Debt Snowball Method: Definitions + Best Practices

The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

The debt snowball method is a repayment plan that involves paying off debts in order of lowest to highest principal sums. As you pay off small loans, you gain the confidence and money needed to repay larger ones.

Paying multiple debts is a juggling act. On one hand, paying all debts at once is tempting but expensive. On the other hand, paying one at a time is more affordable, but that takes long-term financial management. Thankfully, you can use the debt snowball method to simplify your debt payoff plan..

The debt snowball method is a debt repayment plan in which you quickly pay off small debts to focus on larger ones. Even though it’s simple in concept, you may have questions about the execution. To help you out, we’ll explain the method in detail, walk you through its steps and share a few best practices.

Table of contents:

- What is the debt snowball method?

- How to snowball debt in 4 steps

- Snowball method example

- Best practices for the snowball method of paying off debt

- The snowball method vs. avalanche method of debt consolidation

- Pay off debt and improve your credit with Lexington Law Firm

What is the debt snowball method?

The snowball method is a debt repayment approach where you pay off debts in order of smallest to largest principal sums. After making the minimum payment on all debts, spenders invest all they can into debts with the smallest principal. Once you pay off these small debts, you can roll funds over to the next highest.

Unlike other debt consolidation and payoff strategies, the snowball method doesn’t factor in interest rates. Instead, this approach focuses on principal payments. With each debt repaid, you should feel better equipped to tackle the next in line.

Who should use the snowball method?

Anyone juggling multiple debts should consider the snowball method. It provides a simple strategy for organizing your debts. As you knock out small debts, the snowball effect offers the momentum and confidence you need to get out of debt.

Pros of the snowball method

The snowball method of debt repayment offers distinct benefits over other approaches. The main advantages include:

- Actionability: Small changes to your budgeting make this approach actionable. It doesn’t come with any prerequisite or additional charges. As a result, jumping in is fast and straightforward.

- Empowerment: If you can’t pay your bills or keep up with debt, the snowball method mentally and financially empowers you. With every small debt cleared, you see progress and stay motivated as you pay off greater debts.

- Simplicity: The snowball method is easy to wrap your head around. It also breaks large chunks of debt into smaller, approachable pieces.

Cons of the snowball method

Despite its strengths, the snowball method comes with a few downsides, including:

- Interest accrual: If your larger loans have a higher interest rate, the snowball method may not work as well. According to these credit facts, if you follow the strategy, higher interest rates may cost you more over time.

- Emphasis on small debts: This approach works best when knocking out small debts back to back. You won’t see the same immediate results if you’re juggling a few large loans.

- Inflexibility: The snowball method doesn’t leave much room for customization. You may want to consider another option if you want a malleable strategy you can modify.

How to snowball debt in 4 steps

Thanks to its simplicity, you can implement the snowball method in only four steps. This is the process in detail:

Step 1: Take a debt inventory

The first step of the debt snowball method is to list all your debts from smallest to largest. While you can keep interest in mind, focus on the principal balance. If two debts share a similar principal, you can place the one with a higher interest rate first.

Step 2: Make minimum payments on all debts

Make the minimum payment on each of your debts every month. This step is crucial because you don’t want to incur any fees or penalties for not making payments on other debts even as you focus on one in particular.

Step 3: Pay down your smallest debt

On top of the minimum payment, invest as much as you can into your lowest principal balance. While you want to pay it off quickly, don’t forget to set money aside for:

- Savings

- Groceries, laundry and other household costs

- Day-to-day expenses like eating out or investing in your hobbies

Step 4: Repeat until debt-free

As you pay off each debt, you can roll more money into larger ones. When you aren’t juggling as many debts, you’ll have the resources to focus on paying down the highest sums. Eventually, most or all of your debts should get paid off.

Snowball method example

To help explain the snowball method, here is an example of how you budget for it. Assume you make $2,500 a month and have to manage these expenses:

- Rent: $700/month

- Utilities: $150/month

- Student debt: Minimum payment of $120/month (total principal: $21,000)

- Medical debt: Minimum payment of $60/month (total principal: $4,500)

- Auto debt: Minimum payment of $40/month (total principal: $1,800)

- Credit card debt: Minimum payment of $15/month (total principal: $900)

You would implement the snowball method of paying off debt like this:

- Pay necessary expenses like rent and utilities. This brings you down to $1,650.

- Pay the minimum balance on all debts. Your spending money drops to $1,415.

- Pay down your lowest debt. In this case, it’s the credit card debt. Let’s say you pay $500 and bring that principal down to $400. Your remaining balance comes out to $915.

- Spend the remainder of your money on day-to-day expenses. Remember to save as much as you can. It never hurts to have an emergency fund ready.

