How Student Loan Debt Factors into Your FICO® Score

By Tom Quinn

This year’s summer break may be a bit more stressful if you are a college student who plans on taking out subsidized federal student loans to help pay for upcoming tuition. Unless Congress takes action this summer to restore lower rates, new student loans will have interest rates twice what they were in the spring semester (3.4 percent to 6.8 percent). You don’t need to be a math major to know this is not good news.

This difference in interest rates will increase the total amount of money you end up investing in your education. And it will likely impact a lot of US consumers.

With education costs rapidly outpacing inflation, more students and their parents are taking out student loans to pay for education. Based on recent FICO research looking at a large data sample from one of the credit bureaus, we found that 6.2{6fac3e6a3582a964f494389deded51e5db8d7156c3a7415ff659d1ae7a1be33e} of US consumers had two or more open student loans on their credit report in 2005. By 2012, that number grew to roughly 11.8{6fac3e6a3582a964f494389deded51e5db8d7156c3a7415ff659d1ae7a1be33e}.

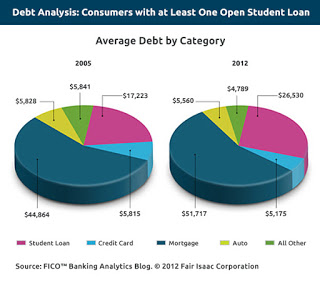

Consumers also have a greater amount of student loan debt today. In 2005, consumers with an open student loan on file had an average student loan debt of $17,233. In 2012, that number increased 54{6fac3e6a3582a964f494389deded51e5db8d7156c3a7415ff659d1ae7a1be33e} to $26,530. This has outpaced growth for other types of debt, as the chart below shows.

So what does all this mean for your FICO Score?

While this increase in interest rate has no direct effect on a FICO® Score (as interest rate information is not captured on the credit report and not considered by the score), it is important to understand that how you manage your student loan debt does have an effect on the score.

Let me set the record straight on exactly how student loan credit is factored into the FICO® Score:

- A student loan receives no special treatment by the FICO® Score; it is treated like any other installment loan. The score doesn’t employ any variables that specifically evaluate student loan data.

- It makes no difference to the score if the student loan is backed by the government or a private loan from a lender.

- A student loan that is reported in deferred status does not receive any “special treatment” by the score. These loans are considered by the algorithm and can have a positive, negative, or no impact on the score, depending on what other credit information is present.

- Inquires identified as student loan related searches for credit are included in the FICO® Score’s special inquiry treatment logic.

It’s important to understand that while student loan debt can factor into the FICO® Score, revolving debt (like credit cards) has a larger influence. That’s because we’ve found that revolving type indebtedness has a stronger statistical correlation with future borrower performance than installment loan indebtedness.

While you have limited control over what happens “inside the Capital Beltway”, you do have control over how you manage your finances, and improve your knowledge of what drives your FICO® Score, which can influence your access to affordable credit options. That’s a lesson we can all benefit from understanding!

Good luck to all students getting ready for the fall semester.

Tom Quinn is the Vice President of Business Development for myFICO, and has over 20 years of experience working with consumers, regulators and lenders and regarding credit related questions and initiatives.

Next Article:

How Employment Credit Checks Keep Applicants From Getting the Job

Visit the Credit Restoration Associates Website

Back to the CRA blog homepage:

Credit Repair Va:

CRA Resources:

Credit Repair:

About CRA:

Good Articles:

The Credit Score That You See is NOT the Same as Lenders See

SOURCE: The Credit Restoration Associates World Famous Weblog – Read entire story here.