Student Loans for Bad Credit: What to Know

The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

Even if you have bad credit, you can still get student loans. Most federal loans don’t require a credit check, which means you can borrow funds for education regardless of your credit history.

The Education Data Initiative found that the average cost of college is $36,436 per year in the United States. This includes tuition, living expenses, books and supplies. This isn’t the same at all colleges, and you can pay significantly less. The average cost for in-state tuition is $9,678, but over the years spent in school, these costs add up. Many people don’t have this kind of cash on hand, so many take out student loans.

If you have a bad credit score, you may want to know about student loans for bad credit, but you may have better options. Bad credit loans come with much higher interest rates, so it’s beneficial to research all of the options so you don’t graduate with more debt than necessary.

Today, you’ll learn about how to get student loans with bad credit as well as which options are right for you.

How to get a student loan with bad credit

If you have a bad credit history, you have two options if you want to take out a student loan. You can apply for federal student loans or find a cosigner for a private student loan.

- Federal student loans are funded by the U.S. Department of Education, and they’re basically no-credit student loans since you can apply regardless of your credit history.

- Private student loans are offered by a variety of nongovernment financial institutions, and they’re often limited to people with higher credit scores or cosigners.

Federal student loans are often the better option because they’re low-interest loans for students with no credit or bad credit. Private student loans have much higher interest rates, which makes them more expensive as a whole. In some cases, students may need to take out both of these loans, depending on the cost of their school.

In order to receive a federal student loan, you need to meet the eligibility requirements first. Some of the requirements include:

- Proof of financial need

- Proof of U.S. citizenship

- Have a valid Social Security number

- Enrolled in a degree or certificate program

Your financial aid is based on need. This is known as “need-based aid,” which uses a calculation to determine how much you can receive based on your Student Aid Index (SAI) and Expected Family Contribution (EFC).

In addition to United States citizens, DACA recipients may also qualify for federal student loans.

Federal student loans for bad credit

Federal student loans are an excellent option for many people, including those with bad credit, because they are based on financial need rather than credit scores.

You may be eligible for any of the following types of federal student loans:

- Direct Subsidized Loans: These loans are available based on financial need, and they include the benefit of having the Department of Education pay interest while you’re enrolled in school as an undergraduate.

- Direct Unsubsidized Loans: Unsubsidized loans are offered regardless of financial need, and they will accrue interest even when you’re enrolled in school. With these loans, you don’t need to show financial need.

- Direct PLUS Loans: These loans are available to graduate students or the parents of undergraduates, and they are the only federal loans that require a credit check. You may still qualify with a bad credit score, but these have higher interest rates than other federal loans.

- Direct Consolidation Loans: These loans enable you to combine all of your federal loans into a single loan, which can reduce the complexity of your payments.

Private student loans for bad credit

Your credit score matters if you want a private student loan. To apply for a private student loan, you can go through regular lenders like banks or credit unions. Unlike many other private loans, you may not be able to find bad credit loans for student loans.

One of the best ways to qualify for a private student loan with no credit or bad credit is to find a cosigner. A cosigner is someone with a good credit score, so the lender uses their score rather than yours. The cosigner needs to have a good credit score to help you qualify, and it’s important to note that if you miss your payments, it can harm both of your credit scores.

Federal loans vs. private loans

Federal student loans are typically the best option if you’re trying to figure out how to get a student loan with bad credit. You don’t need to find a friend or family member to cosign on the loan with you, and the interest rates are lower. If the school you choose is more expensive, you may need to take out a private loan in addition to your federal student loan.

It’s also beneficial to understand the difference between the interest rates. The average interest rate for fixed-rate student loans is between 4.8 and 12 percent. If the private loan has a variable interest rate, the average is between 5.9 and 15 percent. However, the average interest rate for federal student loans is only 5.5 percent.

For example, the average student loan debt is $37,787. If you took out a federal student loan for this amount and paid it off over the course of 10 years, it would cost a total of $49,211, including interest. That same loan could cost as much as $73,156 with a private student loan.

