5 Reasons Why You Need a Budget!

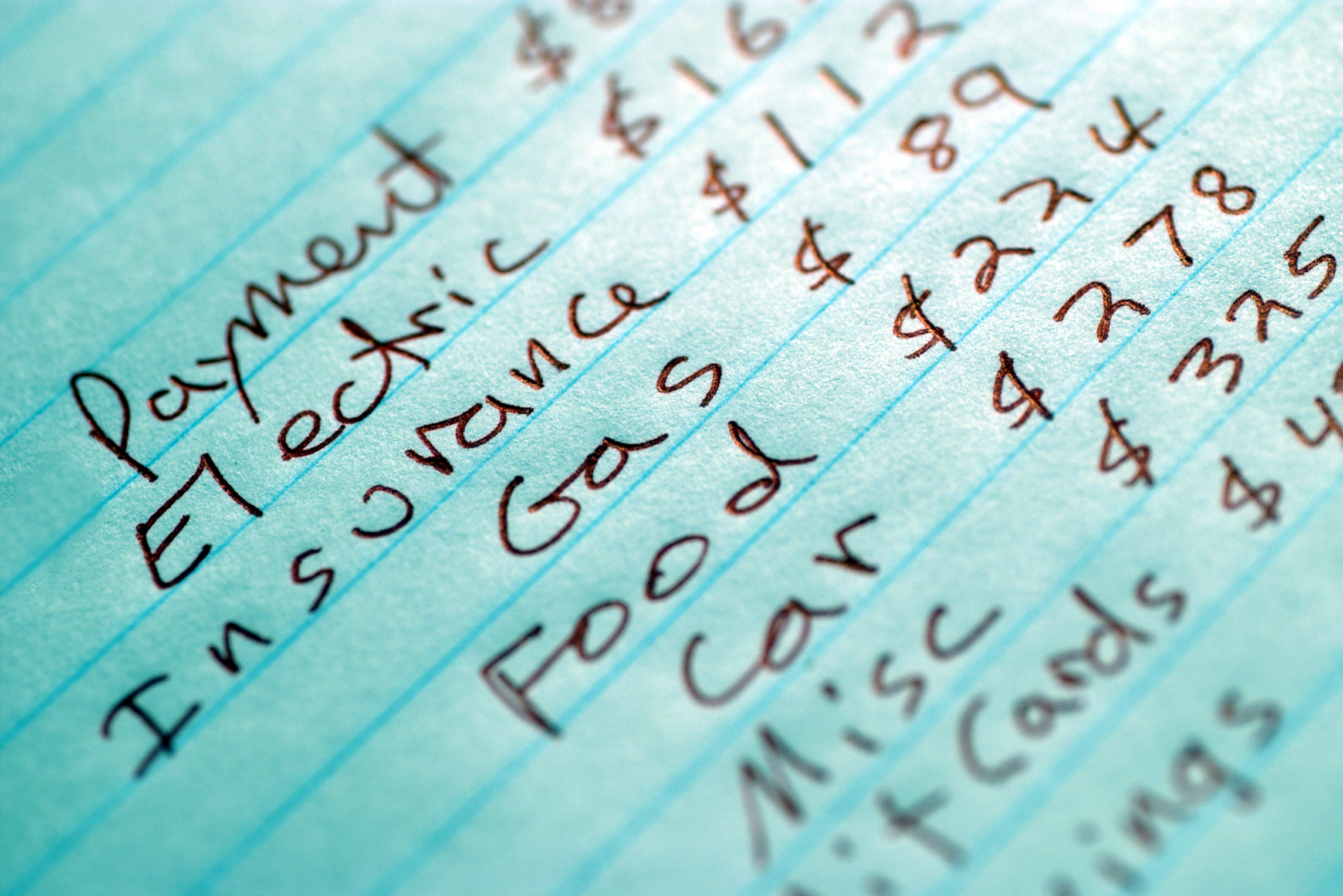

If I asked you to tell me how much you spend eating out or buying gas each month, could you tell me? What about your household’s true cost of living?

This is the most basic reason you need a budget: To be able to plan and track where your money goes! Most people who I speak to about their finances have no clue how much they spend on a monthly basis. All they know is that by the end of the month, their bank accounts are nearly empty and they are waiting for their next paycheck.

