High interest business savings accounts (that actually pay 4% or more)

With interest rates on the rise over the last couple years, we have seen lots of personal savings accounts with good interest rates 4%+.

But what about business savings accounts?

Are there actually any business savings accounts that actually pay well?

It turns out that most of them are still paying 0.1% (or basically nothing), but after doing some digging I found that there are a few out there that are paying 4% or more currently.

And as usual, I was doing this research for myself and so I thought I would share it with you, to save you the time!

Where I have my primary business checking account

For the last few years I have been using Relay bank (and the Profit First system) and I really love Relay. After 15 years of business they are the first business bank account that I have actually liked.

And they are rare in that they have a savings account that pays more than 0.1%.

With their savings account they pay 1%. Which I appreciate, but again I wanted to see if I could do better.

After digging around I found this helpful article from Nerdwallet which helped me create my shortlist here:

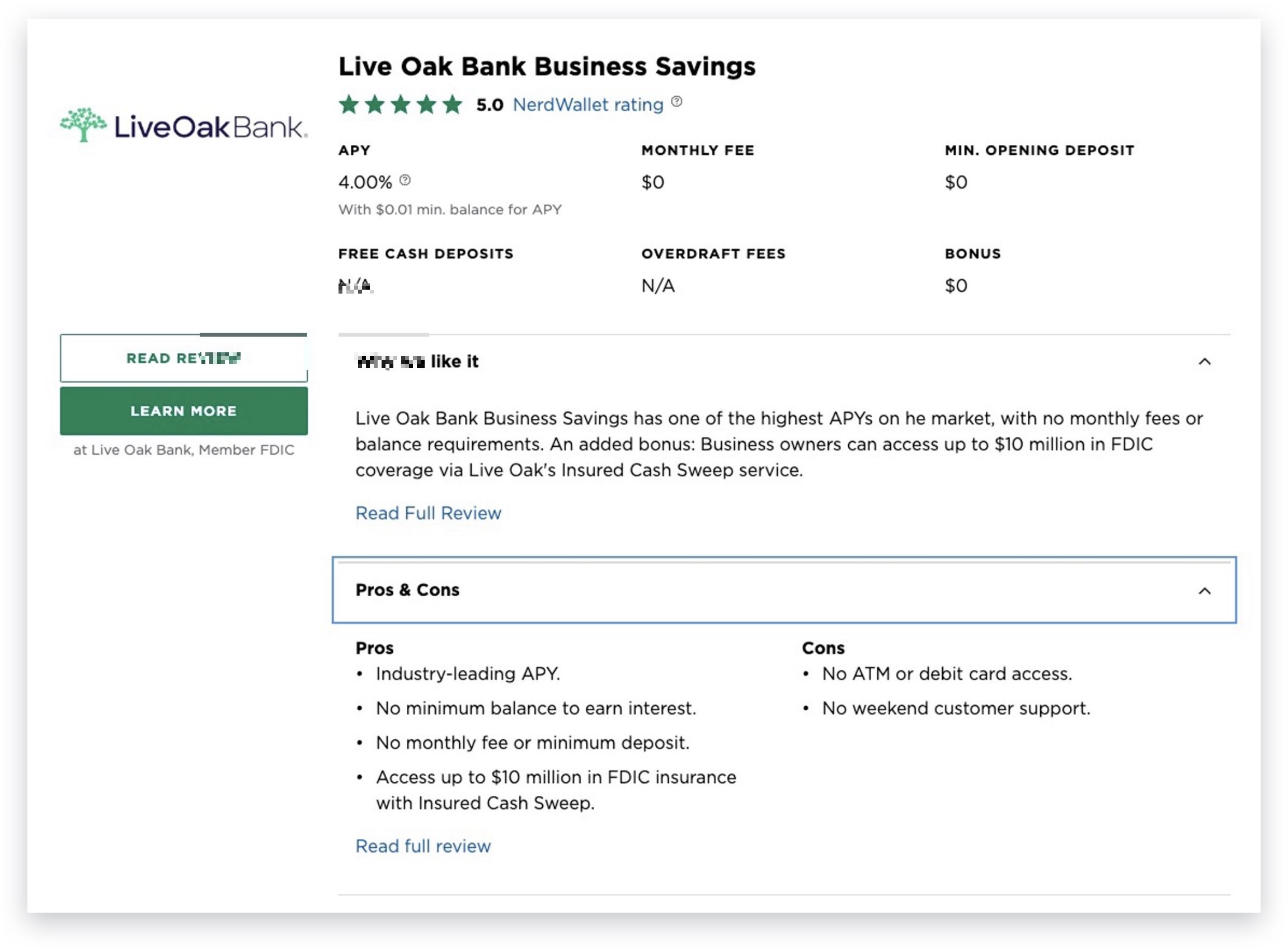

LiveOak is offering 4% with no monthly fee and no minimum opening deposit.

