FICO Score vs. Credit Score: What’s the Difference?

The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

Credit score and FICO® score essentially mean the same thing. While both measure your creditworthiness, your FICO score uses a specific scoring system created by the Fair Isaac Corporation (FICO).

Your credit score is a personally assigned number generated by any credit scoring model that measures your creditworthiness. Lenders and creditors use this score to determine whether they can approve you for loans and credit, and if so, at what interest rates.

People often use the terms “credit score” and “FICO score” interchangeably. In reality, a FICO® score is only one kind of credit score. Keep reading for a complete rundown of the differences between a FICO score and a credit score.

Table of contents:

What is a credit score?

A credit score is a three-digit number that predicts the likelihood that you will pay a loan back on time based on data pulled from your credit reports. Your credit score is critical as it can dictate what types of financial products you’re approved for (mortgages, credit cards, personal loans, car loans) and the terms and interest rates on these products. In fact, your credit score can even reach beyond your finances, as it can be collected by employers and landlords reviewing applicants.

What does a credit score signify to a lender?

A higher score signals to lenders that you may be a more reliable borrower, and you’ll likely get better loan offers. Meanwhile, a lower score signifies that you may be a risky borrower and lenders may deny your application or give you a higher interest rate to offset the risk.

Who generates credit scores?

Credit scoring companies, such as FICO, calculate credit scores based on consumer information from the three major credit bureaus (Equifax®, Experian® and TransUnion®). Those credit bureaus receive consumer data directly from lenders and creditors, who report the information monthly.

What is a FICO score?

A FICO score is a type of credit score generated by the credit scoring system developed by the Fair Isaac Corporation (FICO). The FICO score originated in 1989 and is one of the most commonly used credit scoring systems for lenders today. According to FICO, 90 percent of all top lenders use FICO scores.

FICO scores can range anywhere from 300 to 850. There are multiple versions of FICO scores, but the newest is the FICO Score 10 model. FICO releases new credit scoring models every few years to adapt to changes in the marketplace. For example, one of the main updates seen in the FICO 10 model is that debt from the most recent 24 months is more heavily weighted than other debt.

Industry-specific FICO scores

In addition to the standard FICO models, there are industry-specific FICO scores, such as the FICO Auto Score and the FICO Bankcard Score. These industry-specific scores are made for select types of credit, such as cars, mortgages and credit cards. While standard FICO scores range from 300 to 850, industry-specific scores range from 250 to 900.

Overall, FICO industry-specific scores aren’t used as frequently as the standard model.

Is a FICO score the same as a credit score?

A FICO score is a type of credit score. Your FICO score may vary slightly from other types of credit scores because credit scoring companies calculate scores differently.

How is a FICO score calculated?

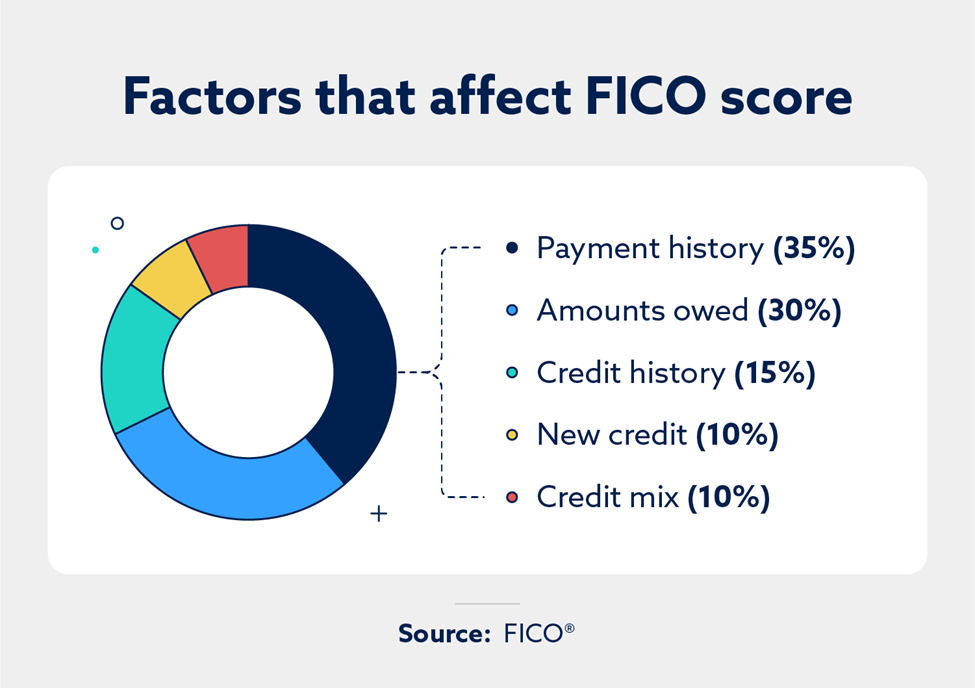

Your FICO score is made up of the following five factors, all of which have an assigned weight:

- 35 percent: Payment history

- 30 percent: Amounts owed

- 15 percent: Length of credit history

- 10 percent: New credit

- 10 percent: Credit mix

What is a good FICO score?

