Can You Get a Tax Break for Buying a House?

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations.

After a long year, tax season is finally upon us. You’re probably getting all your ducks in a row—collecting all the information you need, choosing your tax software, and so on. If you’re a homeowner, you might be able to catch a few tax breaks—but can you get a tax break for buying a house?

If you itemize your deductions via Schedule A rather than claiming the standard deduction, you could be eligible for one or more home-related tax breaks. And if you work from home, you might be able to claim a home office deduction (more on that later). The information below is general information regarding these deductions. It is always best to consult a tax professional if you have any questions related to your specific situation.

Deductions vs. Credits

Many people mistake deductions for credits—but they’re not the same thing. Let’s take a closer look at both types of tax breaks.

Deduction

Deductions reduce your taxable income according to the highest federal income tax bracket you fall into. So, if you qualify for a $2,000 deduction, the amount of money you can be taxed on will be reduced by $2,000.

There are two types of deductions: standard and itemized. Standard deductions are specific amounts based on your filing status and are updated annually. Itemized deductions are specific amounts you paid during the taxable year and you should use itemized deductions when your total of allowable itemized deductions is higher than the standard deduction.

Credit

Credits lower your income tax liability by a fixed dollar amount. If you qualify for a $500 tax credit, you pay $500 less in taxes.

Good to know: Some tax credits are nonrefundable, so if you don’t owe a lot of tax to begin with, you don’t qualify for the entire credit. Other tax credits, like the Earned Income Tax Credit, are refundable, so you get the entire amount under any tax circumstances. The remaining amount of credit available that wasn’t needed to pay down your tax bill comes to you in your tax refund.

Nondeductible Home Expenses

Unfortunately, some homeownership expenses just aren’t deductible. These include:

- Closing costs (title insurance, appraisals, etc.)