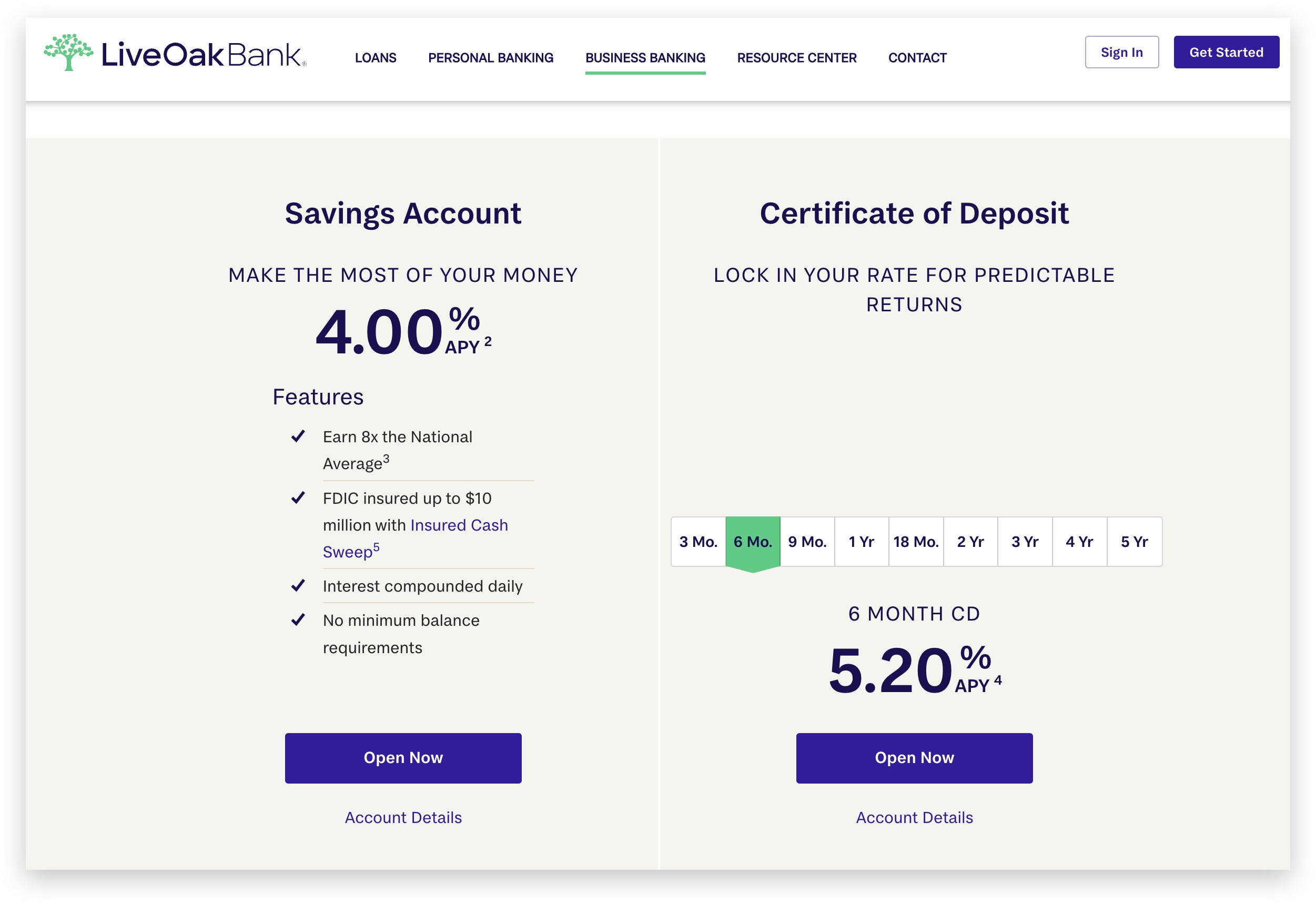

In addition to the 4% that they are currently offering on their business savings account they also are offering a 6-month business CD paying over 5% – which is great to see.

If you are interested in finding out more, you can do so here.