- Once you pay off the credit card debt, move on to the next lowest principal sum. So, you would pay off auto, medical and student loans in that order.

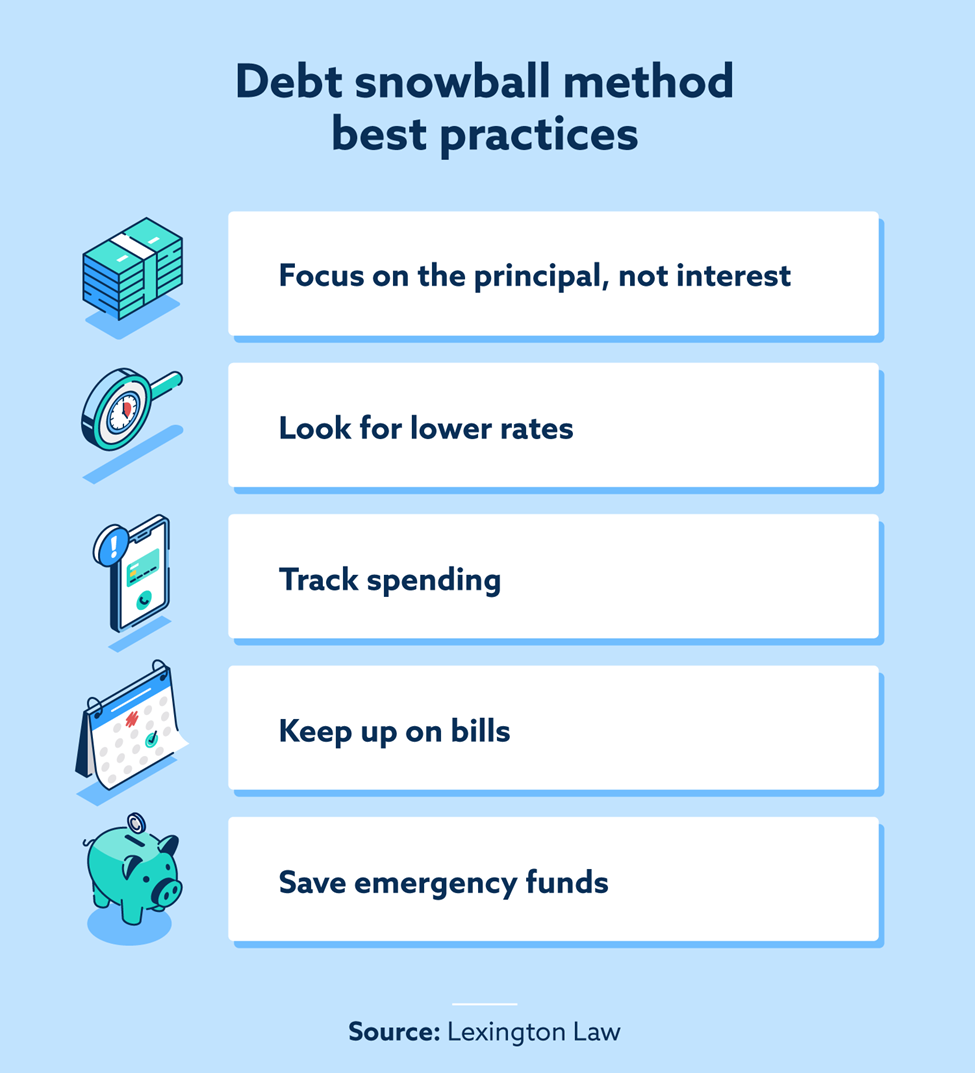

Best practices for the snowball method of paying off debt

To see the best returns on the snowball method, follow these tips:

- Don’t base repayment order on interest: Anyone trying the snowball method should focus on principal balances. This approach relies on small wins to build up to bigger debts. Large, high-interest loans get in the way of that.

- Mitigate high interest with lower rates: While focusing on small loans, try to reduce interest on larger ones. Negotiating a lower interest rate will help save money in the long run.

- Track spending over time: You should avoid wasting money that could go toward paying off debt. Additionally, track the amount you spend on debt repayment. That way, you can stay on track as weeks or months pass.

- Don’t fall behind on bills: Falling behind on bills or loans can lead to fees or a higher interest rate. In the long run, this will slow down your repayment.

- Set aside emergency funds: You shouldn’t invest every cent in settling your debts. An emergency fund can help you avoid more debts after home repairs or health issues.

