Average Auto Loan Rates by Credit Score

The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

A typical auto loan rate for a new car for someone with excellent credit is around 5 percent, while someone with poor credit may have an interest rate closer to 12 percent.

Auto loan interest rates are determined by several factors, including credit score. A typical auto loan rate for someone with excellent credit is around 5 percent, while someone with poor credit may have an interest rate closer to 12 percent—though exact percentages vary over time and in different circumstances.

When you’re looking to purchase a car, it’s helpful to understand how your credit will affect the auto loan interest rate you’ll be offered. Generally speaking, a better credit profile will lead to a lower interest rate on your car loan. If you do apply for a car loan with poor credit, you’ll often pay significantly more in interest over the life of the loan, so taking steps to improve your credit before applying can be beneficial.

Read on to learn about the average auto loan rates by credit score, other factors that affect car loan interest rates and ways to get a better auto loan rate.

Table of contents:

What is the average auto loan rate for each credit score?

When you apply for a car loan, the financial institution offering the loan will look at your credit score to determine your score range, from deep subprime all the way up to super prime. The higher your credit score and score range, the lower your interest rate is likely to be.

Using the most recently available data from Experian®, we found the average auto loan interest rate by credit score for both new and used cars. You can see all of the data in the table below.

|

Credit score range |

New cars |

Used cars

|

|---|---|---|

|

Super prime (720 or above) |

5.18% |

6.79% |

|

Prime (660 – 719) |

6.40% |

8.75% |

|

Nonprime (620 – 659) |

8.86% |

13.28% |

|

Subprime (580 – 619) |

11.53% |

18.55% |

|

Deep subprime (579 and lower) |

14.08% |

21.32% |

On average, those with higher credit scores are offered lower interest rates on auto loans. Note that interest rates for car loans are higher for used cars than for new ones, though having better credit still helps keep rates low.

While credit scores are one factor that banks and credit unions use to determine the interest rate on a car loan, there are several other factors they use as well.

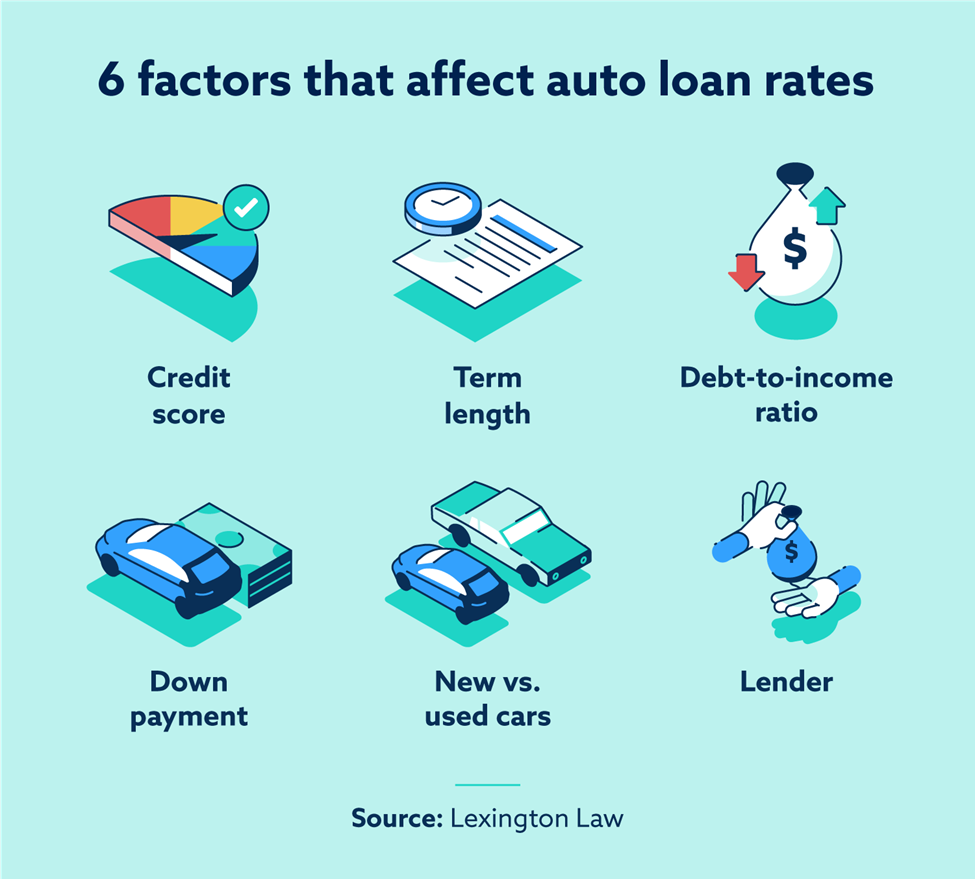

Factors that affect auto loan rates

Although high credit scores are strongly related to lower interest rates on car loans, there are a few other factors that determine what rate you’ll receive—and whether you’ll be offered a loan at all.

Consider the effect that the following factors may have on your auto loan before applying.

