How Do Interest Rates Work?

Key Takeaways:

- Interest rates are fees that you pay while borrowing money until you completely repay a loan.

- Interest rates are calculated with the formula A=P(1+rt), which can help you find the total interest on a loan.

- Having a higher credit score can help you qualify for lower interest rates.

In essence, interest rates work by determining how much a borrower must pay a lender while using a loan. Learning about things like interest and APR can help you understand how much you’ll have to pay for a loan in total—and how much you can charge when lending your funds to someone else.

This guide will explore how interest rates are calculated and how they apply to different types of loans. We’ll also share some of Credit.com’s helpful financial tools, including our interactive calculators.

What Is Interest?

When borrowers lend their money to another person or organization, they charge interest until the loan is repaid in full. The precise amount of interest that you’ll pay for a loan depends on several factors, including the total amount you initially borrow and the time it takes you to repay the loan.

When it comes to money in savings accounts, interest works to your benefit—financial institutions will pay you for the privilege of using your funds.

How Are Interest Rates Calculated?

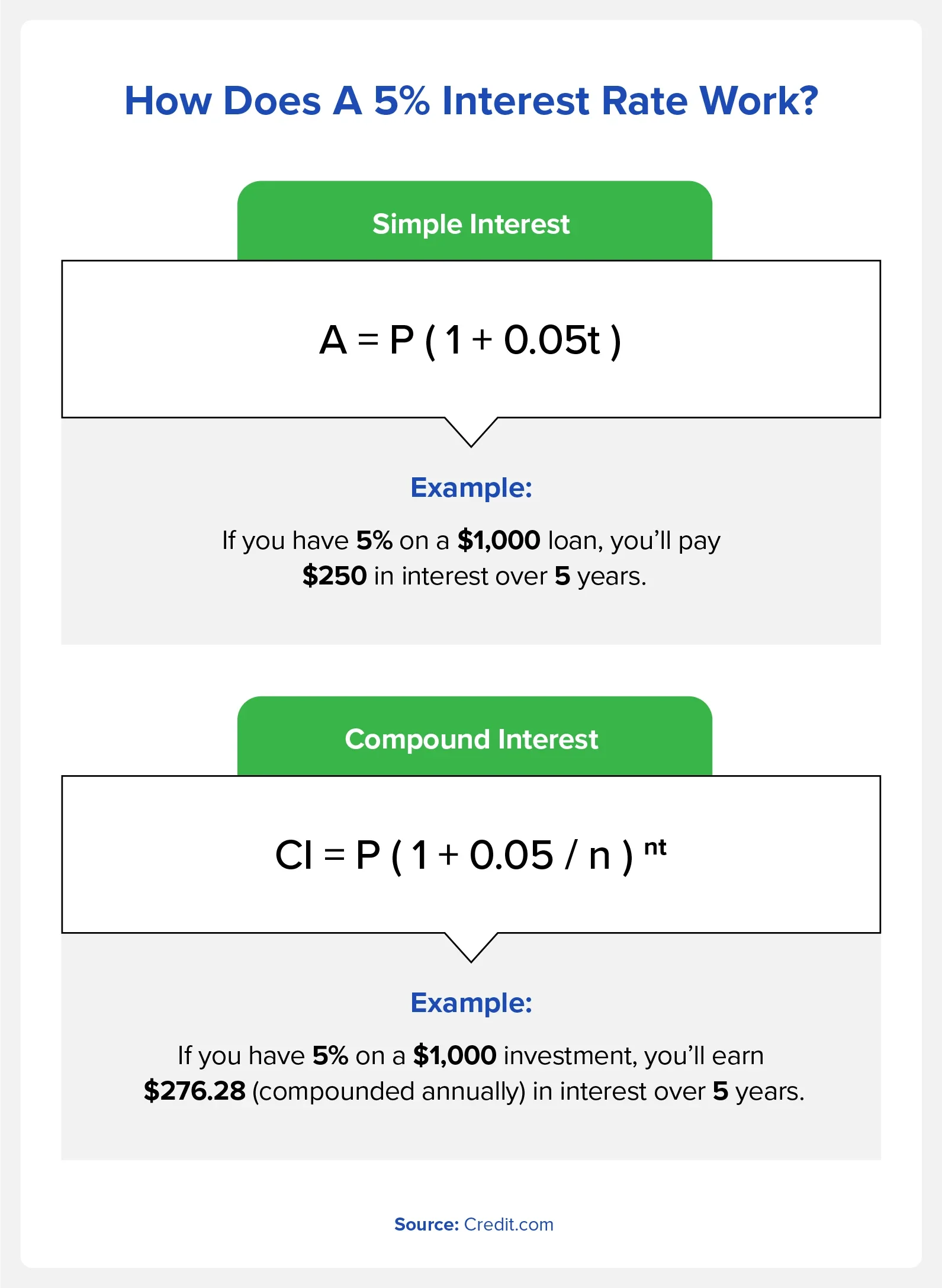

Simple interest and compound interest are two common methods that lenders use when charging borrowers.

