How to Get a Loan With No Credit History

2-7 years

6 Alternative Ways to Get a Loan With No Credit

Here are some alternatives to no-credit-check loans that are ideal for individuals with little to no credit history.

Search for Lenders Who Take Alternative Credit Backgrounds Into Account

While credit history is typically used to assess a borrower’s risk, some banks will accept alternative data to determine your eligibility such as salary, rent, or utility payment history and bank statements. Remember that most lenders will only accept alternative data for smaller loans like credit cards, personal loans, and auto loans as opposed to larger loans like mortgages.

To find a lender that accepts alternative credit backgrounds, contact financial institutions in your area or apply for loans online. Make sure to have important documents such as bank statements, W-2s, tax returns, and rent payments readily available.

You can also opt to have alternative data reflected in your credit history. For example, you can sign up for a service that reports your rent and utility payments to the three credit bureaus. This is an excellent way to start building your credit.

Credit tip: You may have better luck if you consult with a lender face-to-face rather than over the phone.

Request a Payday Alternative Loan (PAL) Through Your Credit Union

Some credit unions offer payday alternative loans that are typically lower-cost substitutes to pricey payday loans. PALs are small loans granted in amounts ranging from $200 to $1,000, and they have a maximum APR of 28%. To qualify, you must have been a member of a credit union for at least one month.

Credit tip: You can research credit unions to join by visiting MyCreditUnion.gov.

Apply for a Secured Loan

Secured loans involve putting down a valuable asset as collateral. Assets typically used as collateral include cars, houses, or savings accounts. While these types of loans are beneficial because they have less strict credit history requirements, they are risky in the sense that you could potentially lose the asset you put down as collateral if you’re unable to pay the loan back.

Credit tip: Assess whether you can avoid losing the asset before putting it down as collateral.

Borrow Money From Your Retirement Account

If you have a 401(k) plan, you can take out a loan against your account. Most plans allow you to borrow up to 50% of your savings up to $50,000. Since you are essentially borrowing money from yourself, you won’t need to show credit history to take out a 401(k) loan.

While taking this route could cost you in investment earnings, it is generally a better option than other no-credit-check loans that charge high interest rates. Just make sure to repay the loan within five years to avoid paying taxes and penalties.

Credit tip: Avoid taking out a 401(k) loan if you plan on leaving the company, as you may have to pay it off right away.

Find a Trustworthy Cosigner

If you lack credit history, including a trustworthy family member or friend as a cosigner might help you secure a loan. For a cosigner to improve your chances of being approved, they need to have a good credit score and preferably a long credit history.

However, getting someone to agree to cosign may prove to be difficult, because if you miss payments or default, the cosigner’s own credit will be hurt. Note that this could strain your relationship with the cosigner if you get behind on payments.

Credit tip: If someone in your life agrees to cosign, consider scheduling a reminder to make payments on time.

Turn to a Family Member

If you’re in a position where you need money to cover an expense, consider asking a family member or close friend for a loan. While it might be tough to bring it up, this route can help you avoid getting stuck in a situation with a predatory lender.

Credit tip: When borrowing money from family, consider drafting up a contract to ensure everyone is on the same page about the loan amount, repayment timelines, and any interest that may be charged.

How to Get a Loan With No Credit FAQ

Below, we’ve answered some common questions regarding getting a loan with no credit.

Can I Get a Loan With No Credit?

Yes, it’s possible to get a loan with no credit, although it will be more difficult to get approved, and you may incur a higher interest rate.

What Loans Can I Get With No Credit?

Types of loans you can get with no credit include no-credit-check loans, secured loans, online loans, credit union loans, and family loans.

How Much Can I Borrow With No Credit?

The exact amount you can borrow with no credit will depend on the type of credit account you’re approved for. Remember that the higher your credit score, the more money you’ll be able to borrow.

What Is a Good Credit Score to Get a Loan?

While the exact credit score to get a loan varies, borrowers need a FICO® score of at least 670 to fall within the good credit score range.

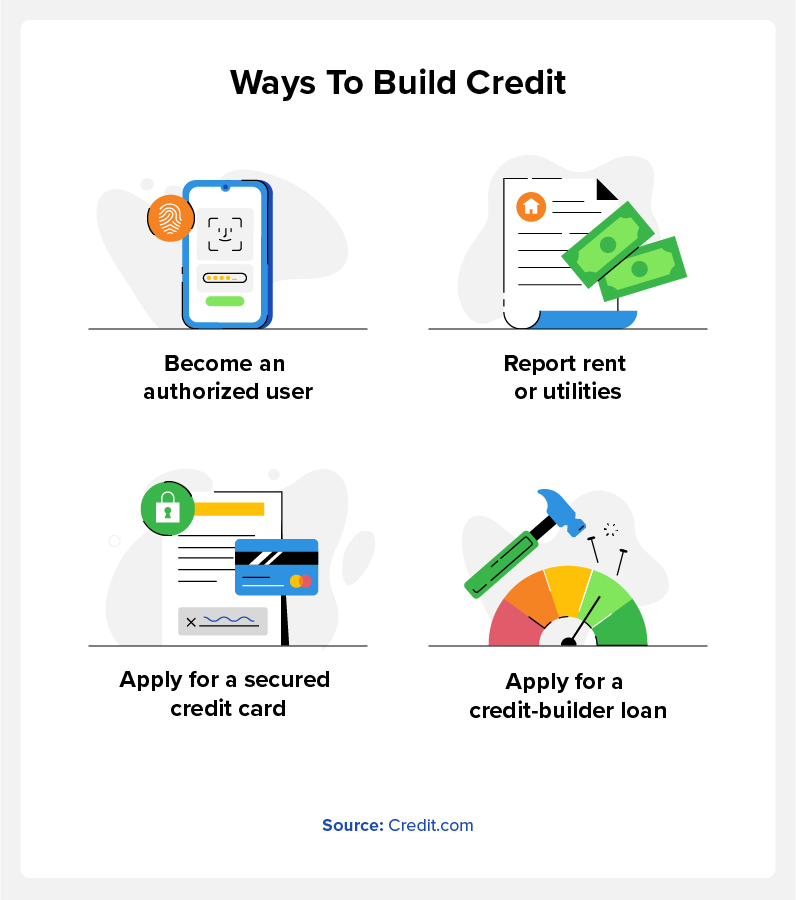

How to Build Credit

Establishing credit from the ground up can seem daunting. Here are some ways to start building credit so you can get approved for loans more easily in the future:

- Become an authorized user: Ask a trusted person in your life to add you as an authorized user to their credit card account so that you can establish credit history.

- Apply for a secured credit card: A secured credit card is a type of beginner-friendly card that requires you to put down a refundable deposit. Since these cards pose less risk to the lender, they’re easier to get approved for when first establishing credit.

- Report rent or utilities: While most companies don’t report to the credit bureaus, you can sign up for a rent and utility reporting service that reports these payments to build credit faster.

- Apply for a credit-builder loan: A credit-builder loan is an installment loan specifically geared to individuals looking to build credit history. When you take out a credit builder loan, the borrowed funds are placed in a secure savings account or certificate of deposit (CD) and held as collateral until you repay the loan.

Ready to start building your credit? ExtraCredit® is a tool that provides complete credit coverage, including rent and utility reporting and other credit profile-building offers. Try it for free today.