March is Credit Education Month!

At Credit Karma, every month is credit education month. So we’re fully behind celebrating March for actually being credit education month, and we’ve launched a new website in its honor.

We created CreditEducationMonth.com as a destination for consumers, Credit Karma members or not, to further educate them on the importance of good credit health and the huge financial impact it can have. Our new site breaks what can be an intimidating subject into easy-to-digest pieces, illustrating the impact of credit scores and what influences them, how people should read a credit report and what to do to take control of their credit situation.

CreditEducationMonth.com shares results from a survey¹ that perhaps best explains why a site like CreditEducationMonth.com is needed. There’s a gap between perception and reality in how people view their own situation. Two-thirds of those surveyed said that their credit score fell into the “excellent” or “good” brackets (scores of 700 and above), when only 41.9 percent of people have scores in these ranges². Compounding the effects of this, less than half of the people surveyed said that they were “completely comfortable” managing their own credit.

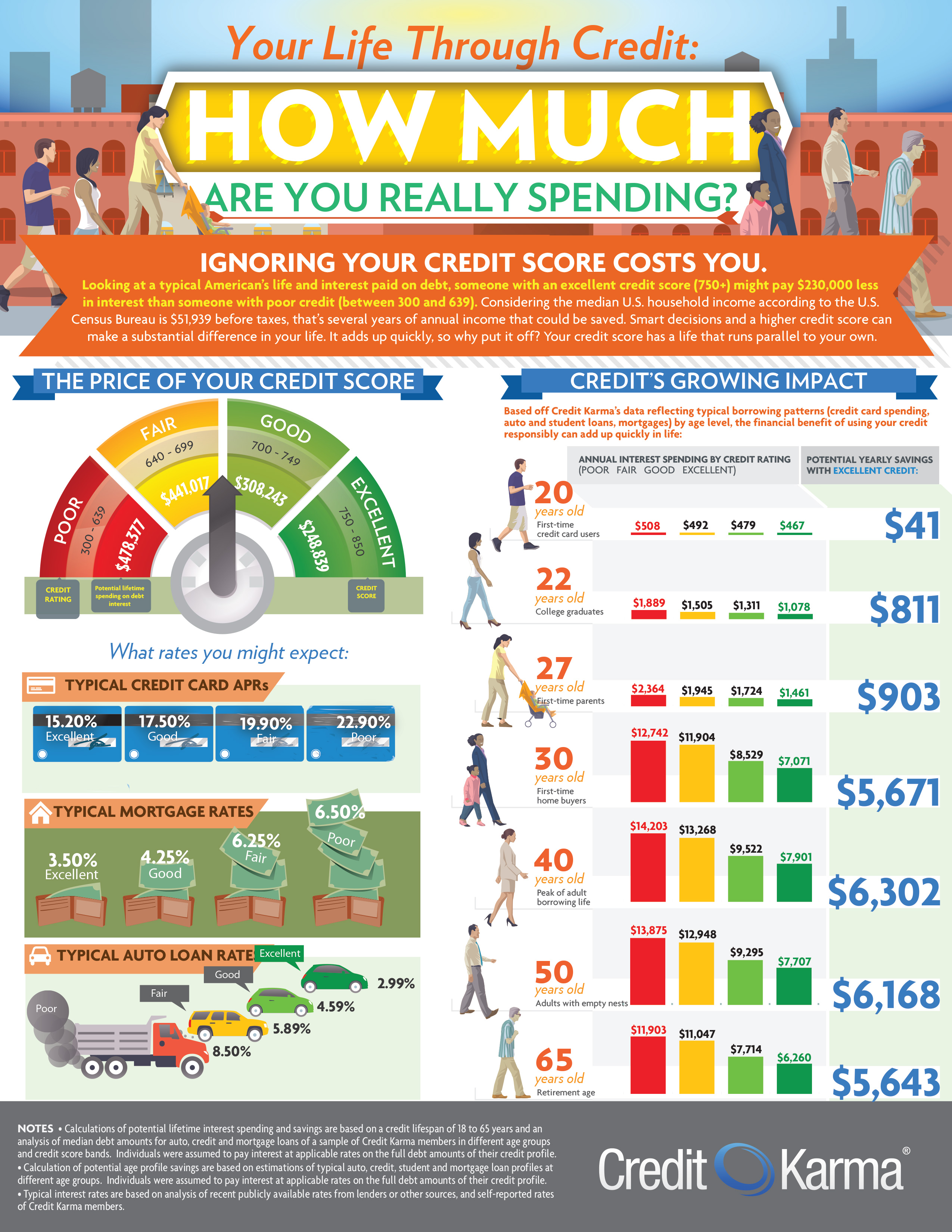

Our own research for CreditEducationMonth.com puts a clear price tag on what this lack of credit education can cost. Looking at our data, we saw that between the ages of 18 and 65, a typical consumer with a credit score below 640 could pay $229,538 more in interest than someone with a score greater than 750. Factor in that the average household income in America is $51,939 – that’s a huge amount of money and an avoidable penalty equal to 4.5 years of median annual income.

At Credit Karma, a central tenet of our business is that awareness and education provide the foundation for helping consumers take control of their credit health. We’re hoping that sites like CreditEducationMonth.com can help consumers face their credit situation head on and be equipped with the right information and tools to improve it.

– Greg, Head of Consumer Insights

—————————

¹ A survey was conducted online within the United States among 1,050 adults 18 and older, from February 10 to 12, 2015, for Credit Karma using Qualtrics’ research suite. This survey has a margin of error of plus or minus 3 percent at a 95 percent level of confidence.

² Based on information provided by VantageScore Solutions, LLC

Disclaimer: All information posted to this site was accurate at the time of its initial publication. Efforts have been made to keep the content up to date and accurate. However, Credit Karma does not make any guarantees about the accuracy or completeness of the information provided. For complete details of any products mentioned, visit bank or issuer website.

Follow Credit Karma!

-

Facebook: http://www.facebook.com/CreditKarma

Twitter: http://twitter.com/creditkarma

YouTube: http://www.youtube.com/creditkarma

SOURCE: Credit and Personal Finance Blog – Read entire story here.