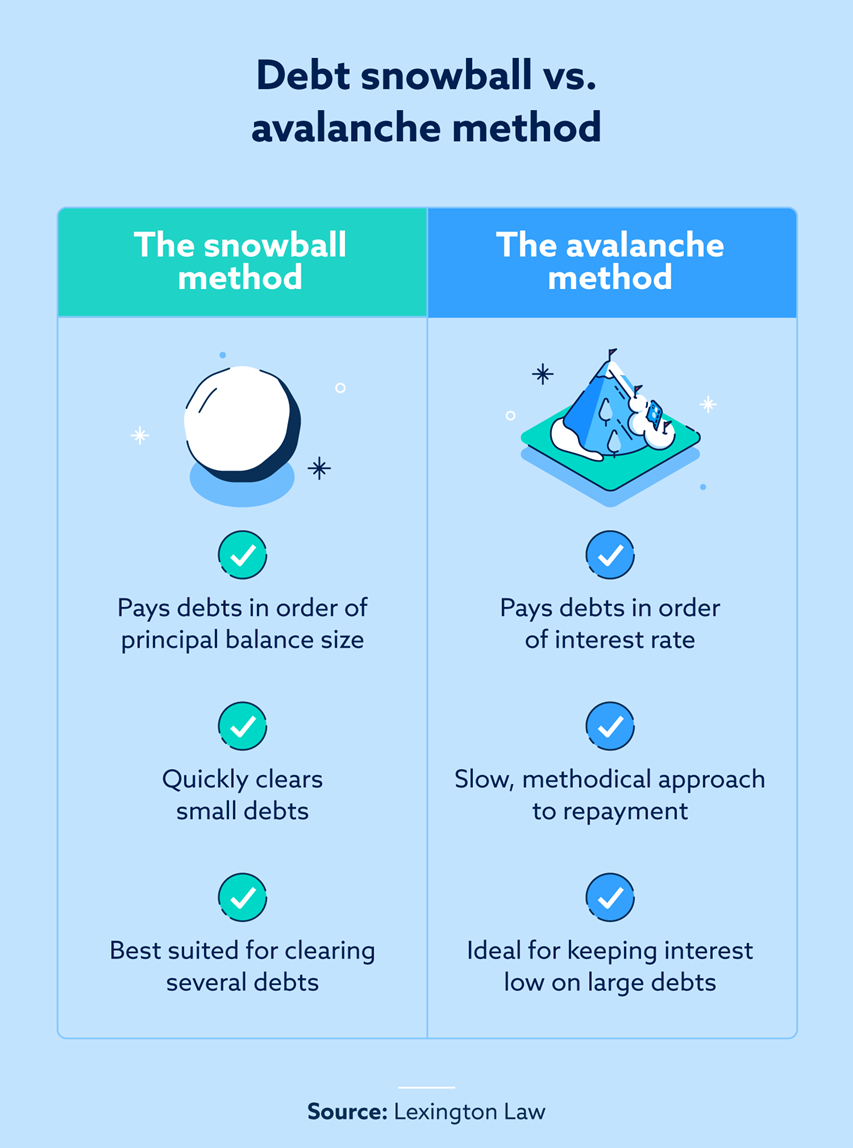

The snowball vs. avalanche method

The avalanche method is another way of paying off debt that determines payment order by interest rate. In both the avalanche and snowball approaches, you make minimum payments on all debt each month. From here, they diverge:

- The avalanche method has spenders pay off the debt with the highest interest rate first. Once customers pay off this loan, they move to the one with the next highest interest rate.

- The snowball method ignores interest rates to focus on principal payments.

While the snowball method quickly pays off small debts, the avalanche approach is slow and steady. It may take you longer to pay off your debts, but you will accrue less interest. So, depending on your interest rate and principal sum, you may pay less overall, which could make this option more appealing.

Which method is right for you?

The avalanche and snowball methods can both help with debt repayment. The right approach for you depends on personal preference and your financial situation. To find the right strategy, ask yourself:

- Do you need help staying motivated to pay off debts? If so, the snowball method offers more small wins to keep you going.

- Is your financial management style analytical and patient? Then the avalanche method will complement a slow and steady approach.

- Do you have several small loans or a few high-interest loans? The snowball method suits the first situation, and the avalanche method fits the second.

Work to improve your finances and your credit with Lexington Law Firm

Whether you need to rebuild your credit or get out of debt quickly, the debt snowball method can help. Unlike other strategies, the snowball approach is easy to jump into. While paying off debts can take time, this method gives you the confidence and direction to pay down debts one by one. While using any debt repayment plan, you don’t want to forget about maintaining or even improving your credit. Stay current on all your bills, create a budget and track your spending. If you’re working on repairing your credit, Lexington Law Firm could help you on your journey with our credit repair services.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.