestment amounts. For me, this was well over $1,000 a year in fees.

- Betterment only charges fees ranging from 0.15-0.35{6fac3e6a3582a964f494389deded51e5db8d7156c3a7415ff659d1ae7a1be33e} depending on your total balance or the amount you deposit each month. If your balance is less than $10,000, or you contribute less than $100 a month, you’ll pay a flat fee of $3/month.

You can already see that initiating a Roth IRA rollover from 2{6fac3e6a3582a964f494389deded51e5db8d7156c3a7415ff659d1ae7a1be33e} at Edward Jones, to 0.15-0.35{6fac3e6a3582a964f494389deded51e5db8d7156c3a7415ff659d1ae7a1be33e} at Betterment is a HUGE amount of savings on investment fees.

And the best part? There’s no annual fee when using Betterment, it’s completely free to open an account and you can close it at any time.

Benefits to Using a Robo-Advisor

The nice thing about Betterment is that even though it’s a fairly new startup, the funds they use to build your custom portfolio are Vanguard, Schwab, and Blackrock ETFs, and those have all been around for decades. So even if something were to happen with Betterment, I’m confident that the actual investments in the accounts would not be impacted.

As a self-employed freelancer my income is widely inconsistent. Some months I have plenty of money to pay the bills and then extra, while other months are very lean.

I like the flexibility that a robo-advisor like Betterment offers where I can adjust the amount I’m automatically saving each month, or just make a one-time deposit. Edward Jones doesn’t allow this and requires a consistent amount of money every month.

4 Steps to Rollover an IRA to Betterment

Now that I’ve shared a bit about my story and reason for moving all of my retirement accounts to Betterment, here’s a step-by-step guide for performing an IRA rollover yourself.

Step 1: Create a new account (or login). You’ll be taken through a quick 5-step process to create a new Betterment account. It’s pretty self-explanatory and does not require a minimum balance.

You’ll be requested to fill in your personal information, like your Social Security number, physical address, and your annual income. You’ll also have to link a bank account to which you want to fund the account. Your information is totally safe, as Betterment uses bank-level encryption for their service.

Or if you already have a Betterment account, like I do, then you can simply log into your account and skip these above steps.

Either way, once you’re logged in you have 3 choices:

- Deposit money into your account

- Rollover funds from a different investment or IRA account

- Add a goal or create another tax-advantaged account

Since we want to initiate a rollover, simply click the Rollover button to start the process.

Step 2: Select type of account to rollover. There are multiple types of accounts you can open with Betterment.

- Individual Retirement Account (Traditional, Roth, SEP, SIMPLE)

- 401K, Pension Plan, Profit Sharing

- 403B, 401A

- 457B, Thrift Savings Plan

For my purposes (and the purpose of this article) I’m focusing on a Roth IRA account transfer. Select Roth IRA from the drop-down menu. You’ll then choose from a list of popular companies or accounts to transfer your funds from — your old retirement provider.

In my case Edward Jones wasn’t listed (which is kind of strange since they’re a popular brokerage firm), so I just scrolled down to the bottom of the list and clicked “Other”. Then I typed “Edward Jones” in the space provided.

If your account is listed just choose from the options in the drop-down menu and proceed to the next step. In my husband’s case, we are also in the process of transferring his Roth IRA from Chase (because their fees are even more outrageous than Edward Jones) to Betterment.

So yeah, I’ve done this process twice in the last month. Ha!

The next screen prompts you to input your investment or IRA account number, and whether you want to transfer the entire balance or only a portion of it. Yes, this means you can transfer a portion of your current IRA into Betterment if you want to test it out before rolling over the entire amount!

Verify that your account number is correct, then scroll down to the bottom of the screen and initiate the transfer request.

Here’s a quick video of how the entire process works! See, it’s not nearly as complicated as you, or I, might have thought.

Betterment will then send you an email summary checklist of the next steps. Once you sign the form and mail it, you’ll receive confirmation of the transaction from your current broker or bank within 2-3 weeks.

Some banks or brokers will require an additional medallion certificate so you may need to go down to your local bank branch and sign the form in person before they the process of the rollover is complete.

Step 4: Receive confirmation of your rollover. Within a couple weeks the entire process should be finished. If all the paperwork is correct and has been accepted, you will receive an email confirmation from Betterment.

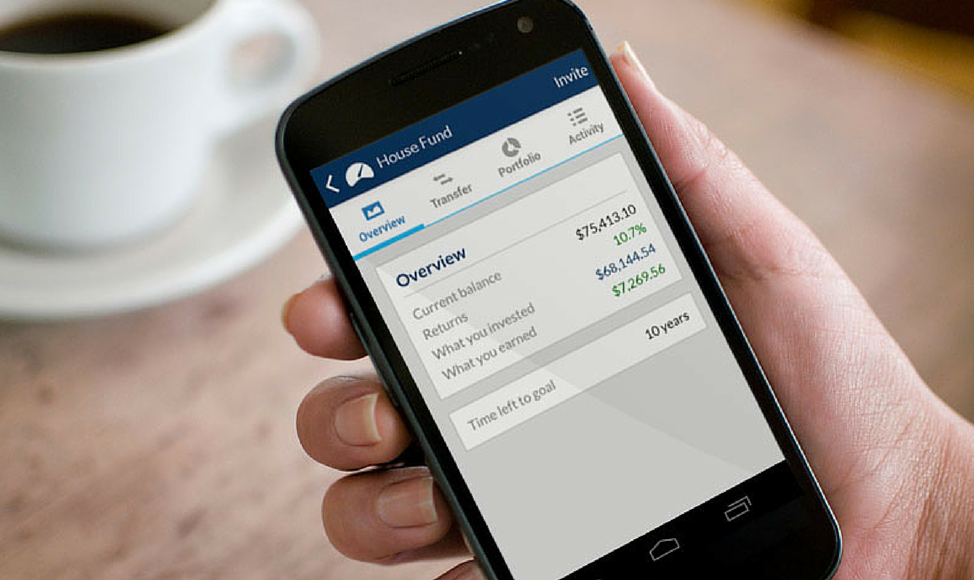

While you’re waiting you can log into your Betterment account to check the progress by clicking on the Activity tab. It will show the date you started the Direct Transfer request, and display a checklist of where your account is in the process.

In the case of my husband’s Roth IRA rollover we had to follow up with Chase to make sure they received everything. Somehow the paperwork got lost and we had to start over. Thankfully though, Betterment’s account Activity tab kept us updated and on track.

Try an IRA Rollover for Free

If you’re wasting money with a high-cost brokerage account like I was, what are you waiting for? Open a Betterment account for free and rollover your IRA today! The process is very quick and you’ll instantly save loads of money on investment fees over the lifetime of your retirement savings.

I’ve been very happy with my Betterment account and have been a customer for over 4 years. I know you won’t be disappointed when trying out their service.

[If you sign up for Betterment I’ll get a small commission fee that helps keep this site going, but it won’t cost you anything extra. I only recommend products and services that I personally use.]

The post How to Rollover an IRA to Betterment in 4 Simple Steps appeared first on Careful Cents.

SOURCE: Careful Cents – Read entire story here.