You can find out how much simple interest you might have to pay on a loan with the formula A = P (1 + rt).

- A – the total amount that a loan costs when fees are taken into account

- P – the principal amount that you initially borrow when you take out a loan

- r – the rate of interest that a lender charges annually

- t – the overall time it takes you to repay a loan. This is calculated in years

Here’s an example of the formula at play:

- The principal amount you borrow is $5,000.

- The bank sets your interest rate at 3%.

- It takes you five years to pay back the loan.

- In this case, A is $5,750.

Using this information, the formula should be $5,750 = $5,000 x (1 + 0.03 x 5).

Compound interest calculates interest growth (like in a savings account) based on the principal amount and all previous interest payments over a set period. The formula to find compound interest is CI = P( 1 + r/n)nt.

- CI – your total compound interest

- P – the principal amount

- r – the annual interest rate

- n – the number of times your interest compounds in a year—this can be daily (365), monthly (12), or annually (1)

- t – the total amount of time that passes on a loan or investment

Compound interest on a loan can be exponentially costly, while compound interest on an investment or savings account can generate great profit over time.

Here’s an example of how compound interest can build income in a savings account:

- The principal amount you invest is $5,000.

- Your interest rate is 4%, or 0.04 in decimal form.

- The interest on your account is compounded annually (1).

- You commit to a 10-year investment plan.

Plug those numbers into the formula, and you’ll get $5,000 ( 1 + 0.04/1) x 1 x 10, which will equal $7,401.22 in compound interest.

Keep in mind that we didn’t factor in additional contributions with this example. Investors who add more funds to their accounts each month can increase their earnings from compound interest.

What Is the Difference Between APR and APY?