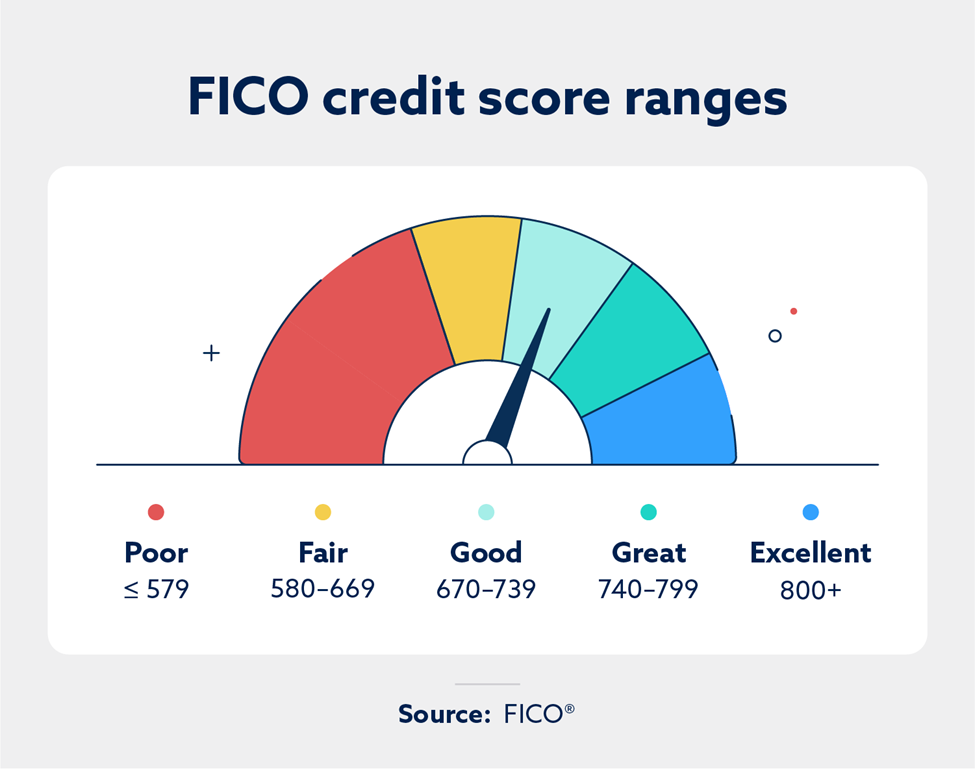

Generally speaking, anything above 670 is seen as a good credit score. However, this will vary from lender to lender.

The FICO model groups people’s scores into these categories:

- Exceptional: 800+

- Very good: 740 – 799

- Good: 670 – 739

- Fair: 580 – 669

- Poor: 579 and below

An exceptional score means you’ll likely get quickly approved for everything (or almost everything) you apply for, you’ll receive the best terms and you’ll secure the lowest interest rates. In comparison, a poor score will usually lead to application denials, and when you areapproved, it’ll be with high interest rates and poor loan terms.

How to get your FICO score

You can get your FICO score directly from FICO or one of its partners.

- Check the FICO Open Access Program: FICO has partnered with several institutions to provide your FICO score number for free under its open access program. Check to see if your bank or credit and financial counseling program is listed.

- Purchase access from FICO: You can purchase your score and other services from FICO.

- Purchase from an authorized FICO retailer: FICO-authorized retailers are Experian and Equifax.

When you receive your score from any provider online, make sure to confirm which scoring model was used. Most lenders do use FICO scores when making lending decisions, but it’s still helpful to understand the other scoring models—like VantageScore®.

FICO score vs. VantageScore

The two dominant credit scoring models are the FICO score and VantageScore. VantageScore was created in 2006 by the three major credit bureaus. While VantageScore is less popular overall, it’s gaining more market share every year.