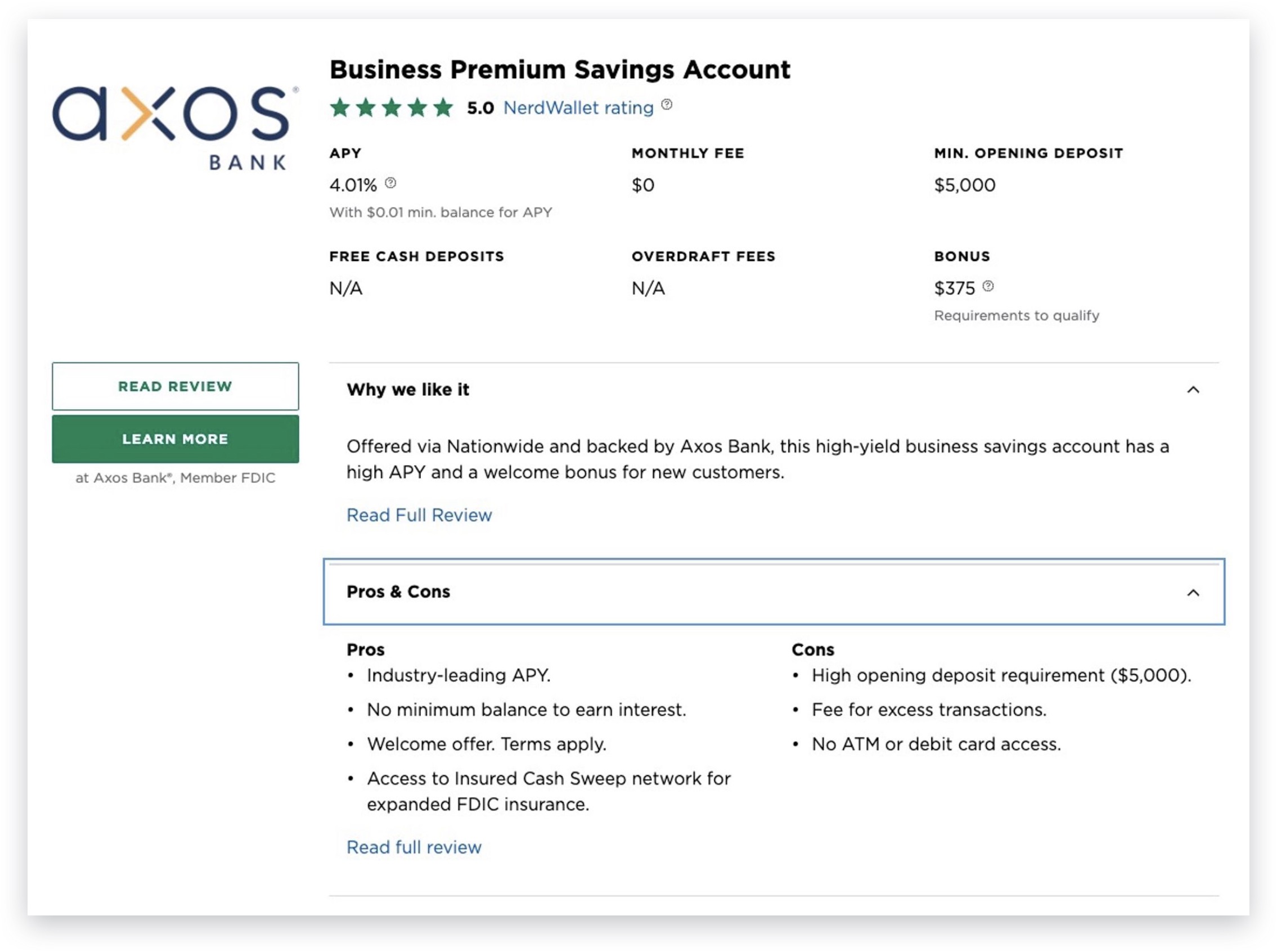

I was excited to see Axos bank with a 4% business bank account because I already had a personal account with them.

Unfortunately it isn’t going to save me much time in the account opening process, so I am opted for LiveOak because that option of a 5% CD is enticing.

Also, it is worth noting that Axos requires a $5,000 minimum opening deposit.

