Credit Restoration Institute Welcomes Greg Carafello to Board of Directors

North Chesterfield, VA] – Credit Restoration Institute (CRI), a non-profit credit repair agency dedicated to improving the lives of individuals and communities through education and individual counseling, is pleased to announce the addition of Greg Carafello to its Board of Directors.

As President and Co-Founder of Executive Franchise Group, LLC, based out of New York City, Carafello brings over four decades of expertise and skill in the franchising industry, having served as a master franchisee for several leading brands. He is also a Certified Franchise Executive under the Institute of Certified Franchise Executives (ICFE), endorsing the highest standards of quality training and education.

CRI’s Board of Directors is responsible for governing the organization through policy and strategic goals creation, fundraising and relationship development, and general organizational oversight.

“We are thrilled to welcome Greg Carafello to our Board of Directors,” said CRI’s Executive Director Robert Linkonis. “His extensive experience in the franchising industry and commitment to enhancing the professionalism of the field through quality training and education make him an invaluable asset to our team. We are excited to work with him to continue advancing our mission of serving our community through education and individual counseling that results in improved credit scores and better lives.”

Individuals interested in learning more about Credit Restoration Institute’s programs and services or applying to join the Board of Directors can visit the organization’s website at https://creditrestorationinstitute.com/application-for-bod

Contact: Robert Linkonis, Credit Restoration Institute, 31 North Providence Road, North Chesterfield, Virginia 23235 Phone: (804) 823-9601 Email: mail@creditrestorationinstitute.com

The HOMEownership Down Payment and Closing Cost Assistance Program (DPA) provides financial assistance to first-time homebuyers on adjustable gap terms. This program allows homeowners to purchase homes at or below 80% of the area median income (AMI) and to expect homes that are safe, of quality, and attainable. Assistance is provided in the form of a grant with a mandatory “affordability period” for applicants to continue to claim the house as their primary residence. An income-eligible homebuyer may receive up to 10% or 15% (within the established approved areas by DHCD) of the sales price, plus up to $2,500 to pay for the cost of closing (e.g. attorney’s fee, title insurance, taxes as needs demand).

Eligible applicants: Qualify as a first-time Homebuyer; Receive homeownership counseling from a HUD-certified agency and HUD-certified Housing Counselor; Complete a HUD-certified Homebuyer Education Course through a Virginia Housing or Neighborworks® certified course; Demonstrate that their income does not exceed 80 percent of the AMI; Have a median credit score of 620 or higher and debt to income ratio that does not exceed 43%; Contribute one percent of the sales price of the home from their personal funds if the income is between 50%-80% of the AMI, and if the income is less than 50% of the AMI, they can contribute $500 towards the purchase of the home.

If you are a first-time homebuyer this could be a valuable resource. Click the button to learn more.

Click Here For The Full Report

According to the International Monetary Fund Global inflation is expected to fall from 8.8% in 2022 to 6.6% in 2023 and 4.3% in 2024, still above pre-pandemic (2017–19) levels of about 3.5%. In their recent January article, they projected the fall of global growth from an estimated 3.4% in 2022 to 2.9% in 2023, then a rise to 3.1$ in 2024.

The possibility of risk is still high but a drop in inflation numbers is still possible. There are many factors that play a role in the outcome of the financial standing of the average consumer such as international health concerns, current military involvement, and stricter financing costs across global markets.

Click the button below to learn more.

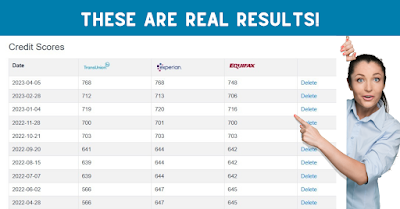

Our custom credit disputes leverage the consumer protection laws and the credit bureaus’ automated codes to help remove or correct unverifiable items.

As our client, we dispute accounts with the bureaus and creditors on your behalf. Using our years of experience, we use the tools you need to move your case forward and get the results you are looking for.

Mortgage readiness and getting pre-approved all imply creditworthiness. You, too, can improve your credit.

Read More About Creditworthiness Here

Give us a call today to start your credit repair journey!

Mon-Fri 9 a.m. – 5 p.m. (804) 823-9601 | (800) 648-5157

mail@creditrestorationinstitute.com