How Our New Mortgage Will Affect Our Budget

So now that I’ve talked about the cost of buying a home in Southern California, it’s time we talk about the real important stuff, like how this new jumbo mortgage payment is going to affect our budget.

Before I give you some financials, I want to present to you some numbers about salaries in Orange County, CA and the cost of housing–because let’s face it. You can’t compare the cost of living in southern California to the cost of living in the mid-west.

And before I start getting all those comments about how we should just move to Kansas–it’s not happening. People choose to live where they live for a variety of reasons. For some, cost may be the most important factor. For us? It’s family. And ALL our extended family on both my side and Eric’s side live in southern California and we are not moving. And that’s that : )

Here are some numbers though that I recently found out about from a discussion on affordable housing that I attended through my job:

- The median salary in Orange County, CA is $87,000+ for a family of four

- Rent for a one-bedroom apartment in the city that Eric and I used to live in was $2205

- Rent for a two-bedroom was $2805

Two things to note as we take a look at our budget:

- Eric and I had a very good deal on our two-bedroom townhome. We were paying several hundred dollars less than the average on a one-bedroom apartment. This was great for us because it allowed us to save a lot of money, but it was not realistic of the rental prices in Orange County

- Eric and I make a lot more than the median Orange County salary

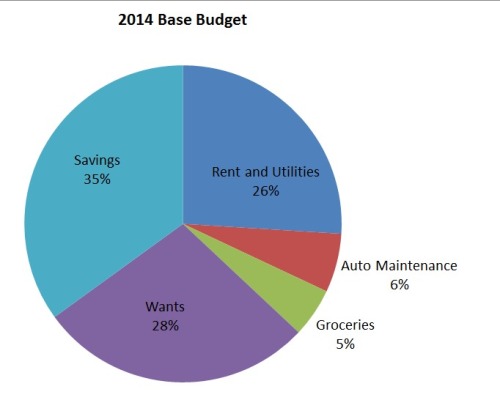

2014 Base Budget

Below is our monthly base budget for 2014. Our base budget includes only our after-tax salaries (and after-401k contributions). This means that my side hustle income is not included.

Another thing to note is that our base salary does not include any overtime we earned. To give you an idea of how often we actually make our base salary, only once this past year did we only make our base salary. All other times we made more than our base through overtime from either Eric or me–and that still didn’t include my freelance income.

Technically, we put all my freelance income and Eric’s overtime pay into savings, which is why it doesn’t really sway our finances one way or the other, but sometimes we do use it for other things, like travelling.

Our New Budget with Our New Mortgage

After talking with our financial adviser, we settled on a number that we felt we could realistically afford. Because of the tax benefit of being homeowners, we could automatically afford several hundred dollars more in mortgage than we could as renters, due to the tax breaks we’ll receive from being homeowners. We are essentially only paying $300 more in a mortgage payment than as a renter. (*this sentence was edited to reflect information in the comments below)

However, there is a pesky little thing called property taxes and homeowners’ insurance that drives up our total monthly payment. This is what our new base budget will be in 2015 with our new mortgage.

BUT, these numbers do not include the raises that Eric and I are both set to get at the end of the year. 5{6fac3e6a3582a964f494389deded51e5db8d7156c3a7415ff659d1ae7a1be33e} for me, and I’m not sure how much for Eric, but probably around the same. However, we are not counting on that as you can see.

Holy Guacamole that’s a really big jump in Rent and Utilities!! (Now that I look at it, I guess it should say mortgage, right? Yeesh, that’s so grown-up)

The above would be a very, very conservative budget for us. Like I said, the only time we ever met our base budget in 2014 was once, and that still didn’t include my freelance income for the month. At the suggestion of our adviser, we will be treating my freelance income as part of our normal budget in 2015, rather than as a separate entity. This will help to really show how much total income we’re bringing in and how much total we’re spending and saving.

Because my freelance income and Eric’s overtime income fluctuates from month to month, we still chose to go with our most conservative budget when you add those in. And this is what we expect our 2015 monthly budget to look like:

While still on the high side, I am much more comfortable with our mortgage and utilities around 36{6fac3e6a3582a964f494389deded51e5db8d7156c3a7415ff659d1ae7a1be33e}. Our total needs seem to hover around 45{6fac3e6a3582a964f494389deded51e5db8d7156c3a7415ff659d1ae7a1be33e}, which is a bit high. Luckily, we have low wants because we try and limit our free spending while still feeling free to spend on the things we prefer.

As for savings, there are a lot of different goals we plan on saving for:

- Max out Eric’s Roth IRA for 2014 (we have until April to save for this)

- Save for a down payment on a car

- Save for the master suite upgrade in 2018

- Rebuild our Emergency Fund

- Vacation fund (can’t live without that..)

- Christmas fund ($50 per paycheck)

- Car Insurance & Expenses: Every month we set aside money to pay for our car insurance, registration, oil changes, and repairs. This way it doesn’t hurt so much when that bill pops up in the mail every six months

Experts recommend the 50-30-20 rule: 50{6fac3e6a3582a964f494389deded51e5db8d7156c3a7415ff659d1ae7a1be33e} of your income should go toward needs, 30{6fac3e6a3582a964f494389deded51e5db8d7156c3a7415ff659d1ae7a1be33e} toward wants, and 20{6fac3e6a3582a964f494389deded51e5db8d7156c3a7415ff659d1ae7a1be33e} toward savings.

I feel this is a little bit off, but it’s a good starting point to strive for. I think I would feel the most confident with a 40-30-30 rule.

What financial rule do you try and follow?

The post How Our New Mortgage Will Affect Our Budget appeared first on Newlyweds on a Budget.

SOURCE: Newlyweds on a Budget – Read entire story here.