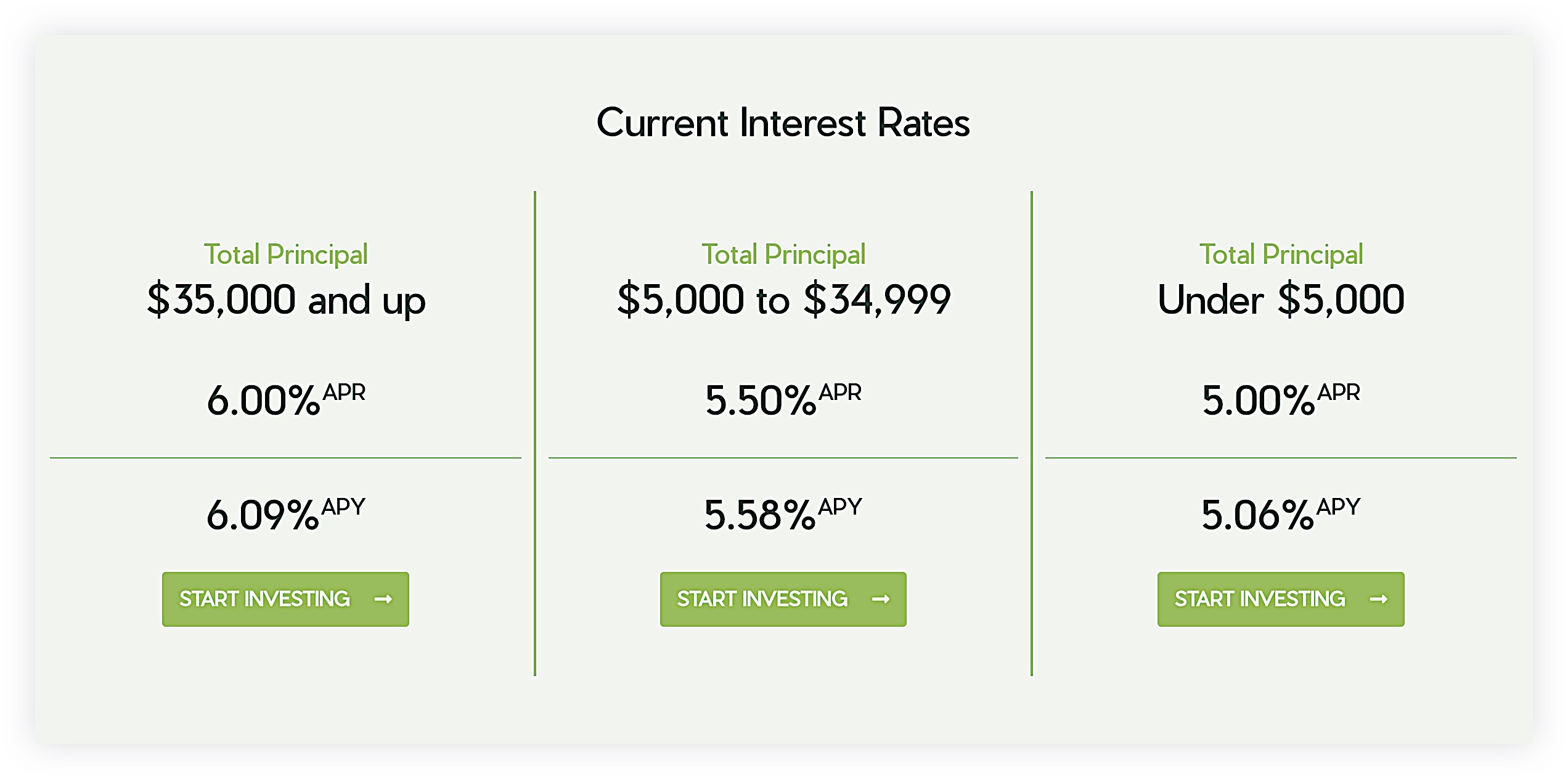

While this one isn’t a business bank account per se (it is actually an investment account) I think it is worth noting for a couple reasons.

1. It is basically a Christian bank (though not technically) that is focused on keeping money in the Kingdom.

What they do is provide loans to churches and then investors like you and I can fund those loans by being part of their investment account.

So I put in $1,000 and get paid interest on my money (just like a business savings account) and that $1,000 is loaned out to a church.

They are a not-for-profit as well, so all the money is being recirculated in the Kingdom rather than going to Wall St.

2. The rates they pay are even better than what ANY business savings account is paying right now.

At the time of this writing, you can get up to 6% if you put in $35k or more. And even if you only have a few hundred to invest they are paying 5%.

Now, while I LOVE what they are doing and I am going to be investing in this program, it is important to know that your investment with them is NOT FDIC-insured because this technically NOT a business savings account, but is an ‘investment account’.

So while I still personally feel that this is a relatively safe investment, it isn’t backed by FDIC insurance (or SIPC insurance) and that is important to understand before putting any money in with them.

So what am I doing with my money?

At this point, I decided to go with LiveOak because of the 4% savings rate and the 5% return on short-term CDs. This was the first step I took to upgrade my business savings account from 1%.

I will be opening an account with the Wesleyan Investment Foundation as well because I really love the idea of getting my money working to advance the Kingdom.

What about you? What are you doing with your business savings?

Your friend and coach,