- Depreciation

- Domestic service

- Down payment

- Fire insurance

- Mortgage insurance premiums

- Mortgage principal

- Utilities such as gas, electricity, and water

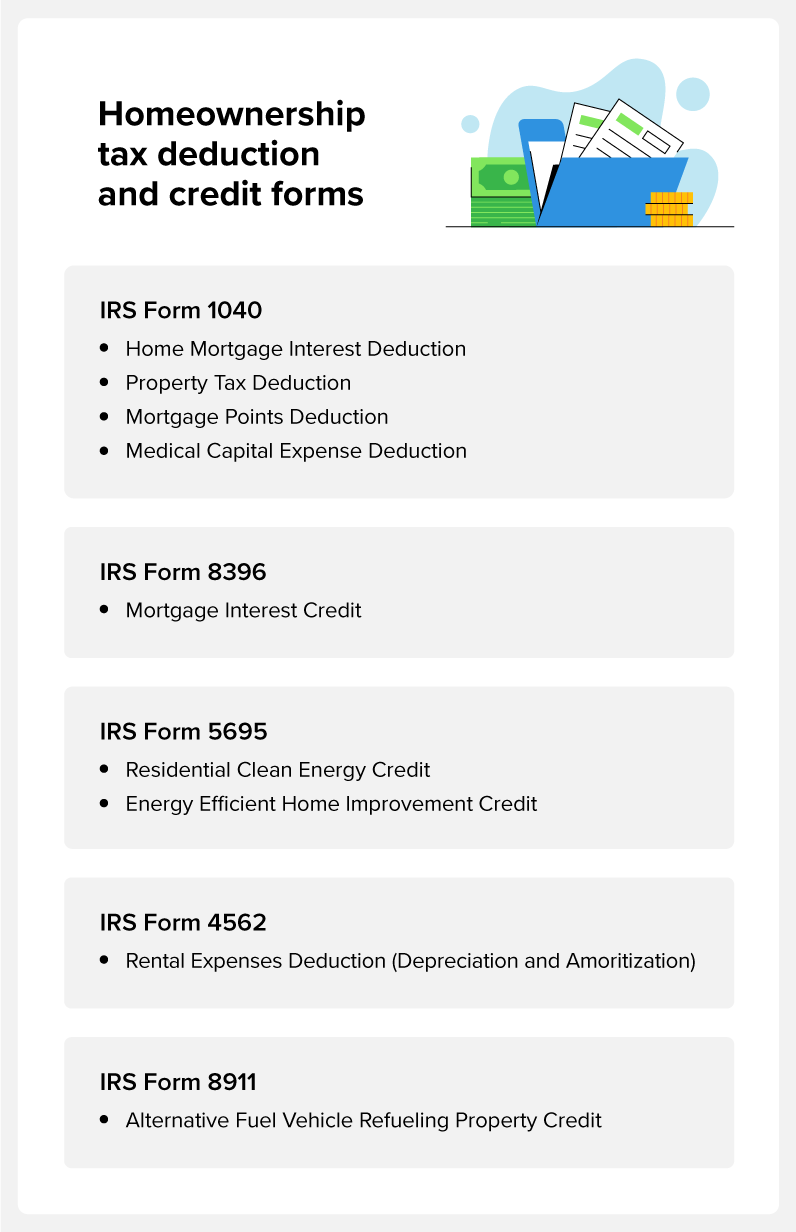

Common Homeownership Deductions

If you itemize your deductions, there are several homeownership deductions available.

Home Mortgage Interest Deduction

Arguably the most well-known tax break for homeowners, the home mortgage interest deduction (HMID) lets you deduct interest paid on your mortgage up to $750,000 (or $375,000 if married filing separately).

If you take out a home equity loan or a home equity line of credit (HELOC) to make home improvements or buy or build a primary or secondary residence, you can deduct the interest through 2025.

You can claim this deduction on Form 1040, Schedule A.

Property Tax Deduction

Do you pay property taxes monthly or yearly? In either case, both state and federal property taxes are tax deductible on your federal return. For tax year 2023, the deduction amount is capped at $10,000 for married couples filing jointly and $5,000 for other tax statuses.

You can also claim taxes paid at closing when you buy or sell your home and certain payments made to town or county tax assessors. However, you can’t claim taxes paid on commercial or rental property.

To claim this deduction, report your total state and local income taxes in box 5a on Schedule A of Form 1040.

Mortgage Points Deductions

A homebuyer can purchase mortgage points, also called discount points, at the time of closing to lower their interest rate. For example, buying one point may lower your interest rate by 0.25%.

You can either deduct these points in the year in which you opened the mortgage or over the mortgage term. There are limitations, which you can view on the IRS website.

You can file for this deduction using Form 1040, Schedule A.

Home Office Deduction

If you’re self-employed and work from home, you can claim a home office deduction. To do so, you have to prove that you’ve used a portion of your home exclusively for business purposes. In other words, your office or another “separately identifiable space” counts, but your bedroom doesn’t—even if you work on your laptop in bed. Voluntary, occasional, or incidental freelance work won’t entitle you to a home office deduction.

There are occasions where you don’t need to meet the exclusive-use test. These include:

- If you use part of your home as a day care facility for children, disabled adults, or elderly individuals

- If you use part of your home to store physical inventory or product samples

Deductible expenses include:

- Refurbishment and repair costs

- Depreciation

- A portion of your rent or mortgage payment

- A portion of your utility bill

- Business insurance

- Office supplies

You can’t deduct landscaping or lawn care costs unless you’re a gardener or you’re in the lawn care business.

You can also consider using the simplified method for claiming your home office. That allows you to deduct $5 per square foot of your home used for business purposes. Often, this is a much more convenient way to deduct your home office versus taking the time to itemize each of your expenses.

Important: Before 2017, traditional employees could claim unreimbursed employee business expenses that exceeded 2% of their adjusted gross income on their tax return, including home office expenses. The Tax Cuts and Jobs Act eliminated that option until at least 2026. So, if you have an employer, you can’t currently write off any unreimbursed expenses related to your home office.

To claim this deduction, you’ll need to complete Form 8829, Expenses for Business Use of Your Home as part of your tax return.

Rental Expenses Deduction

If you rent your home, you can deduct some landlord expenses on your taxes, including operating expenses, depreciation, and repairs.

