5 Reasons Why You Need a Budget!

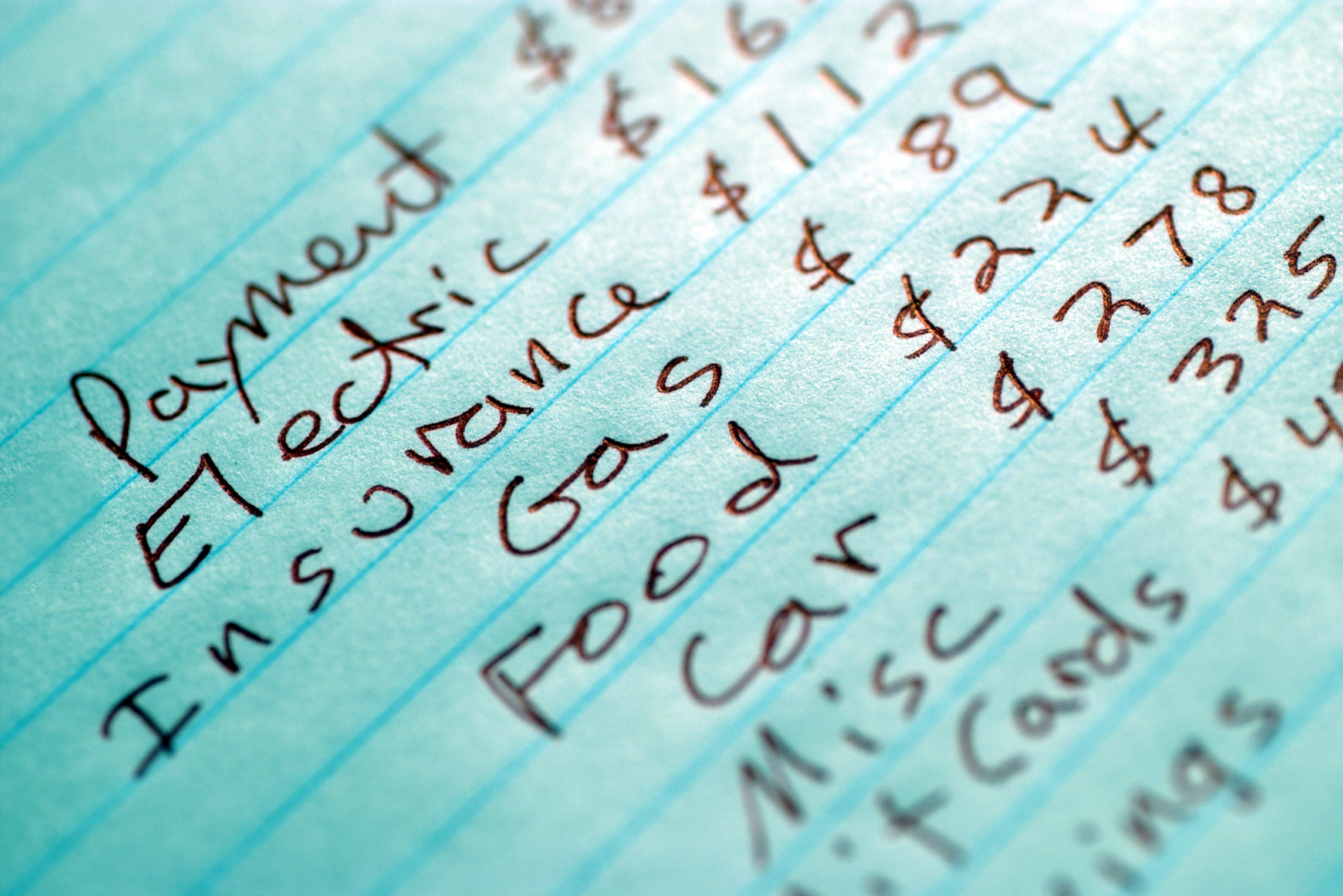

If I asked you to tell me how much you spend eating out or buying gas each month, could you tell me? What about your household’s true cost of living? This is the most basic reason you need a budget: To be able to plan and track where your money goes! Most people who I speak to about their finances have no clue how much they spend on a monthly basis. All they know is that by the end of the month, their bank accounts are nearly empty and they are waiting for their next paycheck. Even if you don’t find yourself scraping together pennies at the end of the month, you still need to have a budget in place. In order to take control

Read More