Credit score

Your credit score is the most important factor in determining the interest rate of your car loan. A higher credit score will usually lead to a lower interest rate, but it’s still possible to finance a car with bad credit.

Term length

In general, the longer term you select for your loan, the higher the interest rate you’ll pay. Car loan terms are usually 24 to 72 months, and selecting a shorter term can lead to a lower rate, which reduces the interest paid over the life of the loan.

Debt-to-income ratio

Your debt-to-income ratio, which shows the relationship between how much money you bring in and how much you owe for debt payments, is another factor in getting a car loan. Banks and credit unions may not offer loans to applicants with significant debt relative to their incomes, as this may indicate they won’t be able to make payments on the loan.

Down payment

Making a substantial down payment or trading in an old vehicle can help increase your chances of approval for an auto loan and also potentially lower the rate. By reducing the overall cost of the loan, you can signal that you are more likely to make on-time payments each month.

If you’ve already looked at banks, credit unions or dealerships for a loan and could not find a suitable rate, there are steps you can take to try to get a better auto loan interest rate.

New vs. used cars

As discussed above, the age of the vehicle can impact the auto interest rate. Manufacturers want buyers to purchase brand-new vehicles at their dealerships and will usually offer lower interest rates to entice buyers. However, when it comes to used vehicles, lenders tend to provide higher interest rates. Used vehicles are usually lower in value and seen as more risky than new vehicles.

Lender

Every lender has their own credit underwriting criteria and may value certain factors differently across the board. For example, certain lenders may have a higher minimum credit score than others. While lenders always consider debt-to-income ratio and credit score, some may consider other factors, like occupational experience. Therefore, all lenders have different ways of determining auto loan interest rates.

Ways to get a better auto loan interest rate

While securing an auto loan is straightforward, getting a good interest rate can be difficult, especially if you don’t already have excellent credit. Even a relatively small difference in interest rates can make a big difference in your total payment over the life of a loan, so it’s usually in your best interest to do whatever you can to get the lowest rate possible.

For example, if you take out a $15,000 auto loan for 60 months, you’ll pay just $1,373 in interest with a rate of 3.5 percent, but you’ll pay $2,821 in interest with a rate of 7 percent.

Fortunately, there are a few ways to try to get a better auto loan interest rate.

Try any or all of these ideas to see if you can find a loan with an interest rate that works for you.

Shop around for a loan

While the convenience of a dealership loan is appealing, consider looking at several different banks for a loan to get a sense of the interest rates available to you. If you are a member of a credit union, they often offer competitive interest rates to their members.

Get a cosigner

If you don’t currently have the credit score you need to get a car loan on your own, consider asking someone to cosign on the loan, which increases the chances of approval and may lower your rate. This also offers the possibility of building your credit while benefiting from better loan terms.

Make a larger down payment

When possible, save up for a substantial down payment prior to purchasing a car. By reducing the amount needed for your auto loan, you reduce your risk to lenders, who may be willing to offer a lower rate in return.

Select a shorter loan term

Opting for a shorter loan term can help lower your auto interest rate. However, you can expect to have much higher monthly payments. With longer loan terms, you’ll have a lower monthly payment. In exchange, you’ll have to deal with a higher interest rate.

If you can afford higher monthly payments, you’re more likely to qualify for a better loan interest rate and reduce how much you’re paying toward interest.

Get help improving or repairing your credit

Ultimately, the best way to get a better auto loan interest rate is to improve your credit, which involves making payments on time, keeping your credit utilization low, having a variety of accounts, maintaining accounts in good standing over time and doing other things as well. While building credit takes time and discipline, the reward is lower interest rates for loans.

Where to get the best auto loan rates

There are a few places you can shop at to find the most favorable auto loan rates for your budget.

Banks

Banks are ideal if you already have a preexisting relationship with one and have a good financial history. Most banks offer auto loans for used and new cars. With a bank account, you’ll have a better chance of qualifying for an auto loan with a good interest rate.

Dealerships

Dealerships are hit-and-miss when it comes to interest rates. However, more than not, they usually offer lower interest rates—especially when it comes to new vehicles. Typically, dealerships have relationships with third-party lenders. When you submit your application with a dealership, they’ll share it with their lenders and provide you with the best interest rate.

However, it’s important to be cautious when getting an auto loan through the dealership. Sometimes, the dealership will mark up the provided interest rates for compensation. The borrower will end up paying more through the dealership than if you applied directly to the lender.

Credit unions

Similar to banks, credit unions may offer account holders favorable auto loan rates. You must be a credit union member to apply for an auto loan. Membership requirements differ between credit unions but tend to be pretty straightforward. If you have a lower credit score, your credit union may be more inclined to approve your application than other institutions.

Online lenders

Online lenders don’t deal with the operational costs like banks and credit unions do. Therefore, they may be able to offer lower interest rates to applicants. If you choose this route, shop at different lenders to find the most favorable rates.

Repair your credit with Lexington Law

A good credit score is crucial for getting the best auto interest rates. Be sure to check your credit report for inaccurate information, including negative items that you believe are in error. With help from credit repair services like Lexington Law Firm, you can potentially improve your credit through the credit repair process.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.