You can only deduct costs associated with keeping the rental in good operating condition. For example, you could deduct the cost of repairing a full bathroom that flooded, but you couldn’t deduct the cost of renovating a half bath into a full bath.

To claim this deduction, complete Form 4562, Depreciation and Amortization (Including Information on Listed Property).

Medical Capital Expense Deduction

If you have a medical condition that requires you to make improvements to your home or install special equipment, you may be eligible to deduct some or all of their cost.

Common capital expense deductions include:

- Constructing ramps to exterior doors to make entering and exiting the home easier

- Widening doorways or hallways to allow for wheelchairs or other mobility equipment

- Installing railings, support bars, and other bathroom safety modifications

- Lowering or modifying cabinets to make them usable

- Installing a lift or otherwise modifying stairways

- Modifying warning systems, such as fire alarms and smoke detectors

To file this deduction, use Worksheet A Capital Expense Worksheet to determine your medical capital expenses and enter the total on your Schedule A (Form 1040).

Common Homeownership Credits

As a homeowner, you may also qualify for specific homeownership tax credits.

Mortgage Interest Credit

Some lower-income first-time homeowners may receive a Mortgage Credit Certificate (MCC) from their state or local government, subsidizing the purchase of their home up to $2,000 on mortgage interest.

This credit comes with a few stipulations. For example, you’ll have to deduct the total amount of the credit from the mortgage interest you deduct. See the instructions page of Form 8396 for a complete list of stipulations. You’ll need to submit this as part of your tax return to claim the credit.

Residential Clean Energy Credit

Formally the Residential Energy Efficient Property Credit, the Residential Clean Energy Credit has a credit rate of 30% through 2032 and can cover costs related to renovating or building a home that runs on clean energy.

Specific limitations vary based on the type of improvements made, but they can apply to:

- Solar electricity

- Solar water heating

- Small wind energy

- Geothermal heat pumps

- Biomass fuel

- Fuel cells

See the IRS website for more details.

To claim the credit, complete Form 5695, Residential Energy Credits Part I as part of your tax return.

Energy Efficient Home Improvement Credit

If you improve your home’s energy efficiency, you may qualify for the Energy Efficient Home Improvement Credit.

Qualifying improvements include:

- Building envelope components

- Home energy audits

- Residential energy property (i.e., central air conditioners that meet the Consortium for Energy Efficient (CEE) highest efficiency tier)

- Heat pumps and biomass stoves and boilers

Each improvement has specific limits and guidelines. Learn more at the IRS website.

To claim the credit, complete Form 5695, Residential Energy Credits Part II as part of your tax return.

Alternative Fuel Vehicle Refueling Property Credit

Owners of electric vehicles may opt to add a charging station to their home. If you did so in 2023, you may qualify for the Alternative Fuel Vehicle Refueling Property Credit when you file your taxes. However, currently, this credit applies only to homes in low-income or urban areas.

To claim the credit, complete Form 8911.

A Word About Capital Gains

Many people worry about the amount of capital gains tax they’ll pay on a home sale. If you plan to sell your primary home and believe you’ll make a profit, you can exclude up to $250,000 of the gain from your income, or $500,000 if you file a joint return with your spouse. But there’s a catch: You have to have lived at the home for a minimum period of two years before the sale.

How Much Does Buying a House Help With Taxes?

Do you get a tax break for buying a house? It depends! Based on your tax situation, you could take advantage of various tax breaks available to homeowners.

Most homeowner credits and deductions only apply if you itemize your return—and you’ll only know whether itemization is worth it after you complete your tax forms. If you’re looking for a simple solution for filing your taxes, use TaxAct. As you enter information into your return, TaxAct will recommend whether itemizing your deductions or claiming the standard deduction is better for you.

You don’t have to wait for tax season to save money! Get your free credit report card from Credit.com. See where you need to work to start improving your credit to prepare for home ownership.

Disclosure: All TaxAct offers, products and services are subject to applicable terms and conditions. Price paid is determined at the time of filing and is subject to change.

The TaxAct® name and logo are registered trademarks of TaxAct, Inc. and are used here with TaxAct’s permission.