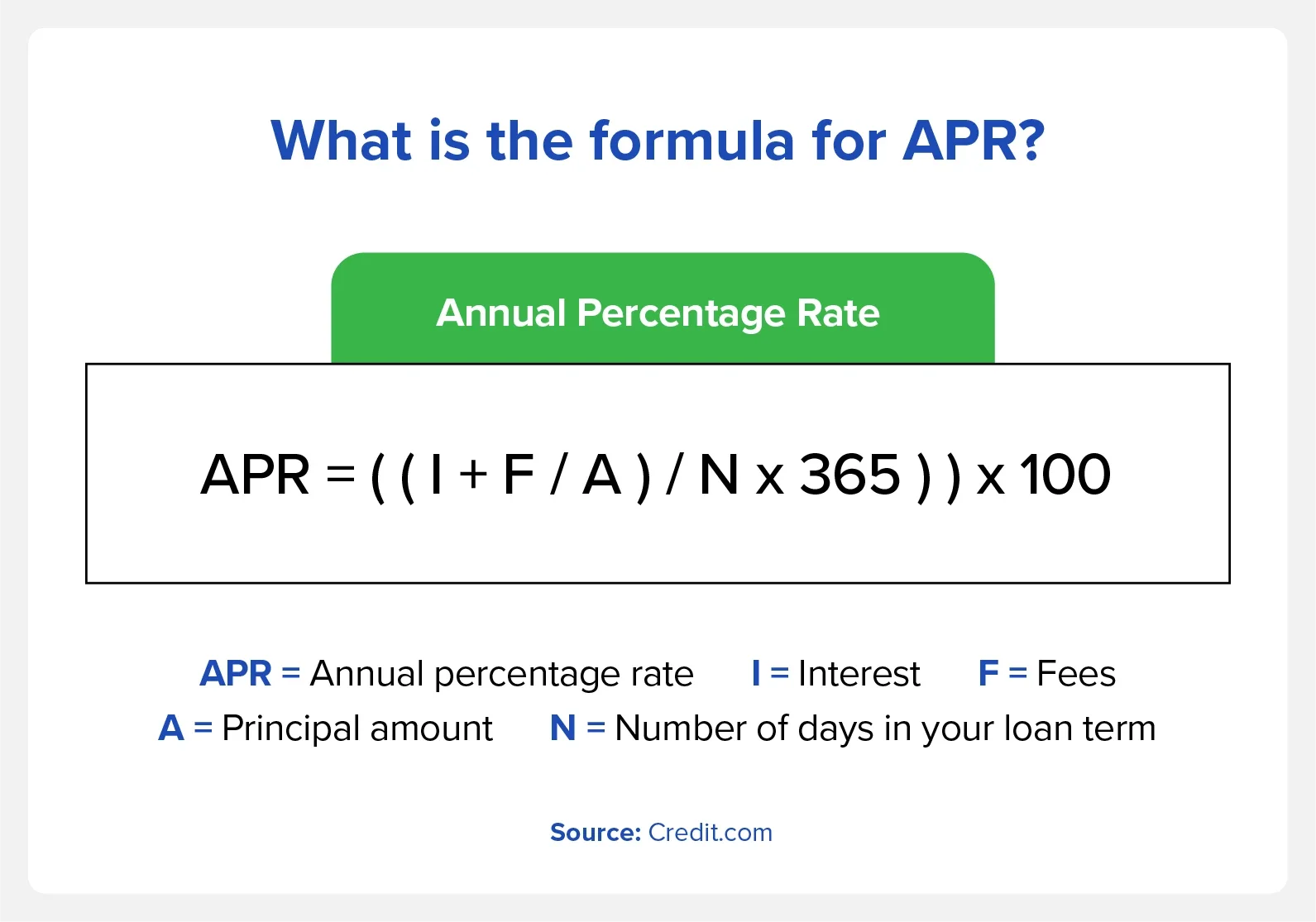

APR represents your annual percentage rate, though people may simply say interest instead of using this term. This works for credit cards but not all types of loans. For most loans, APR also includes fees that are slightly more costly than the base interest rate.

Annual percentage yield (APY) refers to the amount of interest you’ll earn on an investment each year. When shopping around for compound interest savings accounts, the APY is your estimated rate of return.

How Is APR Calculated?

Similar to simple interest, there’s a formula to calculate APR:

APR = ((Interest + Fees / Principal amount) / Number of days in your loan term)) x 365 x 100.

When calculating APR, it’s important to add interest and fees together before you divide your principal amount. After that, you’d divide the resulting amount by the number of days in your loan term, then you’d multiply the resulting number by 365 (to represent each day of the year) by 100.

How Is Your Interest Rate Determined When You Borrow Money?

Your credit history, the lender’s unique policies, and the base rate influenced by the Federal Reserve determine how much interest you’ll initially receive.

- Market factors influence your base rate. This includes economic trends and changes made by the Federal Reserve.

- Each bank sets lending rates and policies that apply to all of its patrons.

- If you have a higher credit score, you have a better chance of earning a lower interest rate.

Why Is Your Credit Score Important?

Lenders use credit scores to gauge which applicants will most likely repay a loan. Having a good or excellent credit score shows lenders that you tend to repay your loans on time and that you don’t borrow more than you can afford to repay.

Poor credit, however, can cause lenders to doubt your ability to repay any funds that they give you. To make up for this doubt, lenders might give you higher interest rates to discourage you from borrowing too much money or being late with your payments.

Different Types of Interest Rates

Interest rates have different nuances depending on the type of loan they’re tied to. For example, home mortgage rates factor in fees and taxes, while interest rates for credit cards are a bit more straightforward. Below, we’ve tallied up several examples.

Credit Card Interest Rates

Credit card interest is calculated based on factors like the balance on your card and the transaction you’re initiating. Moreover, lenders might charge penalty APR if a cardholder repeatedly misses payments or exceeds their credit limit.

The best way to figure out how interest affects your credit card is by learning your account’s daily periodic rate (DPR). You can find your DPR by taking your APR, converting it into a decimal, and then dividing by 365.

Mortgage Interest Rates

A works differently than a credit card’s interest rate largely due to the various items that factor into it. Mortgage insurance, property taxes, and realtor fees can all influence the APR on your home.

It’s best to check your credit score and report before buying a home, as your credit health will greatly affect your mortgage APR. Other factors that impact your rate include:

- The state you live in

- What type of property you want to buy

- How much you’re putting down

- The type of lending you qualify for

Auto Loan Interest Rates

It’s helpful to make sure you understand all of the common terms about auto loans before you sign any documents. Most auto loans also follow the simple interest formula we explored earlier. However, the fine print can include items like paperwork fees and title fees that can result in surprise expenses.

It’s possible to negotiate some of the fees that dealerships present before signing any paperwork. Arming yourself with knowledge, a sizeable down payment, and a strong credit score all grant valuable bargaining power during the negotiation process.

Fixed Interest Rates vs. Variable Interest Rates

Banks may offer fixed interest rates or variable interest rates on their loans and credit cards. With a fixed interest rate, the APR on your loan can’t change unless your financial institution notifies you and then adjusts it.

Variable interest rates can fluctuate based on changes to the economy and the “prime rate” the Federal Reserve sets for financial institutions. Fixed interest rates are more predictable, but they can occasionally cost more than the prime rate. Variable rates ebb and flow, but they can occasionally be lower than the prime rate.

Get Better Interest Rates With Credit.com

Your credit score can help you secure fantastic loans with low interest rates. Seeking personal finance advice before you apply can greatly improve your chances of scoring low-interest loans and phenomenal promotional opportunities.

Sign up with Credit.com—we’ll provide you your Vantage 3.0 credit score and a breakdown of how it works. There are also tools to help you plan what areas of your credit you would like to work on.