How I Started Investing – Blogging Away Debt Blogging Away Debt

by Hope

Some of you will remember last fall when I was trying out different sites to earn cash. Doing surveys and various other online tasks to see which legitimately paid. In most all cases, I determined that they are not worth my time. However, one of my finds did stick during that journey.

Stash <-not an affiliate link touts itself as an Investing App for Beginners. So you know that is perfect for me. I signed up last fall and began invest $5 a week. It truly was a decision driven by the opportunity to earn $75 for trying it out. (And yes, I did get paid that amount after my first 30 days.)

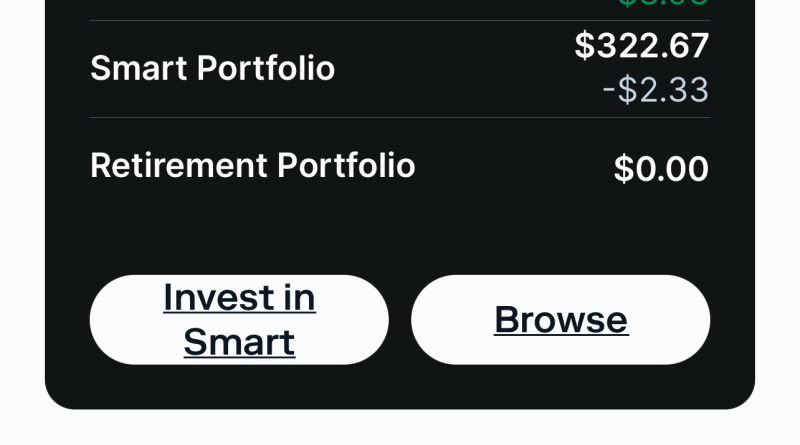

As of today, here is my balances:

It has been so easy and so mindless as far as deciding what to invest in. Now I’m up to investing $35 per week to the two different portfolios. I’ve got all my settings set to re-invest. And my plan is to just let it ride.

If you would like to try it out…and help a girl out, this is an AFFILIATE LINK that bonuses me $20 in stock when you sign up.

My hope is that I can increase my investments significantly by the end of the year or early next year as I begin to reach some big paying off debt goals. But I haven’t sat down and really thought that thru yet.

I appreciate how communicative Stash is about my investments. How easy it is to see where my money is going? And how easy it is to change my risk level and re-balance my portfolios.

While I admit, I truly do not know what I am talking about when it comes to investments. This has made me feel like I’m going in the right direction. And it’s been a consistent “savings” platform for me. (I know it’s not a savings account, I recognize the risk.)

BAD Community, what do you think of this tool for beginning investors? I’d love to hear your more experienced feedback?

Hope is a creative, solutions-focused business manager helping clients grow their business and work more efficiently by leveraging expertise in project management, digital marketing, & tech solutions. She’s recently become an empty nester as her 5 foster/adoptive kids have spread their wings. She lives with her 5 dogs in a small town in NE Georgia and prefers the mountains to the beaches any day. She struggles with the travel bug and is doing her best to help each of her kids as their finish schooling and become independent (but it’s hard!) She has run her own consulting company for almost twenty years! Hope began sharing her journey with the BAD community in the Spring of 2015 and feels like she has finally in a place to really focus on making wise financial decisions.