The VantageScore and FICO score models are very similar—they both range from 300 to 850 and release new versions of their scoring model every few years. Still, there are some critical differences between the two models. For example, FICO requires consumers to have an account open for at least six months before a score can be given, while VantageScore assigns a score as soon as an account appears on your credit report.

Additionally, how VantageScore values various aspects of your credit data differs from FICO. VantageScore assigns the highest weight to credit usage, credit mix and payment history and the lowest weight to new accounts and credit history age.

As a result of these differences, your VantageScore and FICO scores can differ. Unfortunately, even if you score higher with one model, you won’t usually be able to use this knowledge to your advantage. You often won’t know if a lender will pull a FICO score or a VantageScore.

Other kinds of credit scores

There are many other credit scores generated and used by other lenders and companies. Common ones are educational credit scores and business credit scores.

An educational credit score is based on a private lender or credit bureau’s ranking of your financial information.

For example, the PLUS score was designed by Experian to give a basic idea of your risk level and creditworthiness. Although they’re designed to measure credit risk, lenders don’t use educational credit scores.

Models like the PLUS score are meant for consumer use only, so lenders don’t consider them when reviewing your loan application.

Business credit scores predict your company’s financial stability and how reliable you are in terms of managing company finances.

For example, Dun & Bradstreet’s D-U-N-S Number is used to identify your business and is the key to finance-related information about your company, like your business credit report, your D&B Delinquency Predictor Score and more.

All your credit scores will likely differ since numerous scoring models are used, and these models weigh information differently. They may also pull information from one, two or all three credit bureaus.

Instead of focusing on the specific criteria for each score, you should focus on responsibly managing your credit with FICO’s criteria as a guideline since that score is most commonly used.

How to improve your FICO score

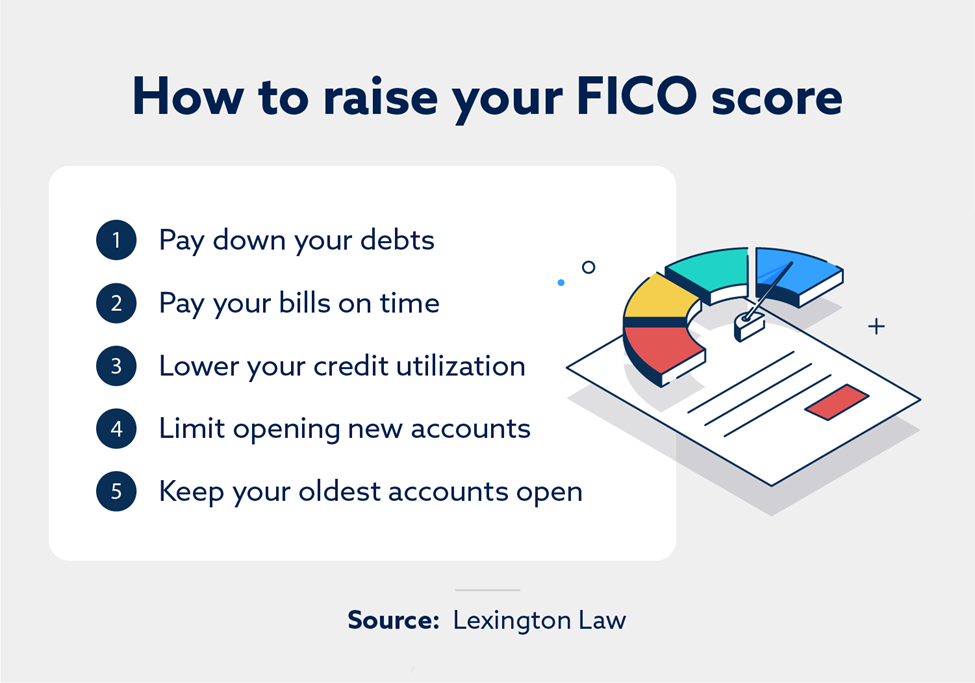

The good news is that if you’re unsatisfied with your FICO score, you can take steps to improve it. By understanding the five factors that make up your credit score, you can also determine what you can potentially do to improve your credit, such as:

- Paying down your debts

- Paying your bills on time

- Keeping your credit utilization low

- Only opening new accounts when necessary

- Avoiding too many hard inquiries

- Keeping your oldest accounts open

It’s also important to check your credit reports frequently. Your credit reports can give you a better understanding of what’s hurting your credit, and you’ll want to make sure that your credit reports don’t contain any inaccurate or false information that’s unfairly affecting your credit. If that’s the case, Lexington Law Firm can help you address the errors to get the accurate credit report you deserve. Check out our services today.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.