Does a business credit card affect your personal credit score?

The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

Business credit cards may affect your personal credit score, depending on the card. Most card issuers will only report to the consumer credit bureaus if your account becomes delinquent.

Many business owners turn to business credit cards as a way to separate their personal and business finances. Your credit score is important, so you may be wondering, “Does my business credit card affect my personal credit score?”

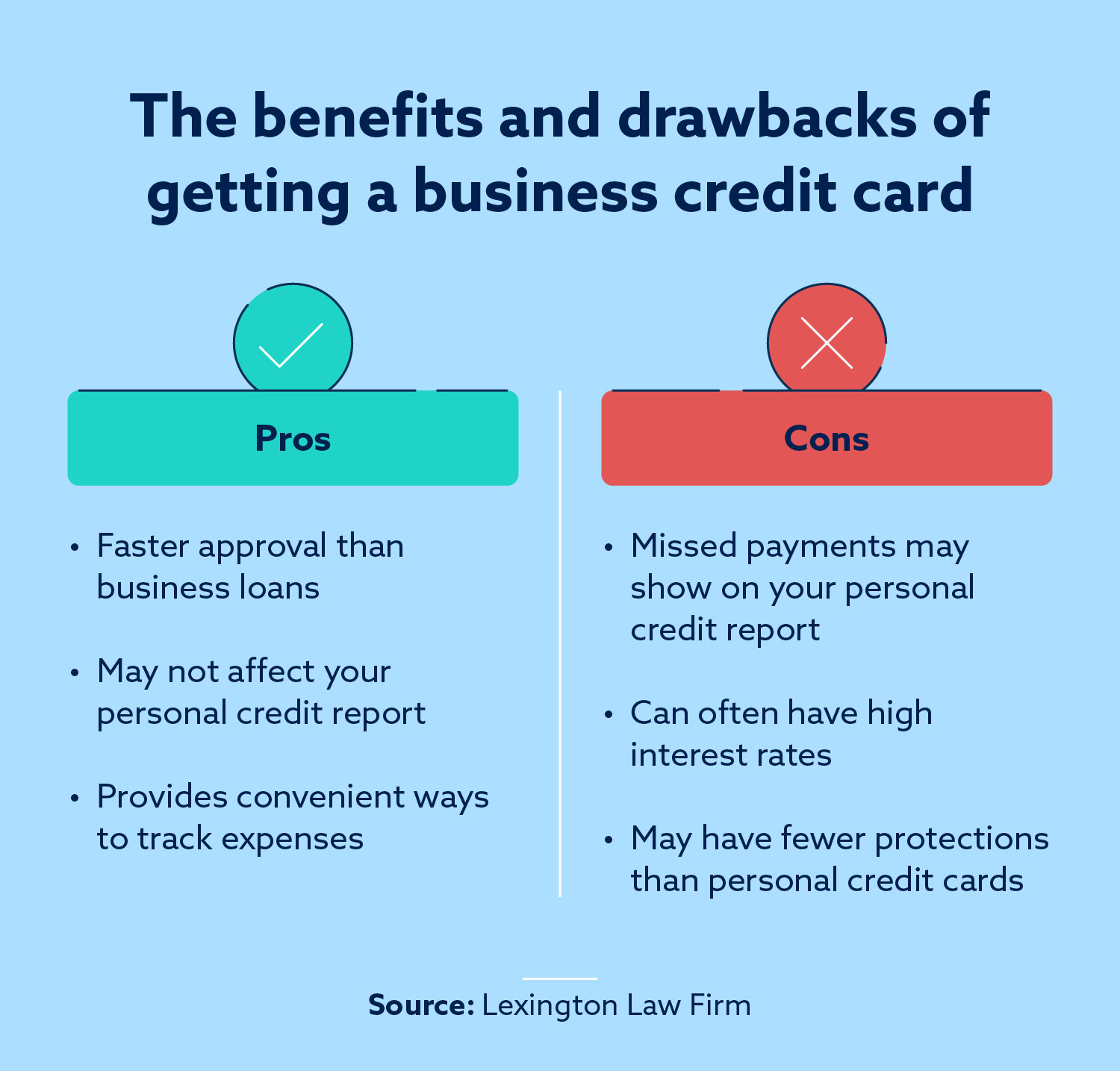

While there are many benefits to business credit cards, it’s helpful to understand how they work. Here, we teach you about how business credit cards can affect your personal credit score and report and if a business credit card is right for you.

