How the Financial Media and Stock Market Analysts Manipulate You

Best Buy, the big box retailer that most shoppers have abandoned sometime in the last decade and a half in favor of Amazon.com, announced better-than-expected earnings for the last three months of 2014, which includes the all-important holiday season.

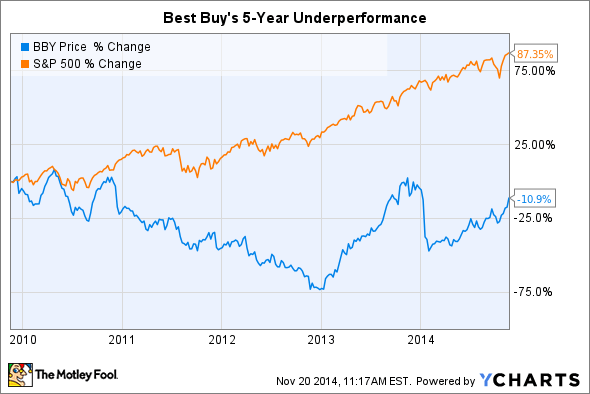

The announcement sent the financial media into a frenzy, as many had all but dismissed Best Buy, even after positive results from the third quarter of 2014. To exemplify Best Buy’s performance and overall sentiment at that time, the Motley Fool presented this five-year chart, comparing Best Buy’s stock price changes over that particular time to the performance of the S&P 500, a popular benchmark for stocks.

Here we have a stock that returned -10.9{6fac3e6a3582a964f494389deded51e5db8d7156c3a7415ff659d1ae7a1be33e} while the rest of the stock market returned a cumulative 87.35{6fac3e6a3582a964f494389deded51e5db8d7156c3a7415ff659d1ae7a1be33e}.

When it comes to the stock market and companies that have public stock available to trade, everyone in the industry including the journalists would prefer if you just look at the charts and make decisions based on the data they choose to show. It’s all in the charts.

And by “all” I mean lies and manipulation, hidden in the “truth” of absolute numbers.

The visual implication with this chart is that Best Buy is a company to keep out of your portfolio. Unless Well, there are some who believe an underperforming stock is a good bargain, if they feel there is some inherent value that the rest of the market is ignoring — a highly unlikely situation. That’s not the impression a reader would get from the article that accompanies the chart.

Compare the chart above with one released today by CNN Money on the occasion of Best Buy’s most recent announcement.

This chart from CNN Money, comparing Best Buy’s stock with an exchange-traded fund that represents the retail industry (XRT), begins tracking the comparison on some undefined date in 2012 and boldly announces a conclusion based on these cherry-picked data.

Maybe everyone was wrong about Best Buy after all, and not only does the retailer’s expectation-beating performance for the latter half of 2014 signal that the company is not focused on the past, and is not depending on what is becoming an antiquated model of shopping for technology, but it has also been a good investment all along!

Well, just for fun, I made my own chart with a comparison between BBY and XRT.

This chart, as accurate as the other charts above, clearly shows that Best Buy (blue line in the chart) has been a bad investment at the same time CNN Money tries to show it has been a good investment. Over this period of time, the stock has returned -8.16{6fac3e6a3582a964f494389deded51e5db8d7156c3a7415ff659d1ae7a1be33e} while the retail sector (red line in the chart) returned a positive 16.26{6fac3e6a3582a964f494389deded51e5db8d7156c3a7415ff659d1ae7a1be33e} overall.

You can as easily and inaccurately draw whatever conclusions you like from my set of data (aided by Google Finance’s charting facility) as you may draw from CNN Money’s chart. “Best Buy has been better buy than other retail stocks” — but not for customers who invest at times that would invalidate that conclusion!

In fact, if you bought Best Buy stock on the day The Street discussed Best Buy’s third quarter results from 2014 and held that stock until yesterday, the investment would have grown 8.68{6fac3e6a3582a964f494389deded51e5db8d7156c3a7415ff659d1ae7a1be33e}, compared with 8.90{6fac3e6a3582a964f494389deded51e5db8d7156c3a7415ff659d1ae7a1be33e} for the retail sector measured by XRT. Marginally worse than the industry — and a bad sign for a company whose outlook was more positive.

I’m not accusing anyone of lying. But it’s easy and simple for the media to design “accurate and truthful” stock market charts that show almost whatever they want in order to support the conclusion on which any particular writer has already decided. The visual charts have more power to convince people of an opinion than they probably should have, thanks to their ease of being manipulated and their immediate communication of a message.

Let’s go back a little farther in Best Buy’s performance history. When Best Buy announced its results for the second quarter of 2014, its performance was worse than expected. Here’s what Fortune Magazine had to say at that time:

Revenue dropped 4{6fac3e6a3582a964f494389deded51e5db8d7156c3a7415ff659d1ae7a1be33e} to $8.9 billion for the quarter ended Aug. 2, worse than the $8.98 billion projected by analysts surveyed by Bloomberg. Domestic same-store sales dropped 2{6fac3e6a3582a964f494389deded51e5db8d7156c3a7415ff659d1ae7a1be33e}, while they fell 6.7{6fac3e6a3582a964f494389deded51e5db8d7156c3a7415ff659d1ae7a1be33e} in international markets. Both declines were worse than what Best Buy reported in the year-ago period.

Best Buy has faced a tough challenge from online retailers, which have reported higher sales growth than brick-and-mortar stores. Online purveyors like Amazon.com also provide customers greater clarity about where to get the best deals for the latest gadgets.

Here’s what you do when you run a public company. When you beat the analysts’ predictions, explain how your good management and leadership resulted in success. When your company doesn’t perform as well as expected, explain how forces beyond your control (systemic failure, market trends, government regulations, etc.) prevented success.

How do you reconcile performance in one good quarter with an analysis that explained bad performance in a previous quarter? In Best Buy’s case, did people start seeing Amazon.com’s dominance as just a phase? Is online shopping just a fad, good enough for day-to-day purchases, but when the importance of holiday shopping is clear, consumers start wandering around big box stores? Now that Best Buy has had two positive quarters, is it finally in a position where it can stop adapting to a changing consumer culture?

Imagine how things would sound if companies reversed their attribution theory, if they took credit for short-term failures and blamed others for short-term success?

- “We performed worse than the market’s expectations this quarter because our CEO failed to lead the company through changing consumer trends.”

- “We are excited about new tax incentives that have allowed us to show a profit in our financial records when we otherwise would have lost money.”

Who would invest in a company whose public relations department said these things?

There’s a kernel of truth to everything, but picking which truths apply to any particular time period’s stock price performance is pure guesswork. Investors continue to read the financial media’s commentary and make decisions based on the advice, explicit or implicit, therein.

Wall Street analysts do work hard, as do the journalists who make sense of an interpret those analyses. The system keeps a fair amount of individuals employed — but they are employed in the entertainment industry.

The best thing any consumer can do it keep the following in mind:

If you see a stock market chart, someone is trying to manipulate you and your opinions.

Just for fun, here’s another chart that compares Best Buy’s performance since roughly the beginning of XRT’s existence in 2006. Best Buy looks like a pretty big loser today.

How the Financial Media and Stock Market Analysts Manipulate You is a post from Consumerism Commentary. New to Consumerism Commentary? Start here.

![]()

SOURCE: Consumerism Commentary – Read entire story here.