How FAFSA works

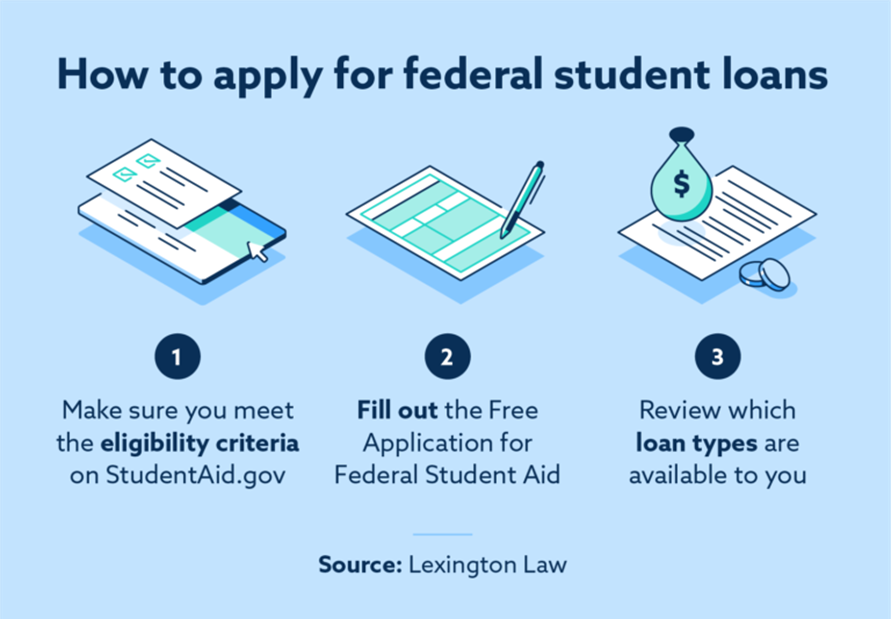

The Free Application for Federal Student Aid (FAFSA®) is what student borrowers use to receive federal student loans. When taking out federal student loans, you need to fill out the FAFSA each year because it’s a needs-based program, so the amount may vary depending on different factors. They’re mainly looking at your personal finances and your family’s financial situation.

Each year, enrollment for the FAFSA opens on October 1st, and the deadlines are on the FAFSA website. Deadlines can vary by state and by college, so the site also lists additional information for every state.

How to improve your credit before applying for a student loan

You may need to take out student loans regardless of your situation, and one of the best things you can do is improve your credit score. When you have good credit, you can worry less about finding bad credit student loans and get better interest rates as well.

The following are some simple ways you can start improving your credit:

- Make your payments on time

- Pay off your debts

- Pay off collection accounts

- Keep your credit utilization low

- Piggyback on someone’s credit as an authorized user

How to apply for bad credit student loans

Prior to applying for federal or private student loans, there are some steps you can take to make the process a little easier:

- Calculate the loan amount: Before applying, you should know how much you’ll need.

- Fill out the FAFSA form: Federal student loans are often the better choice, so it’s helpful to start here. If you need more, you can consider private student loans.

- Compare private student loans: If you need additional money from a private student loan, shop around. Compare the loans to find the lowest interest rate and best loan terms.

- Try to find fixed-rate loans: Variable interest rates mean the interest can change. A fixed-rate loan means that your payments will stay consistent.

- Assess repayment options: Understand your loan as best as possible. Look into the grace period and if there are enrollment restrictions on the loan. Some federal loans require you to be enrolled to qualify for deferred payments.

- Find a cosigner: Talk to potential cosigners before applying for private student loans for bad credit.

Alternatives to student loans for bad credit

Whether you get a federal student loan, a private loan or both, it’s always best to minimize your debt. Some alternatives to student loans you can consider include:

- Working while attending school: Some schools cost less than others, especially in-state schools. You may be able to afford school by working and paying your tuition with cash.

- Work-study programs: You may be able to do a work-study program, which allows you to work part-time for the school while attending. This gives you experience and a way to earn money.

- Scholarships: There are many different scholarships out there. With some time and research, you can apply for different scholarships to help cover the cost.

- Personal loans: Although these are also loans, this is a good option if you have some college savings and only need to borrow a small amount for a shorter period of time.

Check your credit before applying for student loans

Another way to work on your credit is to check your credit report for any errors harming your credit score. Inaccurate derogatory marks can usually be challenged and removed from your report.

Lexington Law Firm has a team of credit professionals who could help you address errors on your credit reports, and if you’re unsure of your credit score, you can get your free credit assessment today.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.