What are business credit cards for?

Business credit cards are one of the more convenient ways for a business to access additional funds. Taking a loan out for a business involves a much longer process than simply applying for a business credit card, which may be approved within a few minutes.

With a business credit card, businesses can cover operating expenses and purchase items they need for their offices. Many businesses use these cards for fuel, travel expenses like flights and hotels as well as meals.

These cards also make it easier to track business expenses. By looking at the credit card statement, you can see what’s spent and when. Some of these cards also have built-in reporting tools for even more convenience.

Some of these cards also offer company-specific rewards, so businesses can save on travel and other categories.

What effect does a business credit card have on your personal credit?

Typically, financial institutions look to credit reports as a way to assess credit risk. Although your business credit card isn’t for personal use, the bank needs to run a hard inquiry, which will show on your personal credit report.

Hard inquiries cause a temporary drop in your credit score, but as long as you’re practicing good credit habits like making your payments on time and keeping your utilization low, it should recover in time. Once you start using the business credit card, it’s reported to commercial credit bureaus. The main three commercial credit bureaus include:

- Dun & Bradstreet

- Experian® Business

- Equifax® Small Business

Depending on the business credit card, some may report to your personal credit report as well. In some cases of delinquencies or late payments, your business credit history may be reported to the personal credit bureaus. This can also lead to derogatory marks on your personal credit report.

Some business credit cards may also require a “personal guarantee.” A personal guarantee is when you agree that the card issuer can come after your personal assets if the business defaults on the debt.

Which business credit cards report to personal credit

Most of your business credit card activity isn’t reported to the credit bureaus, but there are exceptions:

| Card issuer | Reports to consumer bureaus? |

|---|---|

| American Express | Reports negative information only |

| Bank of America | No |

| Capital One | Yes, but the Capital One Spark Cash Plus and Venture X Business cards only report when the account has negative information |

| Chase | Only accounts that are seriously delinquent |

| Citi | No |

| U.S. Bank | Only accounts that are seriously delinquent |

| Wells Fargo | No |

Source: Nerdwallet

Do business credit cards show up on your credit report?

When you apply for a new business credit card, the issuer checks your personal credit report. This hard inquiry will show up on your credit report and will temporarily lower your credit score. A hard inquiry can impact your credit score for six months to a year, but the impact is minimal compared to derogatory marks like missed payments.

Depending on the card and the issuer, the monthly activity of your business credit card may show up on your personal credit report. Many cards only report accounts that are delinquent due to nonpayment of balances.

Whose credit do business cards affect?

Business credit cards typically only affect the primary cardholder who applied for the original card. Adding an authorized user can also affect the credit score of the original cardholder.

A business can also get employee credit cards, but these are linked to the company’s credit account. Employees may receive credit cards for business expenses to make purchases, as well as cover travel costs and other expenses. Much like a singular business card, the responsibility of paying the balance is up to the business owner or whoever applied for the original credit card account.

Staying in good standing with a business credit card can also help build business credit. When a business builds credit, it can help it get loans in the future and open additional credit accounts.

Who should get a business credit card that doesn’t affect their personal credit?

If you’re concerned about cash flow and your ability to pay your business credit card balance, you may not want a card that can affect your personal credit. Keep in mind that even if you choose a card that doesn’t report to the three major consumer credit bureaus, the card issuer may report a delinquent account to these bureaus.

It’s best to track your spending with these cards and create a budget to ensure you pay your bill on time every month.

Can I get a business credit card with bad or no personal credit?

A business credit card can help your business grow and provide convenience for various expenses. To get a business credit, you need to have a good credit score to increase your chances of approval. If you’re unsure of where your credit health stands, Lexington Law Firm can help.

Use our free credit assessment to see your score along with additional information about your credit health. We also provide a variety of other services, like challenging inaccuracies on your credit report, credit monitoring and much more, so sign up today.