Even if you don’t find yourself scraping together pennies at the end of the month, you still need to have a budget in place. In order to take control of your finances you need to come up with a plan. This means assigning a job to every dollar that you receive before you ever receive it.

How? You need to create and update a budget in order to plan and keep track of your spending. This goes both ways – if you don’t keep track of your spending, then creating a budget is pointless. You have to periodically evaluate your spending to ensure that you are staying on track.

Why You Need A Budget

You Need A Budget To Accomplish A Financial Goal

It will be nearly impossible to accomplish a financial goal without a budget – of course it can be done, but with a lot more hassle and waste. With a budget, you can allocate a specific amount toward your goal – whether it be savings or debt repayment – and ensure that it is reasonable.

It will also be easier to accelerate your plan by reducing spending in one or more areas and funneling that money into your “main goal”.

If you look at our 52-week savings challenge results, you’ll see an example of how budgeting can help you reach a financial goal.

You Need A Budget To Help Handle “Shocks” To Your Finances

If you find out today that your job will be cutting your salary, or implementing furloughs (mandatory, unpaid days off), how would you handle it? Would you be able to make the necessary adjustments?

If you keep track of your spending (which will be necessary to follow a budget), it will be easy for you to make these adjustments. You will be able to look at every area of spending and determine where you need to cut back – or even if it’s worth it to try to increase your income.

Learn how to set up a financial contingency plan (and no, it’s not as simple as having an emergency fund)!

You Need A Budget To Identify Areas Of Waste

Most people who make small daily purchases (like coffee, breakfast, or lunch), are shocked to see how much they’re really spending in these areas. It’s easy to spend $5 on a cup of coffee and a bagel in the morning, $3 on a candy bar and soda from the vending machine, and then spend $6-$10 on lunch without even thinking about it.

However, if you have established a budget, it will become increasingly difficult for these expenses to escape your attention.

The first month after you set up your budget will probably be a big eye-opener for you (it definitely was for me). Remember that coffee, candy and lunch from above? You would probably budget about $50 or $75 to that category. However, 22 days (the typical amount of work days in a month) of that type of spending will cost you nearly $400 every month!

Committing to (and adjusting when necessary) a budget will help you to evaluate this type of spending and decide if you should divert money from another category, or change your habits!

You Need A Budget To Ensure That Any Surplus Is Not Spent On Frivolous Items

Similar to looking for areas of waste, this will call for you to identify areas where you can reduce or eliminate spending. Once you allocate your income across living expenses, giving, debt repayment and savings, you may find that you have money left over (a problem that we all would love to have).

Instead of this money just being absorbed into your spending (something that usually happens without a budget), you will be able to give this surplus a new assignment. This, of course, depends on your exact situation and level of risk aversion.

You may choose to give more, accelerate your debt repayment, increase your savings, or master your investment strategy. The point is that having a budget will easily allow you to identify these opportunities.

You Need A Budget To Help Develop Discipline In Multiple Areas

This is accomplished in a few ways. First, you are forcing yourself to tightly control your spending, which will call for discipline – especially if this is the first time you have done this.

Secondly, by constantly monitoring your finances and having to make small adjustments, you are more aware of every financial decision you make.

By holding yourself accountable for every dollar that you spend, you will tend to evaluate your free time in the same manner. For instance, you will begin to consider the value of your time in terms of money and lost opportunity, which may cause you to re-evaluate your decisions.

These are just some of the reasons why you need to develop a budget. Over the next few days, we will look a few painless steps you can take to create a budget, and also to change your thinking about money!

Read The Rest Of The Series

-

Consider Your Income

-

Keep Track Of Expenses

-

Setting Goals

-

Evaluate Expenses

-

Celebrate Small Victories

Reader Questions

- What are some of the benefits that you see in having a budget?

- How often to you review your spending to ensure that you are within your budget?

- Have you ever discovered that your budget was unrealistic?

I look forward to your comments.

The post 5 Reasons Why You Need a Budget! appeared first on Faithful with a Few.

SOURCE: Faithful with a Few – Read entire story here.