Bubble in Stocks, Crypto, Housing Poised for Epic Crash in 2024: Dent

- There’s a bubble spanning stocks, housing, and crypto that will burst soon, Harry Dent says.

- The financial historian expects the greatest crash of his lifetime and economic pain in 2024.

- Excessive government spending has driven asset prices to dangerous, unsustainable highs, Dent said.

There’s a massive bubble in stocks, housing, crypto, and other assets that’s primed to pop — and the fallout will be catastrophic, one veteran market watcher has warned.

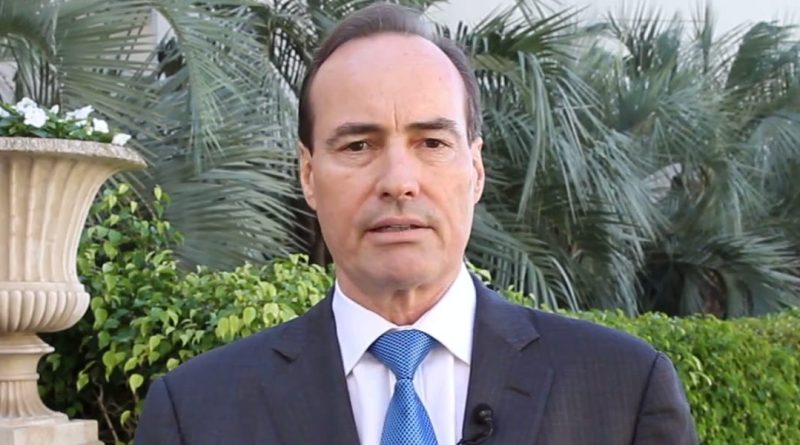

“I think 2024 is going to be the biggest single crash year we’ll see in our lifetimes,” Harry Dent told Fox News Digital in an interview published on Tuesday.

The author and financial historian blamed excessive government spending in recent years for creating an “everything bubble” in asset prices that he’s certain will burst. The S&P 500 fell sharply last year, but has rebounded by nearly 25% this year to trade just shy of its all-time high. House prices have also surged to record highs in recent months, while bitcoin and other cryptocurrencies have more than doubled in value this year.

“This crash is not going to be a correction,” Dent said. “It’s going to be more in the ’29 to ’32 level. And anybody who sat through that would have shot their stockbroker.”

The newsletter writer and founder of HS Dent Investment Management suggested the S&P 500 could plummet by over 80% to its lowest level since the financial crisis, the average US house price could be cut in half, and cryptos could nosedive by over 90%.

Declines of that magnitude might make authorities think twice about running budget deficits and artificially inflating asset prices in the future, Dent said.

“I’m the guy that’s praying for a crash while everybody else is not,” he said. “This should be a lesson I don’t think we’ll ever revisit. I don’t think we’ll ever see a bubble for any of our lifetimes again.”

The author of “The Great Depression Ahead” said there would be clearer signs of impending doom by May.

He said investors got lucky with the market rebounding this year and largely erasing last year’s losses. If they get out of markets for the next six months to a year and his call proves correct, he said, they’ll avoid enormous losses, and be able to buy back in at incredibly cheap prices and earn fantastic returns.

“When this asset bubble bursts and the price of everything, especially housing, comes back down to reality, imagine, not only can you buy the house you want at half-off… You can buy twice as nice a house here for the same mortgage you were going to get before,” he said. “How’s that for a Christmas present?”

Market sentiment has brightened in recent days, after the Federal Reserve signaled last week that it may be done hiking interest rates to curb inflation, and penciled in three rate cuts in 2024. The prospect of inflation dissipating, rates dropping, and the US economy escaping a recession has spurred investors to lift the Dow Jones Industrial Average to fresh highs this week.

However, Dent dismissed a so-called soft landing as a pipe dream, and predicted serious economic pain in the year ahead as the full impact of the Fed’s rate hikes is felt.

Dent has been sounding the alarm on markets and the economy for a while, but they’ve defied his doom saying.

For example, he warned in August last year that the Nasdaq Composite would crash by over 40% to below 8,000 points in a matter of months. The tech-heavy index did slump as low as 10,300 points in October that year, but it has rallied since then to over 15,000 points today.